This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

Prominent players in the industry include John Deere, CNH Industrial (Case IH and New Holland), AGCO Corporation (Massey Ferguson, Fendt, and Valtra), Kubota Corporation, and Mahindra & Mahindra, among others. These companies continuously invest in research and development to introduce cutting-edge technologies and maintain a competitive edge in the market. Market dynamics are influenced by factors such as global population growth, the need for increased food production, technological advancements, government policies, and environmental concerns.

The industry has witnessed a growing demand for more sustainable and precision farming solutions, driving manufacturers to develop tractors that integrate advanced technologies for improved efficiency and reduced environmental impact. There is a growing demand for compact and versatile tractors suitable for small-scale and diversified farming operations. These tractors cater to a wide range of applications, including orchards, vineyards, and specialty crops.

Precision planting equipment is gaining popularity, allowing farmers to optimize seed placement, spacing, and depth. This trend contributes to improved crop yields and resource utilization. The industry is experiencing a shift towards online platforms for tractor sales and services. E-commerce channels provide farmers with a convenient way to explore, compare, and purchase tractors, along with access to information on maintenance and support services.

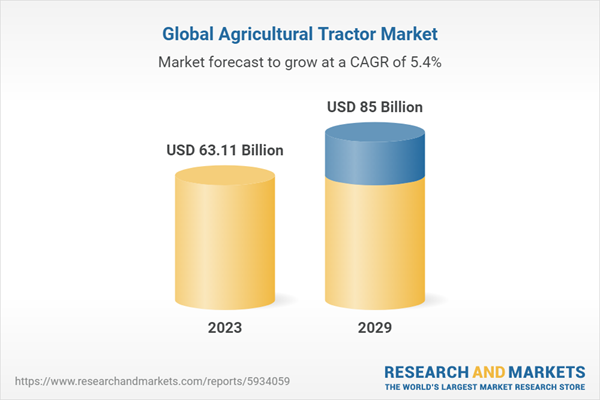

According to the research report, 'Global Agricultural Tractor Market Outlook, 2029', the market is anticipated to cross USD 85 Billion by 2029, increasing from USD 63.11 Billion in 2023. The market is expected to grow with 5.40% CAGR by 2024-29. The market is expected to grow with 13.71% CAGR by 2024-29. The world's population continues to grow, leading to a rising demand for food. To meet the needs of a growing population, farmers are under pressure to enhance agricultural productivity. Tractors play a crucial role in mechanizing farming processes, enabling farmers to cultivate larger areas efficiently.

The shift from traditional, manual farming practices to mechanized agriculture has become imperative for meeting the demands of a modern food supply chain. Tractors significantly increase the efficiency of farming operations, allowing tasks such as plowing, planting, and harvesting to be completed in less time and with greater precision. Ongoing advancements in technology have propelled the Agricultural Tractor industry forward. Modern tractors are equipped with cutting-edge technologies such as GPS-guided systems, precision farming tools, telematics, and automation. These features enhance productivity, reduce resource wastage, and contribute to sustainable farming practices.

The demand for precision seeding and planting equipment has grown, as farmers recognize the importance of accurate seed placement and spacing for optimal crop development. Tractors equipped with advanced planting technologies contribute to higher crop yields and overall farm profitability. Economic growth in emerging markets has led to increased mechanization in agriculture. As farmers in these regions seek to improve productivity and efficiency, there is a growing demand for tractors and other modern agricultural machinery. Many governments around the world provide support and subsidies to farmers to invest in modern agricultural equipment, including tractors.

These incentives encourage farmers to adopt advanced technologies and contribute to the industry's growth. With growing environmental concerns, there is a global emphasis on sustainable agriculture practices. Tractors with features such as electric or hybrid propulsion systems, reduced emissions, and precision technologies align with the industry's commitment to sustainability. Manufacturers are diversifying their product lines to cater to a broader range of farming needs. Compact tractors for small farms, specialty tractors for specific crops, and versatile models that can handle various tasks contribute to a more diverse and adaptable industry.

