Fixed RFID readers offer stability and consistency in data capture within specific areas or zones in the data center. Therefore, the fixed segment acquired $91.5 million in 2022. They are stationary devices installed at predetermined locations, continuously monitoring assets passing through those zones. The increasing demand for fixed RFID readers in the market signifies their importance in providing targeted, continuous, and reliable asset-tracking solutions within specific zones or areas of data centers.

The need for precise and real-time tracking of assets within data centers drives the adoption of RFID technology. Data center operators seek efficient solutions to manage diverse assets, including servers, networking equipment, storage devices, and other critical components. Modern data centers encompass many assets, including servers, networking equipment, storage devices, and other critical components. Managing and tracking these assets manually is a cumbersome and error-prone task. RFID technology provides a systematic and automated approach to asset identification and tracking. Data centers require accurate and real-time visibility into asset location, status, and movement. RFID tags attached to assets enable continuous monitoring without manual intervention. This capability facilitates efficient inventory management and reduces the chances of asset misplacement or loss. Additionally, various industries and regions have specific regulatory standards and compliance mandates related to data center operations. These regulations often necessitate stringent guidelines for asset management, security, data privacy, and auditability. RFID technology facilitates the fulfillment of these compliance obligations for data center administrators by providing dependable and precise capabilities for monitoring and managing assets. Data centers handle sensitive information and critical assets, making security and privacy paramount. Regulatory bodies impose guidelines on managing, protecting, and accessing data. When integrated with access control systems and encryption features, RFID technology helps data center operators comply with these regulations by ensuring controlled access and secure handling of assets. These solutions are crucial in helping data center operators meet compliance obligations, thereby contributing to a secure and compliant operational environment. Thus, the standards and regulations of industries are propelling the market's growth.

However, the complexity of deployment and scalability presents a notable restraint within the market. This restraint arises due to the challenges associated with implementing RFID technology in data center environments and scaling these deployments effectively as the data center grows or evolves. Deploying RFID systems in data centers involves setting up RFID readers, antennas, and infrastructure across various locations within the facility. This installation process can be intricate and time-consuming, especially in larger data center environments with complex layouts. Configuring RFID reader networks to ensure consistent coverage and adequate signal strength throughout the data center poses challenges. Factors like interference from metal structures or densely packed equipment racks can affect signal propagation and require careful planning. Integrating RFID systems with legacy infrastructure and management systems can be complex. Ensuring compatibility, seamless data exchange, and integration with existing software and databases requires meticulous planning and system adjustments. Implementing changes or upgrades to accommodate scalability may require downtime, affecting data center functionality and service availability. Therefore, the complexity in deployment and scalability of the RFID systems is impeding the growth of the market.

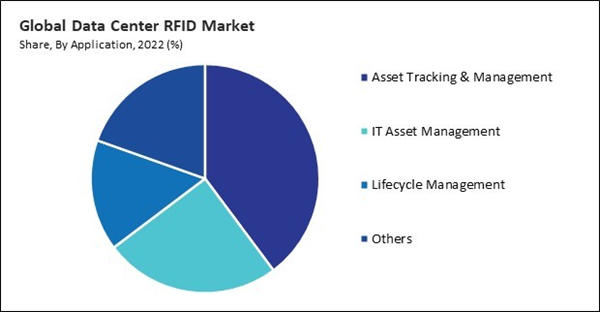

By Application Analysis

Based on application, the market is categorized into asset tracking & management, IT asset management, lifecycle management, and others. In 2022, the asset tracking & management segment registered the highest revenue share in the market. The increasing demand for asset tracking and management solutions in the market is motivated by the necessity for cost savings, enhanced security, and regulatory compliance. These systems are of the utmost importance in optimizing resource utilization, streamlining data center operations, and ensuring the efficient administration of assets throughout their entire lifecycle.By Component Analysis

