Palm oil is a highly efficient crop, producing a significant yield of oil per unit of land, making it a preferred choice for many industries. It is semi-solid at room temperature, making it ideal for various food applications, such as cooking oil, margarine, and baked goods. Beyond the culinary realm, palm oil is also found in a vast array of non-food products, including cosmetics, detergents, and biodiesel.

The versatility of palm oil in both food and non-food industries, such as cosmetics and biofuels, makes it a sought-after commodity worldwide. Additionally, the increasing population across the world creates a rising demand for food products, including those containing palm oil, such as processed foods and cooking oils. Other than this, as economies develop, there is a greater demand for convenience foods, which often contain palm oil, as well as increased usage in industrial applications. Besides this, the expanding middle class in emerging markets, particularly in Asia, is driving greater consumption of processed foods and personal care products, further boosting palm oil demand. In line with this, palm oil production is cost-effective, as it yields a higher quantity of oil per unit of land compared to other oilseeds, making it attractive to producers. Furthermore, the use of palm oil in biodiesel and other renewable energy sources has grown, driven by environmental concerns and the need to reduce greenhouse gas emissions. Moreover, health-conscious consumers and regulatory bodies in some regions have led to increased scrutiny of palm oil due to its saturated fat content, potentially affecting market demand.

Palm Oil Market Trends/Drivers:

Versatility and Wide Application of the Product

It is a key ingredient in numerous food products, ranging from cooking oils and margarine to baked goods and snacks. Its semi-solid nature at room temperature enhances the texture and shelf life of many processed foods. Moreover, palm oil's stable properties make it a preferred choice for frying due to its resistance to oxidation. Beyond the food industry, palm oil plays a vital role in the production of personal care and household products, including cosmetics, soaps, and detergents. It is valued for its ability to provide moisture and consistency to these products. Additionally, palm oil is increasingly used in the biofuel industry, contributing to its growing demand as a renewable energy source. Its adaptability across various sectors makes palm oil a commodity with a consistently high market demand.Rapid Population Growth

As more people enter the middle class, their dietary preferences evolve toward processed and convenience foods, which frequently contain palm oil. This demographic shift has a direct impact on the growth of the palm oil market, particularly in emerging economies where income levels are rising.Significant Economic Development

As countries develop and urbanize, there is a greater reliance on convenience foods and processed products that contain palm oil. The demand for palm oil also extends to industrial applications, such as lubricants and biodiesel, in developing economies. Additionally, economic growth often leads to greater disposable income, enabling consumers to afford a wider range of products that incorporate palm oil. This economic development effect is especially pronounced in regions like Southeast Asia, where palm oil is a significant driver of rural employment and economic activity.Palm Oil Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global palm oil market report, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on application.Breakup by Application:

- Household Cooking

- Food & Beverages

- Oleo Chemicals

- Personal Care

- Animal Feed

- Bio-fuel

Household cooking dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes household and cooking, food and beverages, oleo chemicals, personal care, animal feed, and bio-fuel. According to the report, household cooking represented the largest segment.The ubiquity of palm oil in household kitchens across the globe is a primary driver. It is a staple cooking oil in many cultures due to its affordability, neutral flavor, and versatility. Palm oil's semi-solid state at room temperature makes it ideal for frying, sautéing, and baking, enhancing the taste and texture of a wide array of dishes. Its widespread availability and affordability further cement its place as a preferred choice for cooking purposes in households. Additionally, the sheer size of the global population necessitates a substantial volume of cooking oil. As more people gain access to kitchens and start cooking at home, the demand for cooking oils like palm oil naturally rises. The world's growing middle class, particularly in emerging markets, contributes significantly to this trend as they increasingly opt for home-cooked meals.