Market Drivers

- Global Population Growth: The continuously growing global population exerts pressure on the agricultural sector to increase food production. Agricultural tractors play a crucial role in meeting this demand by mechanizing various farming activities, allowing for higher efficiency and larger-scale cultivation. The need for increased food production to feed the growing population drives the demand for tractors, promoting mechanization and technological advancements in the agricultural sector.

- Technological Advancements: Ongoing technological innovations in the agricultural tractor industry significantly contribute to its growth. Advanced features such as GPS-guided systems, precision agriculture technologies, telematics, and automation improve overall efficiency, reduce resource usage, and enhance the precision of farming operations. Farmers worldwide are adopting modern tractors equipped with cutting-edge technologies, leading to increased productivity, reduced operational costs, and improved sustainability in agriculture.

Market Challenges

- High Initial Cost: The initial cost of acquiring modern, technologically advanced tractors can be prohibitively high for many farmers, especially in developing countries. This poses a challenge for widespread adoption, particularly among small-scale and subsistence farmers. The high upfront cost may limit the accessibility of advanced tractors to a significant portion of the global farming community, hindering the widespread adoption of modern agricultural practices.

- Skilled Labor Shortages: Operating and maintaining modern tractors often require skilled labor. However, there is a shortage of skilled operators in many regions, especially as younger generations may prefer non-agricultural employment opportunities. The shortage of skilled labor can lead to underutilization or inefficient use of tractor technology, limiting its potential benefits. It also increases the need for training programs and initiatives to bridge the skills gap in operating and maintaining modern tractors.

Market Trends

- Rise of Precision Agriculture: Precision agriculture, enabled by technologies such as GPS guidance systems and sensor technologies, is a significant trend in the agricultural tractor market. Tractors equipped with precision farming tools allow farmers to optimize resource use, reduce environmental impact, and increase overall farm productivity. The trend toward precision agriculture is transforming farming practices, making them more sustainable, efficient, and environmentally friendly.

- Electric and Hybrid Tractors: The development and adoption of electric and hybrid tractors represent a growing trend in response to increasing environmental concerns. These tractors aim to reduce greenhouse gas emissions, decrease reliance on traditional fuels, and contribute to a more sustainable agricultural industry. The shift toward electric and hybrid tractors aligns with global sustainability goals and responds to consumer demand for environmentally friendly farming practices.

COVID-19 Impact

The pandemic has disrupted global supply chains, affecting the production and delivery of agricultural machinery, including tractors. Factory closures, restrictions on movement, and logistical challenges led to delays and shortages in the availability of tractor components, impacting manufacturers' ability to meet demand. Lockdowns, travel restrictions, and health concerns led to labor shortages in various agricultural regions. The lack of skilled labor for operating and maintaining tractors posed challenges to farmers, impacting the optimal utilization of agricultural machinery. Economic uncertainties caused by the pandemic influenced farmers' investment decisions.Some farmers delayed or scaled back their plans to purchase new tractors due to concerns about the economic fallout, fluctuating commodity prices, and the overall financial impact of the pandemic on their operations. Several governments implemented support measures and stimulus packages to mitigate the economic impact of the pandemic. In some cases, these measures included financial support for the agricultural sector, which could have positively influenced tractor sales and adoption in certain regions. The pandemic highlighted the importance of resilient and localized food supply chains. Some regions experienced a shift in agricultural priorities, with a renewed focus on sustainable and self-sufficient farming practices.

This shift could influence the demand for tractors; especially those tailored for smaller-scale and diversified farming operations. The need for efficiency and resource optimization gained prominence during the pandemic. Farmers showed increased interest in precision agriculture technologies, including those integrated into tractors. These technologies aim to improve overall farm management and mitigate the impact of external disruptions on agricultural productivity. The pandemic accelerated the adoption of digital technologies in various sectors, including agriculture.

