Key Highlilite imagery services.

Key Highlights

- The Nordic satellite imagery services market has significantly expanded in Nordic countries in the past few years with the increased adoption of satellite imagery services in the military, defense, forestry, and agriculture sectors. Countries like Sweden, Finland, and Norway are offering substantial growth opportunities for market vendors to expand their satellite imagery services in various end-user industries. In addition, the significant presence of regional market vendors such as OHB Sweden, Kongsberg Satellite Services (KSAT), ICEYE, etc., further boosts the expansion of the market.

- Further, the Nordic countries have established policies to strengthen the space ecosystem by launching innovative space missions such as MATS (Mesospheric Airglow/Aerosol Tomography and Spectroscopy), an upcoming Swedish satellite mission designed to investigate atmospheric waves. Moreover, the countries are strengthening their space programs by partnering with global space agencies. For instance, the Swedish space program is primarily implemented in international cooperation, mainly within the European Space Agency, ESA framework. This is analyzed to create growth opportunities for market vendors to offer satellite imagery services to Nordic countries.

- Additionally, the satellite imagery services has witnessed significant adoption in forestry sector with market vendors witnessing demand to offer satellite imagery services for forest monitoring. Moreover, the satellite imagery services market in Nordic countries is further driven by the growing partnership among government authorities and the satellite imagery services market. The region has witnessed several alliances in the past few years to increase the adoption of satellite imagery services in various sectors.

- For instance, in the past, Norway's Ministry of Climate and Environment partnered with Kongsberg Satellite Services, Planet, and Airbus to make high-resolution satellite imagery of the tropics free and accessible to everyone. This trend is analyzed and expected to grow in the coming years, thus providing growth opportunities for the market vendors.

- The COVID-19 pandemic impacted the satellite operations of the market vendors owing to the lockdown and supply chain disruptions, and significantly impacted the market's growth. Post-pandemic, the market is witnessing significant growth with the increase in satellite launches, increasing spending power in end-user industries, and growth in investments in the space sector coupled with increasing growth in launches of innovative satellite imagery services.

Nordics Satellite Imagery Services Market Trends

Forestry and Agriculture is Analyzed to Hold Significant Market Share

- Satellite imagery services are gaining significant adoption in the forestry and agriculture sectors of Nordic Countries, Notably in Norway and Sweden. The increasing demand to revolutionize forest monitoring, reduce and reverse the loss of tropical forests, and gain better insight into what is happening in the rainforests to enhance efforts to protect forests in Nordic countries is driving the demand for satellite imagery services.

- Satellite imagery is emerging as a vital tool in the fight against tropical deforestation in Nordic countries. The government is recognizing the importance of satellite imagery services in forest monitoring and investing a substantial amount. For instance, as part of the satellite data program, Norway has committed up to USD 10 million (NOK 90 mill.) to a project managed by the UN Food and Agricultural Organization (FAO) to let more people use satellite imagery to combat tropical forest loss.

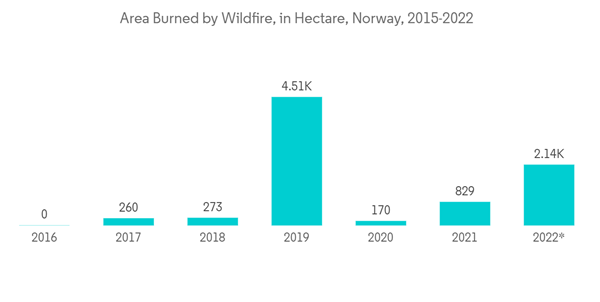

- Additionally, increasing wildfire incidents in Nordic countries due to changing climate and drier weather conditions are driving the demand for satellite imagery services. With the assistance of satellite imagery services, wildfire events can be monitored in almost real-time, and their aftermath can be easily evaluated. For instance, according to the data from European Forest Fire Information System, as of October 2022, 2,143 hectares of land were burned by wildfires in Norway.

- Moreover, the increasing focus on efficient and sustainable agriculture practices in the region is expected to drive the demand for satellite imagery services in the region's agriculture sector. Through the analysis of satellite imagery, farmers can track crop health, assess soil characteristics, and identify susceptibility to pests, diseases, and other risks. Integrating satellite imagery into precision agriculture practices can also significantly enhance sustainability and intelligence in the field. Such factors are expected to drive the demand for satellite imagery services in the forestry and agriculture industry over the forecast period.

Sweden is Expected to Witness Substantial Traction

- The Sweden satellite imagery services market is analyzed to grow at a significant rate owing to the increasing demand across various end-user sectors, the presence of major market vendors such as OHB Sweden, and the increasing demand for satellite imagery services in the country's government sector. Further, the demand for satellite imagery services is also expected to combat climate change issues in the country.

- Climate change in Sweden due to future increases in atmospheric temperature will accelerate erosion through rising sea levels. Satellite imagery services can significantly help government authorities to combat climate change and help in disaster management in the country. Satellite images are taken frequently to measure temperatures and rainfall. They can inform the authorities about the spread of drought, leaf area, pollution, etc.

- Moreover, the booming space sector in the country is analyzed to aid the growth of the satellite imagery services market in the coming years. Swedish space companies are internationally competitive and indulging in innovative satellites. The Swedish National Space Agency (SNSA) contributes to Swedish space operations through calls that allow companies to develop new innovative products and services from satellites.

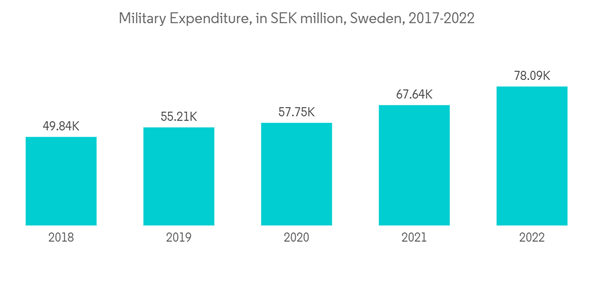

- The millitary and defense sector in the country is expected to witness growth in adoption of satellite imagery services as high-resolution satellite imagery enable millitary and defense agencies to detect and monitor potential targets. Moreover, the increasing millitary budget in past few years in the country offers growth potential for the adoption of satellite imagery services in millitary and defense sector. For instance, according to the data from SIPRI, the military expenditure in Sweden reached SEK 78,094 million (USD 7746.92 million) in 2022 compared to SEK 47,323 million (USD 5550.98 million) in 2017.

Nordics Satellite Imagery Services Industry Overview

The Nordics Satellite Imagery Services market is semi-consolidated owing to a few major market vendors holding significant market share. The market players in the region are indulging in partnership and acquisition activities and launching new innovative satellite imagery solutions with the integration of advanced technologies. Moreover, market vendors are engaging in partnership activities with government organizations to proliferate the demand for satellite imagery services. A few major market vendors operating in the Nordics satellite imagery services market include Thales Alenia Space, Maxar Technologies, ICEYE, Planet Labs, and OHB Sweden, among others.In June 2023, ICEYE, a Finland-based leader in persistent monitoring with radar imaging satellites and an expert in natural catastrophe solutions, expanded its constellation with four new synthetic aperture radar satellites. The next-generation satellites launched by ICEYE can image the Earth with a ground range resolution of 50 centimeters and are accompanied by Spot Fine, a new data product. This new imaging mode is the first class of data offerings enabled by the company's Generation 3 (Gen3) satellite technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.