Breakup by Region:

- India

- Indonesia

- China

- European Union

- Malaysia

- Others

Indonesia exhibits a clear dominance in the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include India, Indonesia, China, European Union, Malaysia, and others. According to the report, Indonesia accounted for the largest market share.Indonesia is also the largest producer of palm oil in the world. The tropical climate of the country and vast expanses of suitable land makes it exceptionally conducive to palm oil cultivation. The favorable growing conditions, combined with the availability of a skilled labor force, enable Indonesia to produce a substantial quantity of palm oil, which in turn, influences its dominance in the market. Additionally, the Indonesian government has actively supported the palm oil industry through policies and incentives, fostering its growth. These measures include land-use policies that prioritize palm oil cultivation, tax incentives for palm oil producers, and infrastructure development that facilitates palm oil production and transportation. Moreover, Indonesia's strategic geographic location enables efficient export to key markets such as China and India, both of which have high demand for palm oil. This geographic advantage enhances Indonesia's competitiveness in the global palm oil market. The Indonesian palm oil industry has made efforts to comply with sustainability standards, such as RSPO certification, which has allowed it to maintain and expand its market share by catering to the growing demand for sustainable palm oil.

Competitive Landscape:

Major palm oil producers and consumer goods companies have made commitments to source sustainable palm oil. They have joined initiatives like the Roundtable on Sustainable Palm Oil (RSPO) and adopted responsible sourcing policies. This includes pledges to avoid deforestation, protect biodiversity, and respect the rights of local communities. Additionally, leading palm oil companies are investing in research to develop more sustainable and productive palm oil varieties. These efforts aim to increase yields per hectare while minimizing the environmental impact of cultivation. Other than this, numerous key players are enhancing traceability in their supply chains. They are implementing systems to track the origin of palm oil and ensure it comes from legal and responsible sources. This transparency helps in identifying and addressing issues related to deforestation and labor rights violations. Besides this, industry leaders are actively engaging with stakeholders, including NGOs, governments, and local communities, to address concerns and collaborate on sustainable practices. This includes dialogues on land use, community development, and conservation efforts.The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Archer-Daniels-Midland Company

- Asian Agri

- Boustead Holdings Berhad

- IJM Corporation Berhad

- IOI Corporation Berhad

- Kuala Lumpur Kepong Berhad

- Kulim Malaysia Berhad (Johor Corporation)

- PT Dharma Satya Nusantara Tbk

- PT PP LONDON SUMATRA INDONESIA TBK

- PT Sampoerna Agro Tbk

- PT. Bakrie Sumatera Plantations tbk

- Sime Darby Plantation Berhad

- United Plantations Berhad

- Univanich Palm Oil Public Company Ltd.

- Wilmar International Ltd.

Key Questions Answered in This Report

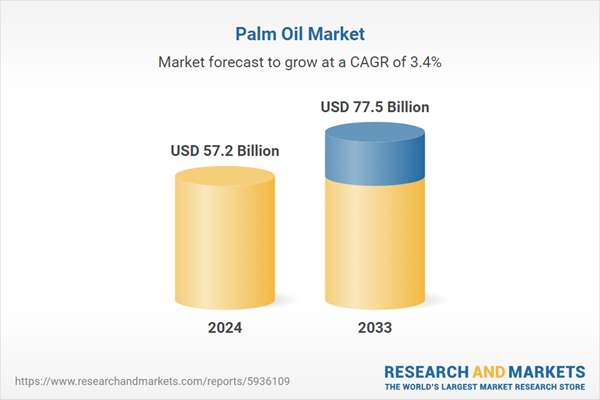

1. What was the size of the global palm oil market in 2024?2. What is the expected growth rate of the global palm oil market during 2025-2033?

3. What are the key factors driving the global palm oil market?

4. What has been the impact of COVID-19 on the global palm oil market?

5. What is the breakup of the global palm oil market based on the application?

6. What are the key regions in the global palm oil market?

7. Who are the key players/companies in the global palm oil market?

Table of Contents

Companies Mentioned

- Archer-Daniels-Midland Company

- Asian Agri

- Boustead Holdings Berhad

- IJM Corporation Berhad

- IOI Corporation Berhad

- Kuala Lumpur Kepong Berhad

- Kulim Malaysia Berhad (Johor Corporation)

- PT Dharma Satya Nusantara Tbk

- PT PP LONDON SUMATRA INDONESIA TBK

- PT Sampoerna Agro Tbk

- PT. Bakrie Sumatera Plantations tbk

- Sime Darby Plantation Berhad

- United Plantations Berhad

- Univanich Palm Oil Public Company Ltd.

- Wilmar International Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 124 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 57.2 Billion |

| Forecasted Market Value ( USD | $ 77.5 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |