Tractors often use hydraulic systems for lifting and lowering implements, such as plows, harrows, and seeders. Therefore, the agriculture segment captured $2,950.8 million revenue in the market in 2022. The hydraulic lift allows farmers to adjust the height of the implements easily, optimizing their performance during different stages of the farming process. In livestock handling, hydraulic systems are often employed in squeeze chutes. These chutes are used for safely restraining animals during procedures such as vaccinations and health checks. Many modern tractors are equipped with hydraulic power steering systems. This makes steering more responsive and requires less physical effort from the operator, enhancing overall maneuverability.

Construction projects involve using heavy machinery such as excavators, bulldozers, cranes, and loaders. Hydraulic systems are critical in these machines, providing the power and precision needed for various operations. Hydraulic systems contribute to efficient material handling in construction sites. Equipment like forklifts and conveyor systems use hydraulics to lift, lower, and transport materials. Cranes are fundamental in construction for lifting and positioning heavy materials. Hydraulic systems play a crucial role in controlling the movements of crane booms, providing stability and precision. Additionally, growing investments in renewable energy projects worldwide contribute to the demand for hydraulic components. Governments, businesses, and utilities are increasingly focused on transitioning to cleaner energy sources, driving the expansion of renewables. Hydraulic systems are used in offshore wind farms for tasks such as adjusting the pitch of the turbine blades and installing and maintaining wind turbine components. Due to the above-mentioned factors, the market is expected to grow significantly in the coming years.

However, high manufacturing costs make hydraulic systems and components less competitive than alternative technologies or lower-cost solutions. This may limit the adoption of hydraulic systems, particularly in price-sensitive markets. Small and medium-sized enterprises (SMEs) may face difficulties adopting hydraulic systems due to the financial burden of high manufacturing costs. This could limit their ability to invest in advanced hydraulic technology. High maintenance costs can dissuade end-users from adopting hydraulic systems, as ongoing operational expenses play a significant role in the total cost of ownership. Maintenance-intensive systems may be less cost-effective. The adoption of substitute products can influence industry standards and specifications. If certain substitutes become widely accepted, they may influence the development of new projects and industry norms, potentially sidelining hydraulic solutions. As a result, the above aspects will cause the market growth to decline.

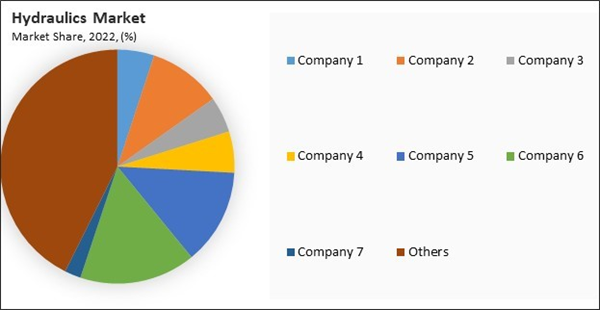

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

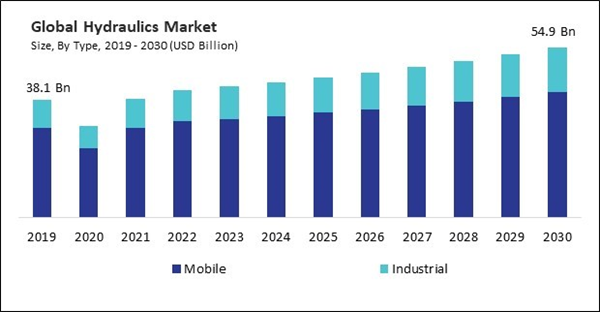

By Type Analysis

On the basis of type, the market is fragmented into mobile and industrial. The industrial segment acquired a substantial revenue share in 2022. Industrial hydraulics play a crucial role in automation and Industry 4.0 initiatives. Their adaptability to automation technologies allows for integrating hydraulic systems into smart factories and interconnected industrial processes. Modern industrial hydraulic systems are designed for energy efficiency, incorporating variable-speed pumps and load-sensing technologies to optimize energy consumption and reduce operational costs. Industrial hydraulics offer high power density, allowing them to generate substantial force within a compact and efficient system. This is particularly advantageous in industrial applications with crucial space and weight considerations.By Component Analysis

