Feeding/Nutrition Management Systems allows dairy farmers to choose the solution that best suits their operational needs, ultimately leading to healthier, more productive herds and improved farm profitability. Thus, the Feeding/Nutrition Management Systems segment captured $419.2 million revenue of the market in 2022. These systems are designed to optimize the well-being and productivity of dairy cattle by ensuring they receive the right balance of nutrients. In this market, several types of systems are prominent.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, in October, 2023, Lely International N.V. partnered with Acorn Dairy Ltd. Through this alliance, the two companies are working together to offer an eco-friendly solution that reduces carbon dioxide emissions by 50%. Furthermore, in December, 2022, Connecterra B.V. entered partnership with ABS Global. Through this partnership, Connecterra aims to leverage ABS's digital solution, Ida, to enhance operational efficiency for dairy farmers and their advisors, ensuring smoother and more effective farming operations.

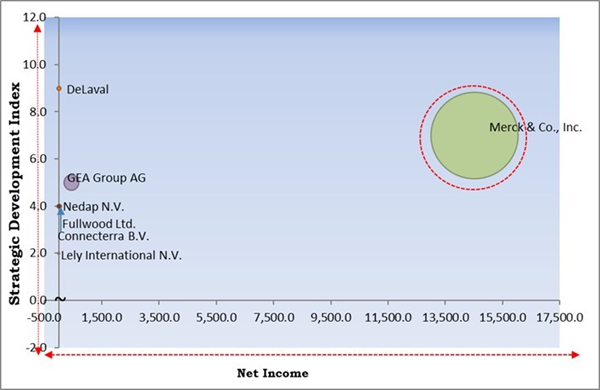

Cardinal Matrix

Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; Merck & Co., Inc. is the forerunner in the Market. Companies such as GEA Group AG, Nedap N.V, are some of the key innovators in the Market. For instance, In August, 2023, GEA Group AG came into partnership with Unilever PLC, a renowned consumer goods enterprise. With this partnership, GEA will implement its cutting-edge manure enrichment solution, the ProManure E2950, in four dairy farms that provide milk to Unilever. Through this endeavor, they aim to leverage the system's data analysis capabilities to study its influence on eliminating Unilever's carbon footprint. This initiative is anticipated to make a substantial contribution to the reduction of greenhouse gas emissions across the entire milk production process.Market Growth Factors

Rapid technological advancements in dairy herd management

Technological advancements have introduced precision livestock farming, a game-changing approach to dairy herd management. This technology leverages sensors and data analytics to monitor individual cows' health, behavior, and nutrition. The precision livestock farming system provides real-time data, allowing farmers to promptly identify and address health issues. As a result, the herd's overall health is improved, leading to increased milk production and reduced veterinary costs. Another positive impact of technological advancements in dairy herd management is the improved welfare of dairy cattle. Automation technologies, such as robotic milking machines, provide a stress-free and comfortable milking experience for cows. These advancements have introduced precision livestock farming, enabled data-driven decision-making, supported sustainability, improved animal welfare, and allowed for remote management, thereby propelling the growth of the market.Increasing use of dairy herd management systems in meeting regulatory requirements

It plays a pivotal role in ensuring compliance with regulatory requirements in the dairy industry. Regulatory requirements often include specific guidelines related to animal welfare. Dairy herd management practices are designed to ensure dairy cattle's well-being and humane treatment. Additionally, Dairy herd managers are responsible for managing the reproductive cycle of dairy cattle, which often involves artificial insemination and pregnancy monitoring. These practices must align with regulations governing breeding and reproduction procedures to ensure animal welfare and reproductive health standards compliance. Thus, as it plays a central role in meeting regulatory requirements in the dairy industry, its increasing use is aiding in the growth of the market.Market Restraining Factors

Low adoption because of the fragmented nature of the dairy industry

Larger, more technologically advanced dairy operations may readily embrace modern herd management practices and invest in advanced technologies. In contrast, smaller and traditional farms may be less inclined to adopt such systems due to financial constraints, lack of resources, or resistance to change. This fragmentation creates a disparity in the industry, hindering the widespread adoption of efficient herd management practices. Moreover, fragmented industry dynamics can hinder collaborative efforts to address common challenges. For example, collective initiatives to improve sustainability, animal welfare, or regulatory compliance may be less effective when farms have varying levels of commitment and resources. Thus, the fragmented nature of the dairy industry can negatively impact the market by creating disparities in the adoption of modern herd management practices, varying access to technology and resources, and inconsistencies in regulatory compliance.End-use Outlook