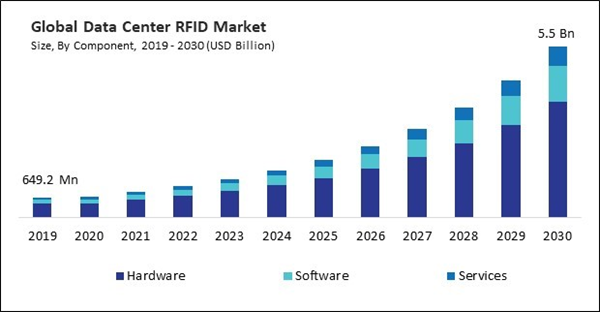

Based on component, the market is divided into hardware, software, and services. The services segment attained a considerable revenue share in the market in 2022. The increasing demand for service offerings in the market mirrors the need for expertise, support, and tailored solutions to maximize the benefits of RFID technology. Service providers provide comprehensive support to data centers throughout the entire lifecycle of RFID technology. This includes assisting with planning, implementation, security, compliance, and continuous enhancement within the data center environment.By Hardware Analysis

The hardware segment in the market is further divided into tags, reader, printer, antenna, and others. The reader segment gained the highest revenue share in the market in 2022. The increasing demand for RFID readers within the market underscores their pivotal role in enabling efficient asset tracking, enhancing security measures, and supporting the overall operational objectives of data centers. As technology advances and data centers evolve, the demand for more sophisticated, secure, and versatile RFID reader solutions will persist.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed the maximum revenue share in the market in 2022. North America has witnessed a surge in data center construction and expansion due to the growing digital transformation, cloud computing, and expansion of data-driven technologies. As data centers expand, there's a greater need for efficient asset tracking and management, which RFID technology offers. The combination of technological advancements, the need for compliance, a focus on operational efficiency, and the adoption of smart infrastructure collectively drive the increasing demand for RFID technology in data centers across North America.Recent Strategies Deployed in the Market

- Oct-2023: Sato Holdings Corporation came into partnership with CipherLab, a provider of automated identification and data capture solutions, specializing in manufacturing mobile computers, barcode scanners, and RFID readers. Through this partnership, Sato would offer their customers a new software solution that facilitates users with smooth access to remote maintenance support and device upkeep for SATO's label and RFID printers, as well as CipherLab's mobile computers.

- Feb-2023: HID Global Corporation took over GuardRFID, a provider of real-time location solutions, specializing in innovative RFID technology for asset tracking and personnel safety. Under this acquisition, combined with HID's expanding range of RTLS and active RFID solutions, offers healthcare clients, both new and existing, a broader array of choices to enhance patient and staff protection.

- Jun-2022: Zebra Technologies Corporation took over Matrox Imaging, a provider of innovative image processing and computer vision solutions, specializing in developing hardware and software components for industrial machine vision applications. This acquisition enhances Zebra's presence in the rapidly growing automation and vision technology solution sector, complementing its recently launched fixed industrial scanning and machine vision portfolio, along with the acquisitions of Adaptive Vision and Fetch Robotics.

- May-2022: HID Global Corporation acquired Vizinex RFID, a company specializing in the design and manufacturing of high-performance radio frequency identification (RFID) tags for various industries. Through this acquisition, HID would be able to offer customers in crucial markets a comprehensive suite of technology and services by demonstrating dedication to strengthening the RFID portfolio.

- Feb-2021: HID Global Corporation took over Technology Solutions (TSL) UK Ltd, a company specializing in the development and manufacturing of RFID (Radio Frequency Identification) solutions for diverse industrial applications. Through this acquisition, HID would be able to expand its RFID components business through the inclusion of TSL which allows HID to offer customers a consolidated source for a comprehensive RFID solution, encompassing hardware and integration tools, all accessible through a unified distribution channel.

List of Key Companies Profiled

- HID Global Corporation (Assa Abloy AB)

- Alien Technology, LLC

- Confidex Ltd.

- Honeywell International, Inc.

- Impinj, Inc.

- Mojix, Inc. (Peak Rock Capital)

- Nedap N.V.

- NXP Semiconductors N.V.

- Sato Holdings Corporation

- Zebra Technologies Corporation

Market Report Segmentation

By Component- Hardware

- Reader

- Handheld

- Fixed

- Tags

- Tags Type

- Passive

- Active

- Tag Frequency

- UHF

- HF

- LHF

- Printer

- Antenna

- Others

- Software

- Services

- Asset Tracking & Management

- IT Asset Management

- Lifecycle Management

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- HID Global Corporation (Assa Abloy AB)

- Alien Technology, LLC

- Confidex Ltd.

- Honeywell International, Inc.

- Impinj, Inc.

- Mojix, Inc. (Peak Rock Capital)

- Nedap N.V.

- NXP Semiconductors N.V.

- Sato Holdings Corporation

- Zebra Technologies Corporation