A hypermarket is a store that consists of supermarkets as well as department stores, with a wide range of products available under one roof. Hypermarkets can be found in urban as well as less-populated areas. Canada, Europe, Japan, the United States, and Australia were among the countries where the concept of hypermarkets was initially established and expanded globally. Hypermarkets in their global expansion are facing disruptions from e-commerce, which is leading to some developing countries omitting the hypermarket stage and jumping to e-commerce.

With the advent of COVID-19, as restrictions came into place and access to hypermarkets became difficult, the retail solution arrived with online ordering and delivery of products ranging from groceries to luxuries. This trend led to hypermarkets changing their business model by including online delivery services and opening new stores in Tier 2 and Tier 3 cities. Even on the consumer side, people moved away from small baskets from different stores to much bigger baskets purchased infrequently from one store. This created an opportunity for hypermarkets to expand their digital as well as offline services.

As the world has recovered from the pandemic, there was a surge in demand for non-food categories, which made available in hypermarkets with the space occupied by them included as a sunk cost for retailers. Through a huge shift to online, this is causing disruptions for hypermarket stores as products are available in variety as well as at a discount through online channels. This requires hypermarkets to review their business models as well as their sustainability.

Hypermarket Market Trends

Consumer Choice Behavior Affecting Hypermarket Market

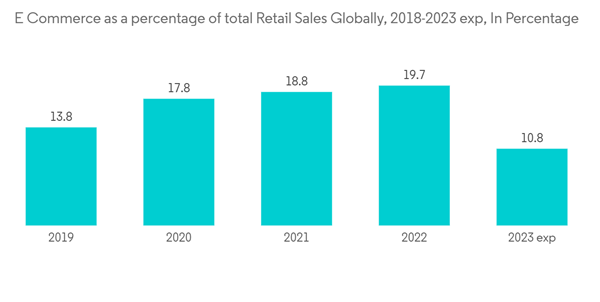

Since COVID-19, sales in e-commerce went up steadily, and this growth is what will drive the future market.Global e-commerce rose from 15% of total retail sales in 2019 to 21% in 2021 and is expected to reach a level of 27% by 2026. To not let its market share of customers be occupied by other markets. Hypermarkets need to develop online retail channels for growing and maintaining their sales volumes. With their low-cost features, hypermarkets provide users with a time-saving, all-under-one-roof, and convenient shopping experience. Hypermarkets are expected to observe growth as the economy recovers from COVID-19 and the rising pent-up demand.Asia and North America are among the countries with the largest penetration of e-commerce. This is leading to the adoption of online retail in the North American region and for the Asia market to expand their market share by adopting e-commerce in their sales. Other than Africa, ASEAN and Latin American countries have a small share of e-commerce, making for lower market penetration for hypermarkets, which is expected to increase with the growing adoption of e-commerce businesses.

Operational Expansion Of Players In Hypermarket Business

A large number of operators are expanding their businesses globally in the hypermarket business. Walmart, with its operations in 24 countries and its 10,500 stores and e-commerce websites, has a large share of the market and continuously rising revenue, similar to other global chains like Kaufland. This is leading to the expansion of the business through more joint ventures and business mergers being established. In large and expanding markets in India, retailers are looking for space in cities to open more hypermarkets over the years. Reliance Retail is focused on the multiple expansions of its store footprints over the years through partnerships with MSMEs and local and international brand companies.With the rise of digital marketing, small businesses are finding it easier to sell their products and grow their market share at the same time.

Hypermarket Industry Overview

Walmart, Target, Kaufland, Carrefour, Costco, E. Leclerc, Sam's Club, Metro, RT-Mart, and Auchan exist among the leading supermarket chains providing their services globally. With the largest number of hypermarkets worldwide existing at 4,500, Walmart is leading, followed by the Target hypermarket chain with a total of 1900 hypermarkets globally. With this global spread of hypermarket chains, these leaders are focused on increasing their services and hypermarkets globally to occupy a larger market share and reap existing benefits.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.