E-commerce platforms for agricultural machinery gained traction as farmers sought alternative ways to explore, purchase, and access information about tractors without physical interaction. Despite the challenges, the agricultural sector demonstrated resilience and adaptability. Farmers recognized the critical role of technology, including tractors, in maintaining food production. This awareness could lead to increased investment in modern agricultural machinery as part of long-term strategies to build resilience against future disruptions.

Sub-30 HP tractors are well-suited for small and diversified farming operations. Many farmers, especially in emerging economies and regions with small landholdings, find these tractors more adaptable to their scale of farming.

Sub-30 HP tractors have found widespread acceptance, particularly among small-scale and diversified farming operations. Their adaptability to the scale of small landholdings, combined with their multifunctionality, makes them an ideal choice for a variety of tasks, ranging from plowing and planting to cultivating and transportation of goods. One of the pivotal reasons for their market leadership is their affordability. Sub-30 HP tractors generally come with a lower upfront cost compared to larger models, enabling small-scale farmers to embrace mechanized farming without incurring a substantial financial burden.

The ease of use associated with these tractors further enhances their appeal, as they are often designed with simplicity in mind, catering to operators with varying levels of experience. Fuel efficiency is another key advantage, contributing to operational cost savings, a critical consideration for farmers with limited resources. The versatility of these tractors is complemented by customization options offered by manufacturers, allowing farmers to tailor the machinery to their specific needs. In regions where agriculture plays a significant role in the economy, particularly in emerging markets, the prevalence of small-scale farming has driven the demand for sub-30 HP tractors.

Additionally, government subsidies and support programs targeted specifically at smaller tractors have further boosted their adoption. The suitability of these tractors for horticulture and the cultivation of specialty crops, where precision and agility are paramount, has added to their popularity. Moreover, in regions where shared usage and rental models are prevalent, the cost-effectiveness of sub-30 HP tractors makes them a practical choice.

Internal Combustion (IC) engine-powered agricultural tractors continue to lead the market powered by either gasoline or diesel engines as they demonstrated enduring popularity and widespread adoption.

Internal Combustion (IC) engine-powered agricultural tractors remain at the forefront of the market due to a combination of historical reliability, proven technology, and unmatched performance characteristics. These tractors, propelled by either gasoline or diesel engines, have stood the test of time and established themselves as the go-to choice for farmers globally. Diesel engines, in particular, have become synonymous with agricultural machinery, owing to their exceptional torque and power output.

The high torque provided by these engines is essential for heavy-duty tasks such as plowing, tilling, and hauling, making them well-suited for the demanding requirements of modern agriculture. Additionally, the durability and reliability of IC engines contribute significantly to their market leadership. Farmers value the robustness of these engines, knowing that they can withstand the rigors of prolonged and often challenging field operations. The long history of IC engines in agriculture has led to a well-established infrastructure for maintenance and repair, further enhancing their appeal.

The familiarity of farmers with these engines, along with the widespread availability of spare parts and servicing facilities, adds to their reliability. Furthermore, IC engines offer a range of power options, allowing farmers to choose tractors with the horsepower that best suits their specific needs. While there is a growing interest in alternative propulsion technologies, such as electric or hybrid tractors, the proven track record, power output, and overall dependability of IC engines continue to make them the preferred choice for the majority of farmers, contributing to their continued leadership in the agricultural tractor market.

The dominance of 2-wheel drive (2WD) agricultural tractors in the market can be attributed to a combination of versatility, cost-effectiveness, and widespread applicability across various farming scenarios.

2-wheel drive (2WD) tractors, which are driven by either the front or rear wheels, have established themselves as the leading choice for farmers globally. One key factor contributing to their market leadership is their versatility. 2WD tractors are well-suited for a range of farming operations, from basic field preparation to crop cultivation and transportation. Their relatively simple design and mechanical configuration make them adaptable to diverse terrains, allowing farmers to navigate through fields with different soil types and topographies.

