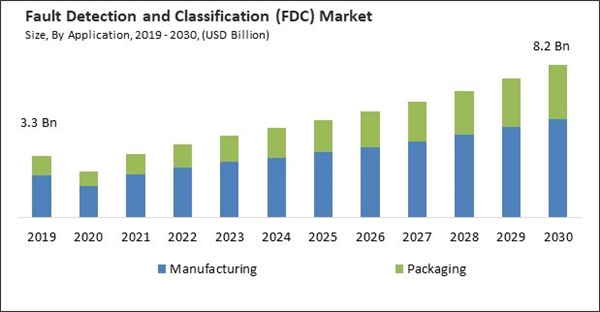

Adopting smart manufacturing, characterized by integrating digital technologies, data analytics, and automation, is a significant driver of FDC. Therefore, the Manufacturing segment generated $2,696.4 million revenue in the market in 2022. As a result, Industry 4.0 and smart manufacturing are synonymously used and rely on real-time data collection and monitoring of industrial processes. FDC systems can continuously monitor data streams and detect anomalies or faults as they occur, enabling proactive intervention. Some of the factors impacting the market are increasing complexity of industrial processes, advancements in sensor technology and lack of skilled workers in manufacturing factories.

Industrial processes are becoming more complex, involving numerous variables, equipment, and components. FDC is crucial for managing this complexity and ensuring the reliability and quality of products. Modern industrial processes often involve multiple variables and parameters, making them multivariate systems. These variables interact in complex ways, and detecting faults or anomalies can be challenging without advanced analytical tools like FDC systems. Industrial processes generate vast amounts of data from various sensors and equipment. Additionally, the availability of advanced sensors and IoT devices has improved data collection capabilities. These sensors provide real-time data, enhancing the accuracy and effectiveness of FDC systems. Sensors are becoming smaller and more compact without sacrificing performance. Miniaturization allows for easy integration into tight spaces, on equipment, and in complex manufacturing environments. Multi-sensor systems provide comprehensive data for more accurate fault detection. Thus, as industries evolve, the demand for advanced FDC solutions will grow and as sensor technology continues to evolve, it will further drive the growth and innovation in the market.

However, FDC systems can be complex to set up, configure, and integrate with existing manufacturing processes and control systems. Skilled professionals are needed to ensure that FDC systems are adequately installed and functioning as intended. Analyzing data from FDC systems and making informed decisions based on the information provided requires a deep understanding of manufacturing processes and domain-specific knowledge. Skilled professionals are better equipped to interpret data accurately. The scarcity of competent professionals in manufacturing facilities hinders the growth of the market.

End-use Outlook

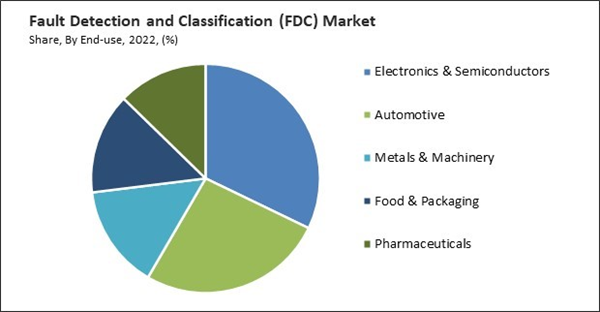

Based on end-use, the market is classified into automotive, electronics & semiconductors, metals & machinery, food & packaging, and pharmaceuticals. In 2022, the electronics & semiconductors segment led the market by generating highest revenue share. FDC plays a pivotal role in ensuring the quality and reliability of electronic components and semiconductor devices. Additionally, electronics and semiconductor manufacturing processes involve numerous complex and interconnected steps. The intricate nature of these processes makes it challenging to identify and address faults manually. FDC systems are designed to monitor these processes in real-time and detect anomalies or deviations.Application Outlook

By application, the market is bifurcated into manufacturing and packaging. In 2022, the manufacturing segment dominated the market with maximum revenue share. Ensuring product quality is a top priority for manufacturers. FDC systems help detect defects and anomalies in real time, preventing substandard products from reaching the market. FDC systems provide valuable data and insights that help manufacturers optimize production processes. The desire for improved quality, efficiency, and cost savings drives the adopting of FDC systems in manufacturing. As technology advances and manufacturing becomes increasingly automated and connected, the role of FDC systems in ensuring product quality and process optimization will continue to grow.Component Outlook

On the basis of component, the market is divided into software, hardware, and services. The software segment covered a considerable revenue share in the market. FDC software collects data from various sensors, equipment, and data sources across the manufacturing process. This data is often disparate and comes from multiple points in the production line. It continuously analyzes incoming data to detect deviations and potential faults as they occur, enabling immediate corrective actions. As technology evolves, FDC software is expected to become even more sophisticated, enabling manufacturers to effectively meet their quality and productivity goals.Regional Outlook

Region-wise, the fault detection and classification (FDC) market are analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region led the fault detection and classification (FDC) market by generating the highest revenue share. Asia Pacific is a center of the world's manufacturing, with countries like China, Japan, South Korea, and Taiwan at the forefront of automotive, electronics, semiconductor manufacturing, and more industries. APAC countries are significant players in the semiconductor and electronics industry. FDC is crucial for these industries to monitor semiconductor fabrication processes, detect defects, and ensure the production of high-quality microchips and electronic components. The semiconductor and electronics industries rely heavily on FDC for quality control and process optimization.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Applied Materials, Inc., KLA Corporation, Siemens AG, Microsoft Corporation, Amazon Web Services, Inc, Tokyo Electron Ltd., OMRON Corporation, Teradyne, Inc., Cognex Corporation and Advantest Corporation.

Scope of the Study

Market Segments Covered in the Report:

By Application- Manufacturing

- Packaging

- Hardware

- Cameras

- Sensors & Processors

- Frame Grabbers

- Others

- Software

- Services

- Electronics & Semiconductors

- Automotive

- Metals & Machinery

- Food & Packaging

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Applied Materials, Inc.

- KLA Corporation

- Siemens AG

- Microsoft Corporation

- Amazon Web Services, Inc

- Tokyo Electron Ltd.

- OMRON Corporation

- Teradyne, Inc.

- Cognex Corporation

- Advantest Corporation

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Applied Materials, Inc.

- KLA Corporation

- Siemens AG

- Microsoft Corporation

- Amazon Web Services, Inc

- Tokyo Electron Ltd.

- OMRON Corporation

- Teradyne, Inc.

- Cognex Corporation

- Advantest Corporation