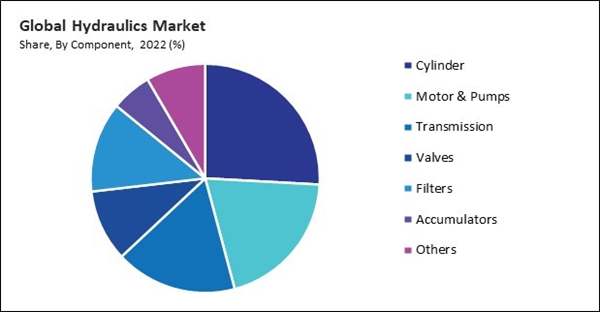

Based on components, the market is segmented into motors & pumps, cylinder, valves, transmissions, accumulators, filters, and others. In 2022, the cylinder segment held the highest revenue share in the market. Hydraulic cylinders convert hydraulic energy into linear motion, allowing for controlled and precise movement along a straight path. This linear motion is essential in applications such as lifting, pushing, pulling, and positioning in various industrial processes. Hydraulic cylinders provide precise control over the speed and position of the moving components. The system's flow control valves and other hydraulic components enable fine-tuning of the cylinder's movements, contributing to accurate and repeatable processes. Hydraulic cylinders are relatively easy to install and integrate into hydraulic systems. Their straightforward design and standardized interfaces make them convenient for manufacturers and system integrators.By End User Analysis

By end user, the market is classified into construction, aerospace, material handling, agriculture, mining, automotive, marine, metals & machinery manufacturing, oil & gas, and others. The oil & gas segment covered a considerable revenue share in 2022. Hydraulic systems provide vertical movement of the drilling string, allowing for efficient drilling operations in oil and gas wells. Offshore platforms often use hydraulic cranes for material handling and lifting operations. These cranes are essential for loading and unloading cargo and equipment. Various valves in the oil and gas industry, including gate valves and ball valves, are actuated by hydraulic systems. This automation is critical for controlling flow and ensuring safety.By Regional Analysis

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. The North America region garnered a significant revenue share in 2022. Ongoing construction projects, infrastructure development, and the need for heavy machinery drive the demand for hydraulic components. Excavators, loaders, and other construction equipment rely on hydraulic systems for efficient operation. The increasing adoption of industrial automation in North American industries contributes to the demand for hydraulic systems. Automated machinery often relies on hydraulics for precise control and efficient operation.Recent Strategies Deployed in the Market

- Feb-2023: Bosch Rexroth AG took over HydraForce, Inc., an Industrial machinery manufacturing company in Lincolnshire, IL. Through this acquisition, Bosch Rexroth AG would enhance its business unit by broadening its product offerings and enhancing customer support.

- Feb-2022: Parker Hannifin Corporation introduced "the Parker Automation Controller PAC120 and the electrohydraulic controller module PACHC". The PLC PAC120 with multiple PACHC controller modules allows for controlling the position and force/pressure of as many as 40 hydraulic axes. Additionally, the PACHC controller module enables precise control over position, force, pressure, and change-over operations. It offers a rapid dynamic sampling rate of 250 µs, ensuring exceptionally fast cycle times.

- Oct-2021: The Danfoss Group took over Eton, an Appliances, electrical, and electronics manufacturing company in Ireland. Through this acquisition, The Danfoss Group would enhance its core operations and elevate the value delivered to customers.

- Jul-2021: Enerpac Tool Group Corp. introduced "ZE2, ZW2-Series Pumps". The Enerpac ZE2 and ZW2-Series electric pumps represent a continuation of the robust and dependable Enerpac ZE line. Additionally, these pumps are capable of extended usage without experiencing overheating issues, offering enhanced overall cost-effectiveness.

- Mar-2021: SMC Corporation unveils “CG1 Series Air Cylinder, the EX600-W Wireless Compact Remote Unit, and upgraded MSQ series rotary tables”. The cylinder is designed to enhance piping flexibility, allowing users to connect piping at every 90 degrees (four positions) and specify the desired piping position during the design phase. For the e-CON type of the EX600 wireless systems device, the weight has been reduced from 965 g to 130 g compared to the existing remote with an M8 connector and digital eight-input specification. The latest models in the MSQ series have experienced a 28% reduction in both height (from 54 mm to 39 mm) and weight (from 940 g to 680 g) compared to the previous models. Another feature includes an increased center hole diameter for piping.

List of Key Companies Profiled

- Enerpac Tool Group Corp.

- The Danfoss Group

- HYDAC International GmbH

- Kawasaki Heavy Industries, Ltd.

- SMC Corporation

- Parker Hannifin Corporation

- Wipro Limited

- Caterpillar, Inc.

- Bosch Rexroth AG (Robert Bosch GmbH)

- KYB corporation

Market Report Segmentation

By End User- Construction

- Aerospace

- Metal & Machinery Manufacturing

- Mining

- Material Handling

- Agriculture

- Marine

- Oil & Gas

- Automotive

- Others

- Mobile

- Industrial

- Cylinder

- Motor & Pumps

- Transmission

- Valves

- Filters

- Accumulators

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Enerpac Tool Group Corp.

- The Danfoss Group

- HYDAC International GmbH

- Kawasaki Heavy Industries, Ltd.

- SMC Corporation

- Parker Hannifin Corporation

- Wipro Limited

- Caterpillar, Inc.

- Bosch Rexroth AG (Robert Bosch GmbH)

- KYB corporation