Healthcare systems have been significantly disrupted and strained at every stage of the rapid spread of COVID-19. Several countries, notably the Thai government, have implemented home quarantine or home isolation programs to prevent medical collapse and improve inadequate medical resources. The number of people infected with COVID-19 in hospitals has increased. Previous studies have shown that telemedicine-based COVID-19 home monitoring programs are feasible in several countries to fill treatment gaps during health worker shortages. These programs monitored symptom intensity and informed patients to seek additional treatment if needed. During the COVID-19 epidemic, hospital capacity was insufficient, and a home isolation system was introduced.

The Thai government has launched education and support on Diabetes Self-Management (DSMES) and telemedicine glycemic control, along with outcomes for COVID-19 patients who have been quarantined at home. In August 2022, the National Research Council of Thailand (NRCT) unveiled a prototype of a Breathalyzer detector that can detect people infected with the new coronavirus with 97% accuracy.

The Thai government has provided medical supplies such as blood glucose meters, blood glucose test strips, lancets and urine test strips donated or purchased with donations during the COVID-19 crisis. Supplies were stored in a central location and distributed by volunteers using same-day commercial delivery services. Pre-filled disposable insulin pens, both long-acting and short-acting analogues, have been chosen instead of insulin vials to reduce dosing errors, especially in insulin patients. Insulin pens were stored at the clinic and distributed by same-day delivery service in temperature-controlled containers.

Thus, the above factors are expected to drive market growth over the forecast period.

Thailand Diabetes Drugs and Devices Market Trends

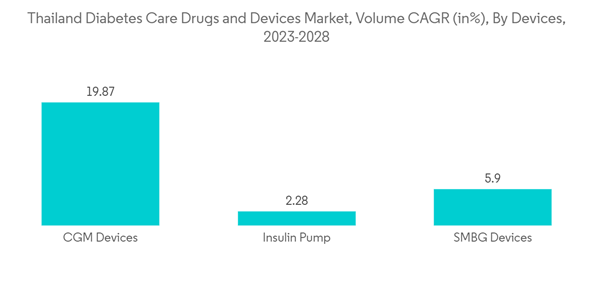

The continuous Glucose Monitoring Segment is Expected to Witness the Highest Growth Rate Over the Forecast Period

The continuous glucose monitoring segment is expected to register a CAGR of more than 11% over the forecast period.A continuous blood glucose monitor is a new technology blood glucose monitor that monitors blood glucose levels day and night. Sensors: Sensors are disposable devices placed under the skin to measure blood sugar levels. The sensor can be used for several days before needing replacement. A ruggedized device consists of a transmitter and a receiver. The transmitter is connected to the sensor, and the reader (receiver) receives and displays the readings. This device provides real-time measurements. This sensor device is a small electrode that measures the blood sugar level of people with diabetes. The sensor continuously measures glucose levels in the body through tiny threads inserted under the skin and records glucose levels. Within 5 seconds, the user can download the data stored in the sensor. The Indian continuous blood glucose monitoring device market considers the FreeStyle Libre Pro sensor (14-day run), Dexcom's G4 sensor (10-day run), Medtronic's Guardian sensor (7-day run), and fluorescence sensors.

The introduction of low-cost CGM in the next few years and government support through subsidies for diabetes monitoring devices may allow CGM device makers to enter the promising Thailand market.

Rising diabetes prevalence in Thailand driving the market in the forecast year

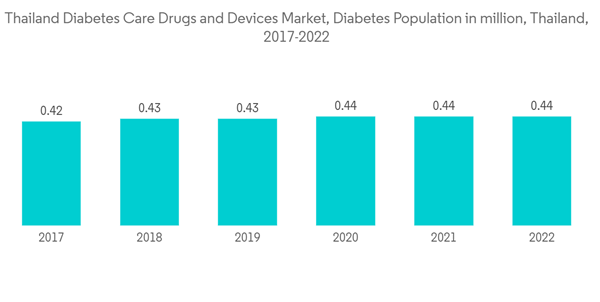

The World Health Organization (WHO) stated that diabetes care accounted for about 11% of Thailand's total healthcare expenditure in 2022, a figure on par with other countries in the region. By 2030, that number is projected to grow by 41%, effectively doubling the social burden of diabetes. There are only 272 endocrinologists (specialists) in Thailand. In Thailand, 3 out of 5 of her diabetics on treatment do not meet recommended treatment goals. According to the WHO report, the five countries most likely to suffer from diabetes include Indonesia, China, India, Brazil, and the United States.Thailand is facing an increase in diabetes due to lifestyle changes, leading to a rise in obesity. Lack of exercise and unhealthy diets are more common in Thailand's urban areas. The Thai government is trying to combat the threat of diabetes through programs such as the Thailand Healthy Lifestyle Strategic Plan 2011-2020. Such programs help people with diabetes understand the benefits of the various diabetes devices.

Diabetes is one of the world's major health problems today, and its prevalence is steadily increasing. According to the World Diabetes Federation, 450 million people worldwide already have diabetes, which is expected to reach 642 million by 2041. Asian countries account for more than 60% of diabetics worldwide2. In addition, compared to other races, Asians may be more prone to type 2 diabetes and at higher risk of diabetic complications.

Blood pressure control is an important part of diabetes management. In addition, people with diabetes are often recommended certain antihypertensive drugs to protect against kidney and heart complications, even if they do not have high blood pressure. No scientific evidence links these antihypertensive drugs to the likelihood or effects of COVID-19 infection. Hyperglycemia (hyperglycemia) is a symptom of diabetes caused by a lack of insulin hormones, problems with insulin secretion, or both.

High blood sugar can cause vital organs to malfunction, deteriorate, and be destroyed. Changing and non-changing variables can contribute to uncontrolled blood sugar levels. Gender, age, duration of diabetes, micro- and macrovascular complications, and comorbidities are immutable factors. Examples of reversible factors include behavioral and psychosocial problems such as poor eating habits, lack of exercise, obesity, not taking prescribed medications as prescribed by a doctor, stress, sadness, anxiety, and especially diabetes-Related concerns, etc.

The increasing diabetes prevalence and the above factors will likely drive segment growth over the forecast period.

Thailand Diabetes Drugs and Devices Industry Overview

Novo Nordisk partnered with Abbott Diabetes Care, which may also assist to enable insulin statistics to be shared between Novo Nordisk-connected insulin pens and digital fitness equipment well suited to the FreeStyle Libre portfolio of products.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.