Key Highlights

- Proteins are considered an essential part of daily diet as they provide muscle strength and nutrition to the body. Protein consumption is increasing in France owing to the increasing consumer awareness about healthy and functional food consumption. The proteins are being used in different food and beverage products as functional and nutritional ingredients.

- Some proteins like caseins, caseinates, gelatins, collagens, and others also provide texture, viscosity, and stability to food and beverages like soups, salad dressings, bakery products, jellies, and others. Owing to this, the use of proteins is increasing. Also, different protein forms like isolates, concentrates, and textured proteins are used in sports nutrition products and infant food to increase their functionality. Owing to this, the demand for proteins is increasing in the country.

- Furthermore, consumer demand for non-GMO, clean-label, and plant-based organic ingredients is increasing due to rising health and environmental consciousness. Owing to this, the demand for plant proteins is increasing in the country. The majority of consumers are opting for the consumption of vegan and vegetarian food, due to which the market players are using plant proteins. The demand for dairy alternative products like dairy-free milk, yogurt, and other products is increasing. Therefore, the demand for oat, soy, pea, and other proteins is also increasing. Additionally, the demand for plant proteins in other applications like personal care, animal feed, and supplements is also increasing. Owing to the increasing demand, the market players are innovating new proteins in the market. For instance, in January 2021, Rousselot introduced Peptan, Marine collagen peptides. The peptides are claimed to be used in supplements and cosmetic products.

France Protein Market Trends

Increasing Demand for Protein Rich Food and Beverages

- Consumer demand for protein-rich food and beverages is increasing in the country owing to the increasing consumer awareness about healthy and functional food and beverages. Consumers are opting for the consumption of protein-rich food and beverages due to fitness consciousness.

- The market players are using different types of proteins in bakery, confectionery, and other products to increase their functionality and nutritional content. Also, proteins are used in sports nutrition food and beverages as proteins help in building muscle mass and overall health.

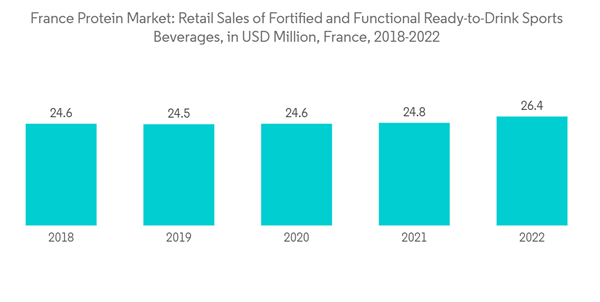

- Thus, the sports and performance nutrition segment has accounted for the maximum share of the market in terms of application. Owing to this, the market players are launching new and innovative proteins in the country to cater to growing demand.

- For instance, in November 2022, Lactalis Ingredients launched a range of whey proteins produced with sunflower lecithin. The company claims that whey protein can be used in bakery and confectionery products. Over the medium term, the demand for proteins is expected to increase owing to the increasing demand for sports nutrition products.

Plant Proteins are Dominating the Market

- The demand for plant-based proteins is increasing in the country due to changes in the food consumption behavior of consumers. Consumers are opting for the consumption of plant-based food and beverages owing to their increasing health benefits over animal proteins.

- Plant proteins are easier to digest than animal proteins. Therefore, they are being used in different food and beverage products. The demand for clean-label, non-GMO, and organic plant-based ingredients is increasing as plant proteins are being used in different plant-based food products.

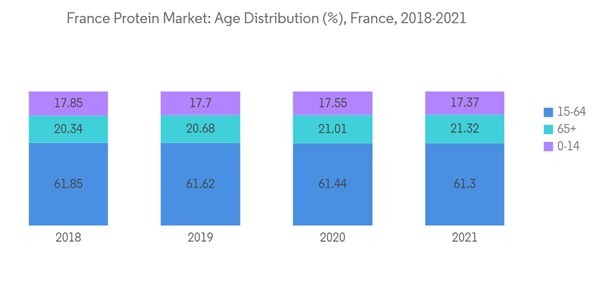

- Also, the demand for processed and convenience food is increasing among working millennials and the teenage population, and these plant-based proteins are being used in products like pastries, confectionery products, sausages, and other meat alternatives as well. The old age population in the country is opting for the consumption of plant-based food products as they have less cholesterol and are easily digestible.

- The market players are launching different plant proteins in the market to cater to market demand. For instance, in June 2022, Roquette Freres extended its Nutralys plant protein range with the launch of the new Nutralys Rice Protein. The protein claims to be used in snack food, sports nutrition, and special diet food.

France Protein Industry Overview

The France protein market is fragmented, with regional and global players dominating the market. The prominent players in the market include Agrial Group, Archer Daniels Midland Company, DuPont de Nemours Inc, SAS Gelatines Weishardt, and Roquette Freres. The demand for different types of protein is increasing, due to which the market players are adopting new strategies like product innovation, mergers & acquisitions, partnerships, expansions, and many more.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.