Key Highlights

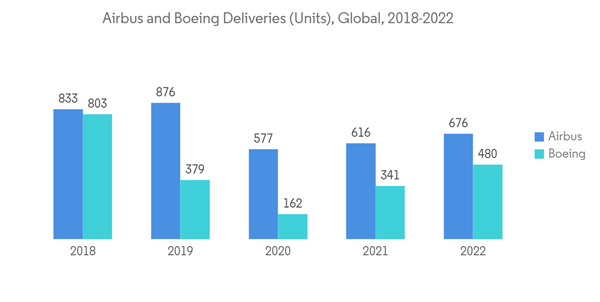

- The COVID-19 pandemic deleteriously affected the aviation industry. Stringent government regulations on air transport, supply chain disruptions, and airline shutdowns hindered market growth temporarily. However, the market showcased a strong recovery post-COVID due to increased air passengers and growing aircraft deliveries. According to the International Air Transport Association (IATA), international traffic in 2022 climbed 152.7% compared to 2021 and reached 62.2% of 2019 levels.

- Airplane windshield wiper systems mainly consist of wiper blades that work by the electrical system on the plane. The system includes a wiper itself, a wiper motor or converter, and a wiper arm. Some aircraft are equipped with wipers for both the pilot and co-pilot, which work on the same electrical system, while some aircraft have wipers on two separate systems. The wipers are used during ground operations, for takeoff, during the final stages of the approach, and for landing. The systems also can be quite noisy, and some pilots find them distracting; thus, many pilots will only use the wipers in conditions of heavy rain.

- An increasing number of air travelers and growing aircraft deliveries of various types of aircraft create demand for windshield wiper systems. Boeing, an aircraft manufacturer, projects that airlines will need to purchase 42,595 aircraft from now until 2042. The aircraft OEM forecast that out of total deliveries, there are 7,440 widebody aircraft, 1,810 regional jets, and 925 freighters. Thus, growing demand for new commercial and regional aircraft and growing passenger safety concerns drive the market growth during the forecast period.

Aircraft Windshield Wiper Systems Market Trends

Commercial Aircraft Segment is Expected to Show Significant Growth During the Forecast Period

- The commercial aircraft segment will showcase remarkable growth during the forecast period. The growth is due to the increasing number of commercial aircraft orders and deliveries and the rising use of advanced windshield wiper systems.

- The growing number of air passengers, increasing spending in the aviation sector, and rising procurement of general aviation aircraft drive the market growth during the forecast period. In March 2022, the International Air Transport Association (IATA) forecasted that overall traveler numbers to reach 4.0 billion in 2024. Furthermore, it projects that the number of air travelers could double to 8.2 billion by 2037.

- Commercial aircraft which are used in the airline industry, such as the Boeing B747, Boeing B737, Airbus A220, and many other variants, have windshield wipers that are used to maintain visibility during the rainy season. Collins Aerospace is the prime supplier of windshield wiper systems to the Boeing B737 and Boeing B747 aircraft family, and Falgayras provides wiper systems to the Airbus A220 and A400M aircraft.

- The plane gains speed along the ground, and water from the nose cone will run over the windshield and reduce visibility which will be cleared with the help of wipers systems. Thus, growing demand for new commercial aircraft and rising aircraft modernization programs from airlines drive the growth of the market during the forecast period.

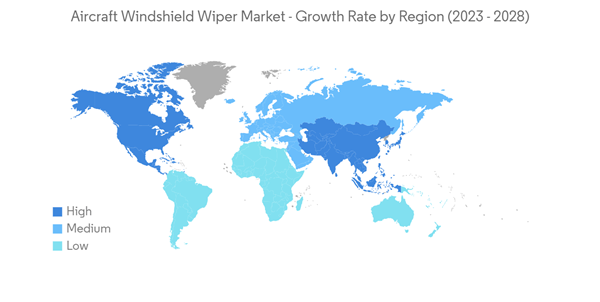

Asia Pacific is Projected to Significant Growth in the Market During the Forecast Period

- Asia Pacific is anticipated to show remarkable growth in the aircraft windshield wiper market during the forecast period. The growth is due to the rapid expansion of the aviation sector and increasing procurement of commercial and military aircraft from countries like China, India, South Korea, and others.

- According to the International Air Transport Association (IATA), China became the largest aviation market in terms of seating capacity in mid-2020. According to plans released in February 2021, China is planning to have 400 civilian transport airports by the end of 2035.

- Furthermore, IATA projects that India will surpass and become the third-largest aviation market by 2024. Also, Boeing forecasts India's passenger traffic will grow at a rate of nearly 7 percent annually, compared with 4.9 percent in China from 2022 through 2041. India is planning to build 72 new airports with an approximate investment of USD 12 billion by 2025. Thus, growing demand for new aircraft and rising investment in the aviation sector drive market growth across Asia Pacific.

Aircraft Windshield Wiper Systems Industry Overview

The aircraft windshield wiper market is consolidated in nature, with a presence of few players holding significant shares in the market. Some of the key players in the market are Safran, Aerosystems S.r.l., Raytheon Technologies Corporation, Krause Airco, Inc., and Saint-Gobain Aerospace.Key original equipment manufacturers (OEMs) are highly investing in developing new windshield wiper systems using 3D printing technology. Furthermore, major players focus on business expansion through innovation, contracts with airlines, agreements, and new product development. For Airbus Helicopters, the German RepRap X400 was instrumental in developing their new windshield wiper system. 3D printing the windshield wiper systems reduced testing time and costs for Airbus.

In April 2020, Ontic signed an exclusive license agreement with Honeywell International Inc. for aircraft windshield wiper product lines. The license covers windshield wiper assemblies, including arms, wiper motor, blades, and components. The products are fitted on commercial and military platforms that include B757, B767, B777, B777X, C-17, KC-46A, and ERJ series.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.