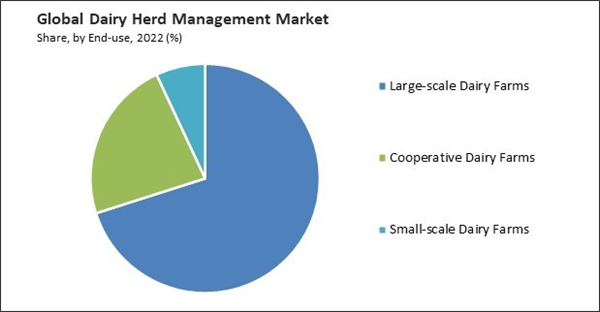

On the basis of end-use, the market is classified into small-scale dairy farms, large-scale dairy farms, and cooperative dairy farms. The cooperative dairy farms segment recorded a significant revenue share in the market in 2022. Cooperative farms can pool data from various members and use herd management systems to analyze trends, share best practices, and collectively improve overall herd performance. A herd management system can help cooperative farms enforce uniform standards and best practices across member farms, improving overall quality and efficiency. By collectively managing and sharing information on disease outbreaks, supply chain disruptions, and market fluctuations, cooperative farms can better mitigate risks and plan for contingencies.Type Outlook

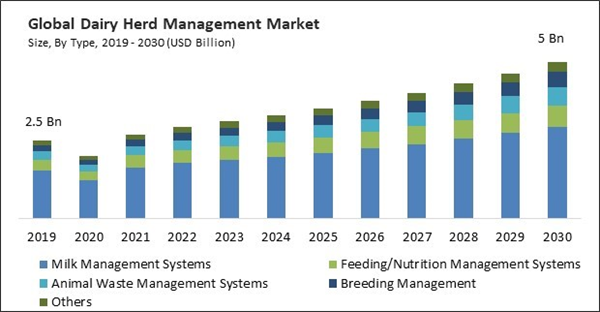

Based on type, the market is characterized into milk management systems, feeding/nutrition management systems, animal waste management systems, breeding management, and others. The animal waste management systems segment procured a considerable growth rate in the market in 2022. Proper waste management systems can significantly reduce the environmental pollution caused by animal waste, including contamination of water sources with nutrients and pathogens. Animal waste management systems allow for the precise application of nutrients to fields, reducing the risk of over-fertilization and nutrient runoff. Some waste management systems can generate biogas or electricity from animal waste, providing an additional source of income for farms.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment witnessed the maximum revenue share in the market in 2022. European consumers and regulators are increasingly concerned about animal welfare. Dairy herd management systems can help improve animal health and well-being by monitoring and addressing issues promptly. Consumer demand for organic and ethically produced dairy products has grown in Europe. The region is home to research institutions and companies at the forefront of dairy technology. This environment fosters innovation and the development of advanced dairy herd management systems.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Alta Genetics Inc. (Urus Group LP), DeLaval (Tetra Laval Group), GEA Group AG,Lely International N.V., Nedap N.V., Fullwood Ltd. (The Verder Group), SUM-IT Computer Systems Ltd, Connecteraa B.V and Merck & Co., Inc.

Strategies deployed in the Market

Partnerships, Collaborations, and Agreements:

- Oct-2023: Lely International N.V. partnered with Acorn Dairy Ltd, an organic dairy company specializing in sustainable products. Through this alliance, the two companies are working together to offer an eco-friendly solution that reduces carbon dioxide emissions by 50%.

- Sep-2023: DeLaval entered into partnership with Deere & Company, a prominent producer of agricultural, construction, and forestry equipment and solutions, through this Partnership to establish a Milk Sustainability Centre, a digital platform designed to assist dairy farmers in enhancing nutrient utilization efficiency for elements such as nitrogen, phosphorus, potassium, and carbon dioxide across their entire farms. This innovative ecosystem enables farmers to assess their performance and pinpoint areas in need of improvement.

- Aug-2023: GEA Group AG came into partnership with Unilever PLC, a renowned consumer goods enterprise. With this partnership, GEA will implement its cutting-edge manure enrichment solution, the ProManure E2950, in four dairy farms that provide milk to Unilever. Through this endeavour, they aim to leverage the system's data analysis capabilities to study its influence on eliminating Unilever's carbon footprint. This initiative is anticipated to make a substantial contribution to the reduction of greenhouse gas emissions across the entire milk production process.

