Argentina has a lot of natural resources, an agricultural sector that is focused on exports, and a diverse industrial base that makes a lot of home appliances that are popular on the market.An average Argentine consumer tends to be rational and conservative with their money and prefers to buy products that are strictly either necessary or cost-effective. This behavior clearly explains the rise in sales revenue generated from certain home appliances, like cookers and ovens, which are both necessities and come at affordable prices. This also states the customer's interest in switching to healthy habits and their preference to eat healthily.

With the advent of COVID-19, smart home appliances, which occupy a large share of the market, observed a continuous decline. With a revenue of USD 131.5 million in the year 2019, it declined to a level of USD 37.42 million in the year 2022. With this decline, the gross national per capita income in Argentina declined from USD 11,220 in the year 2019 to USD 9,010 in 2020, causing a major decline in the purchasing power of the population.

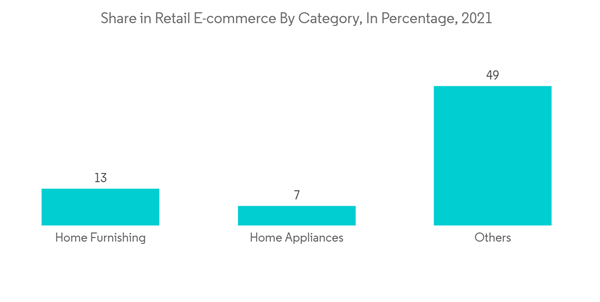

Over the period, customers had become more selective about new products and new brands that were entering the market, and they tended to favor locally manufactured products over imported ones. E-commerce penetration is also increasing gradually but is failing to grab a greater share of the market, owing to its limitations like high delivery charges and limited or no after-sales services offered.

Argentina Home Appliances Market Trends

Convenience Products Leading the Market

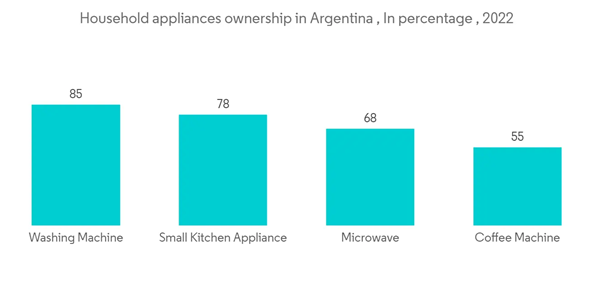

The convenience that the product brings to the consumer's life is making them opt for it. Small home appliances come with a shorter lifespan, which makes it easy for the consumer to replace or exchange them for a newer model. The sales volume of coffee machines almost doubled in the study period and was followed by small kitchen appliances. Customer choices are transitioning. They are shifting to innovative and energy-efficient products for their daily utilization. Products like egg cookers are the best example that explains the increasing interest among manufacturers to focus more on automating people's daily activities by taking a load off their shoulders. They also improve accuracy and bring innovation by producing multi-utility products rather than single-utility products.In the year 2021, the household ownership rate of small appliances in Argentina existed at 55% for the coffee machine, 46% for toasters, and 78% for small kitchen appliances, and it is expected to observe further growth over the coming period.

Store-based Purchases Holding Major Sales Volume

Even though the e-commerce penetration and percentage of customers who are willing to spend on online shopping are increasing, especially among the younger generations, consumers are still preferring to buy their products via stores or outlets only. The factors that are driving these sales are the after-sales service and delivery of the purchased product. It is observed that online sales platforms are failing to reach average customers who do not have their own logistics services. The shipping charges for the majority of the products are almost the same as the price of the product they purchased. The fact that most customers from this region prefer to repair their products rather than replace them is making them choose nearby stores for their desired purchases. All these factors are affecting the Argentine purchasing decision, thus increasing store-based purchases.In the year 2021, retail e-commerce sales of home appliances were at USD 112.1 billion, observing a continuous increase over the years, but it occupied a small share of the total household appliance market. Still, during the year 2022, other than a few products, customers in Argentina will prefer offline purchases.

Argentina Home Appliances Industry Overview

The report covers major international players operating in the Argentine home appliance market. Technology and innovation are driving the market across the world. All the major players are coming up with innovations and investing heavily in their R&D facilities. The Argentine market welcomes newcomers who can make a difference in the way the product range is offered. The market has a lot of room for innovation in the way it operates. The market also holds great scope for online retailers to penetrate.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Whirlpool Corporation

- Electrolux AB

- LG Electronics

- Samsung Electronics

- Panasonic Corporation

- Haier Electronics Group Co. Ltd,

- BSH Hausgeräte GmbH

- Arcelik AS

- Gorenje Group