Another significant factor is cost-effectiveness. 2WD tractors are generally more affordable than their 4-wheel drive counterparts, making them accessible to a broader segment of the farming community. This affordability is particularly advantageous for small-scale and resource-constrained farmers who prioritize a balance between functionality and cost. Additionally, the reduced mechanical complexity of 2WD tractors often translates to lower maintenance costs, contributing to their overall economic appeal.

The applicability of 2WD tractors is further emphasized in regions where the scale of farming operations and the nature of the terrain do not necessitate the enhanced traction provided by 4WD models. While 4WD tractors excel in challenging conditions, 2WD tractors continue to be the preferred choice for many farmers due to their cost-effectiveness and ability to handle a wide range of routine farming tasks. As agricultural practices continue to evolve, the adaptability and economic advantages of 2WD tractors position them as market leaders, especially in regions where their features align with the predominant needs and resources of the farming community.

The leadership of agricultural tractors in harvesting applications can be attributed to their pivotal role in streamlining and optimizing the crucial phase of crop harvesting.

The harvesting process demands a robust and powerful machine capable of efficiently collecting and processing crops, and agricultural tractors are designed with these specific requirements in mind. Equipped with advanced features such as powerful engines, precision steering, and customizable attachments like combine harvesters and forage harvesters, these tractors offer a comprehensive solution for diverse harvesting needs. The adaptability of these tractors to different crops and terrains makes them versatile tools in the hands of farmers. Secondly, the integration of technology into modern harvesting tractors has further solidified their market leadership.

GPS-guided systems and precision farming technologies enable farmers to optimize the harvesting process, enhancing efficiency and reducing wastage. Automated features, such as auto-steering and data-driven decision-making capabilities, contribute to the overall precision and effectiveness of harvesting operations. Additionally, the ability of harvesting tractors to seamlessly incorporate innovative technologies like sensors and real-time monitoring systems ensures that farmers can make informed decisions, ultimately improving crop yield and quality. Furthermore, the modularity and customization options available with harvesting tractors allow farmers to adapt their equipment to specific crop varieties and field conditions.

This flexibility enhances the overall efficiency of the harvesting process. Finally, the economic considerations play a crucial role. While the initial investment in a harvesting tractor may be substantial, the long-term benefits in terms of increased productivity, reduced labor costs, and optimized resource utilization position these tractors as strategic investments for farmers looking to enhance their harvesting capabilities. As global agriculture evolves towards more technologically advanced and sustainable practices, the continued leadership of harvesting applications for agricultural tractors is expected, driven by the relentless pursuit of efficiency, precision, and economic viability in modern farming practices.

Manual tractors are often more affordable than their automated or autonomous counterparts. In regions where economic constraints limit the adoption of high-tech solutions, manual tractors remain a practical and cost-effective choice for small-scale farmers.

Manual tractors are known for their simplicity in design and operation. Farmers who are accustomed to traditional farming methods and have limited access to advanced training may find manual tractors more user-friendly. These tractors are often perceived as reliable and straightforward, requiring less maintenance. Manual tractors can be easily adapted for various tasks through the attachment of different implements.

This adaptability allows farmers to use manual tractors in a wide range of agricultural activities without the need for complex technological adjustments. In regions where there is a lack of technical expertise or infrastructure to support the maintenance and repair of advanced machinery, manual tractors may be preferred. The familiarity of local farmers with manual tractor systems, coupled with the availability of spare parts, can contribute to their continued use.

Based on the regions, sheer scale and diversity of agriculture in Asia-Pacific has created the region to be the dominating factor.

With a significant portion of the global population engaged in farming activities, the demand for agricultural tractors is inherently high. The vast and varied landscapes, ranging from expansive plains to hilly terrains, require tractors with diverse capabilities, and manufacturers have responded by offering a wide range of models tailored to meet the specific needs of farmers across Asia-Pacific. Moreover, the prevalence of small-scale and family-owned farms in many Asian countries aligns with the versatile and cost-effective nature of agricultural tractors, particularly those with lower horsepower ratings, facilitating their widespread adoption.

