Key Highlights

- The Indian waste management market is experiencing healthy growth due to high population density and increased industrial activity, resulting in significant amounts of both hazardous and non-hazardous waste.

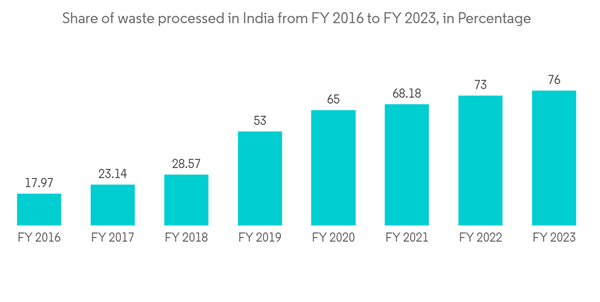

- While the circular economy concept is relatively new to India, it's gaining prominence rapidly. The Indian waste management industry holds immense potential, with only 30% of the 75% recyclable waste currently being recycled. Inadequate policies for waste collection, disposal, and recycling, coupled with inefficient infrastructure, contribute to the poor state of waste management in the country.

- Numerous startups are emerging with innovative waste management ideas and methods for converting waste into valuable resources. However, effectively addressing the challenges in this industry requires a substantial amount of knowledge.

India Waste Management Market Trends

Increase in amount of waste generated

- Increasing population and rapid urbanization have led to a substantial rise in waste generation, necessitating efficient and sustainable waste management practices. Owing to swift urbanization, economic growth, and heightened urban consumption rates, India ranks among the world’s top 10 countries in generating municipal solid waste (MSW).

- According to a report by the Energy and Resources Institute (TERI), India generates over 62 million tons (MT) of waste annually. Merely 43 MT of the total waste generated is collected, with 12 MT being treated before disposal, leaving the remaining 31 MT discarded in waste yards.

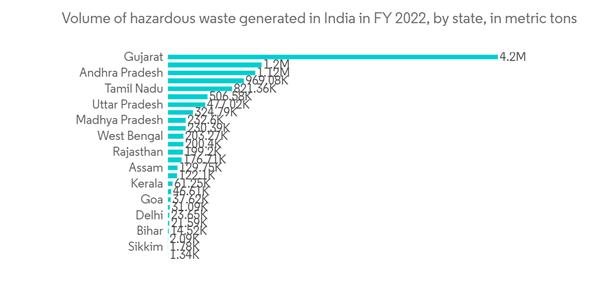

- The Indian Central Pollution Control Board (CPCB) projects that annual waste generation in India will escalate to 165 MT by 2030. Concurrently, hazardous, plastic, e-waste, and bio-medical waste generation are anticipated to increase proportionately.

- Plastic consumption in India has markedly risen over the past five years, consequently elevating its waste output. The country produces 3.4 million tonnes of plastic waste annually, with only 30 percent of it being recycled.

The Increase in Waste Management Startups in India

- The Swachh Bharat Initiative, the Indian government's flagship program aimed at waste collection and effective management, is anticipated to offer substantial growth prospects for emerging startups concentrating on innovative solutions. These startups primarily target electronic and biomedical waste, striving to develop inventive scientific approaches for managing generated waste and prioritizing safer disposal methods.

- One such venture, Jaipur-based waste management startup WeVOIS, secured a total funding of USD 4 million in its pre-Series A round at a valuation of USD 10 million, leveraging a combination of equity and debt. WeVOIS has notably enhanced the environment for over 2.5 million people across 18 cities in India, including Jaipur, Dehradun, Sikar, Gwalior, and Jaisalmer. The company witnessed an impressive 250% year-on-year growth in the past year and a 60% surge in customer acquisition within the last six months, maintaining a zero churn rate since its inception.

- Another initiative, launched in Chennai in August 2020, Bintix, initially serving 100 households, now caters to over 2,000 households and collects 8,500 kg of waste monthly - a figure steadily increasing. Bintix provides households with designated bags, calculated at one bag per week, with collections scheduled every Thursday. Each bag is equipped with a barcode ensuring waste traceability, allowing Bintix to engage households that haven't provided pure dry waste.

India Waste Management Industry Overview

The market studied is fragmented, with many players aiming to mitigate waste generation, as well as recycle and reuse the waste in the most effective way possible. Major Players include A2Z Green Waste Management Ltd, BVG India Ltd, Ecowise Waste Management Pvt. Ltd, and Add Company NameHanjer Biotech Energies Pvt. LtdWith growth in manufacturing and domestic consumption, India’s total waste production is set to increase from its current annual rate of 62 million tons to a whopping 162 million tons by 2030. Numerous startups are focusing on developing innovative approaches for waste disposal in an environment-friendly manner.

As India’s production of waste increases, the country’s government has begun looking to the private sector for help. Municipal bodies mandated with establishing coherent and sustainable waste management systems have been encouraged by the federal government to partner with the private sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A2Z Green Waste Management Ltd

- BVG India Ltd

- Ecowise Waste Management Pvt. Ltd

- Ecogreen Energy Pvt. Ltd

- Hanjer Biotech Energies Pvt. Ltd

- Tatva Global Environment Ltd

- Waste Ventures India Pvt. Ltd

- Hydroair Tectonics (PCD) Ltd

- IL&FS Environmental Infrastructure and Services Ltd

- Jindal ITF Urban Infrastructure Ltd

- Ramky Enviro Engineers Ltd

- SPML Infra Ltd*