- Dec-2022: Connecterra B.V. entered into partnership with ABS Global, a division of Genus Plc, a company specializing in the sale of frozen bovine semen for artificial insemination. Through this partnership, Connecterra aims to leverage ABS's digital solution, Ida, to enhance operational efficiency for dairy farmers and their advisors, ensuring smoother and more effective farming operations.

- Dec-2021: Connecterra B.V. joined hands with Lely International N.V., a prominent supplier of agricultural products and solutions. Through this partnership, their mutual aim is to enhance productivity by harnessing the power of Ida's artificial intelligence.

- Jan-2021: Nedap N.V. has joined forces with GENEX Cooperative, a subsidiary of Urus Group LP, a company specializing in dairy and beef cattle production. This collaborative effort has led to the introduction of the GENEX Herd Monitor, a cutting-edge system designed to monitor various aspects of a herd's health, including eating habits and rumination. This innovative technology is set to empower farmers in efficiently managing their herds, ultimately leading to substantial time and labour savings on their farms.

- Jun-2021: Nedap N.V. formed partnership with Cogent Breeding Ltd., a prominent innovator in the field of sexed semen technology. Through this collaborative effort, Nedap and Cogent are launching PrecisionCOW, an advanced technology solution designed to meticulously track the fertility, well-being, and whereabouts of every cow around the clock. This groundbreaking innovation empowers dairy farmers to enhance the efficiency and profitability of their operations.

Product Launches and Product Expansions:

- Mar-2023: DeLaval has introduced the E500, a cutting-edge rotary milking system, offering operators real-time access to the milked cows' status. The system boasts automated initiation and speed controls, integrated surveillance cameras, and the capability to manage mass gate controls. It also maintains vigilant monitoring of each cow within their individual enclosure, prioritizing their safety.

- Mar-2021: GEA Group AG has introduced a groundbreaking Herd and Farm Management solution named Dairynet. This innovative solution is equipped with task management, analysis tools, notifications, and reporting capabilities, providing a seamless and efficient way to oversee the daily operations of both herds and farms. It seamlessly integrates with GEA's Dairyrobot R9500 and modified mono box, enhancing farmers' efficiency and flexibility while ensuring the welfare of their animals.

- Feb-2020: Merck Animal Health, a subsidiary of Merck & Co., Inc., has unveiled a novel product named Shutout. This innovative, sterile barrier, free from antibiotics, serves the purpose of effectively sealing a cow's teats before the drying-off process. With the introduction of this product, Merck has responded to the needs of the dairy production industry. Which safeguard the cows from intramammary infections.

Acquisition and Mergers:

- Jun-2021: Merck Animal Health, a subsidiary of Merck & Co., Inc., has revealed its plans to acquire the assets of LIC Automation Ltd, a company specializing in the development of automated farming systems tailored for dairy farmers. This strategic partnership aims to integrate LIC products into Merck's existing line of veterinary medicines and vaccines, expanding their portfolio to include complementary technologies that enhance animal health. This expansion is expected to provide tangible benefits to their customers and bolster their profitability.

- Jul-2020: DeLaval has completed the acquisition of Milkrite | InterPuls, a provider of milking point solutions to farmers worldwide. Through this partnership Delaval aims to further enhance farming conditions and promote the overall advancement of the agriculture sector.

- Mar-2019: Fullwood Ltd has successfully completed the acquisition of Mewitec BV, a Dutch company specializing in the import, retail, installation, and technical support of Fullwood's smart milking and cooling solutions. This strategic move by Fullwood is aimed at establishing a direct trading relationship with farmers across the Netherlands, presenting a promising avenue for increased revenue.

Scope of the Study

Market Segments Covered in the Report:

By Type- Milk Management Systems

- Feeding/Nutrition Management Systems

- Animal Waste Management Systems

- Breeding Management

- Others

- Large-scale Dairy Farms

- Cooperative Dairy Farms

- Small-scale Dairy Farms

- North America

- US

- Canada

- Mexico

- Rest of North America- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Alta Genetics Inc. (Urus Group LP)

- DeLaval (Tetra Laval Group)

- GEA Group AG

- Lely International N.V.

- Nedap N.V.

- Fullwood Ltd. (The Verder Group)

- SUM-IT Computer Systems Ltd

- Connecteraa B.V

- Merck & Co., Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Alta Genetics Inc. (Urus Group LP)

- DeLaval (Tetra Laval Group)

- GEA Group AG

- Lely International N.V.

- Nedap N.V.

- Fullwood Ltd. (The Verder Group)

- SUM-IT Computer Systems Ltd

- Connecteraa B.V

- Merck & Co., Inc.