Government policies and support also play a crucial role in propelling the dominance of agricultural tractors in the Asia-Pacific region. Many governments in this region have implemented initiatives to promote mechanization in agriculture, offering subsidies, financial incentives, and easy access to credit for farmers looking to invest in modern agricultural machinery. These supportive measures stimulate tractor adoption, contributing to the overall market leadership. Furthermore, the Asia-Pacific region has witnessed rapid economic development and urbanization, leading to a transformation in dietary habits and an increased demand for diverse crops.

To meet these changing consumption patterns, farmers are embracing mechanized farming practices facilitated by agricultural tractors. The need for increased productivity and efficiency to cater to the burgeoning population further drives the demand for technologically advanced tractors, including those equipped with precision agriculture features. In addition to these factors, the Asia-Pacific region is at the forefront of technological innovations in agriculture. Farmers are increasingly integrating digital technologies, GPS-guided systems, and precision farming tools into their operations, and tractors play a central role in this technological revolution. The adoption of smart farming practices contributes to the region's leadership in modernizing agriculture through advanced machinery.

Vendors actively invest in R&D to develop fundamental technology to establish competitiveness by enhancing core product technology in the agricultural tractor industry. Vendors differentiate themselves by enhancing product development, focusing on after-sales business, and cutting costs through greater operational efficiency. There is competition in the industry in the pursuit of large-scale farming. The agriculture industry is experiencing slow growth and tends to have a competitive environment, heavily influenced by price due to supply balancing demand.

Price competition tends to be more significant for new tractor orders than aftermarket services. Considering the forecast for 2029, pricing for new tractor orders is expected to be a particularly influential competitive factor. Competition in the aftermarket portion of the tractor market is majorly against large, well-established national and global competitors and, in some markets, against regional and local companies.

- In August 2023, Mahindra launched seven new models of its lightweight 4WD tractor 'Mahindra OJA'. The new launch came as part of the company’s effort to transform Indian farming.

- John Deere has announced MY24 updates for its 7, 8, and 9 Series Tractors lineup in March 2023, which will help prepare them for the future of precision agriculture.

- Mahindra & Mahindra launched a new tractor platform, OJA, under which the company will roll out 40 tractor models in April 2023. The company will target Thailand, India, Africa, and Japan markets.

- AGCO launched the latest Fendt 700 Vario series tractors in August 2022, featuring an upgraded powertrain with VarioDrive transmission and Fendt iD low engine speed concept. This new generation aims to enhance efficiency and productivity for customers.

- In November 2022, two best-in-class tractors were launched at the CII Agro Tech India 2022 exhibition by ZETOR TRACTORS and VST Tillers Tractors Ltd. These tractors in the 50 HP and 45 HP categories were successfully implemented by ZETOR and VST at their facilities in India and the Czech Republic.

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Agricultural Tractor market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Engine Power

- Below 30 HP

- 30 HP - 100 HP

- 100 HP - 200 HP

- Above 200 HP

By Propulsion

- IC

- Electric

By Drive Type

- 2WD

- 4WD

By Level of Autonomy

- Manual Tractor Vehicle

- Autonomous Tractor Vehicle

By Application

- Harvesting

- Seed Sowing

- Spraying

- Others

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases. After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Agricultural Tractor industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Deere & Company

- Kubota Corporation

- Mahindra & Mahindra Limited

- CNH Industrial N.V.

- Yanmar Co. Ltd.

- Iseki & Co. Ltd.

- AGCO Corporation

- J.C. Bamford Excavators Limited

- Eicher Motors Limited

- CLAAS KGaA mbH

- VST Tillers Tractors Ltd.

- Action Construction Equipment Ltd

- SDF Group

- Force Motors Ltd

- Pronar Sp. z o.o.

- TYM CORPORATION

- Zetor

- The Sonalika Group

- Daedong Corporation

- ARGO SpA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 211 |

| Published | January 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 63.11 Billion |

| Forecasted Market Value ( USD | $ 85 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |