Key Highlights

- Under Construction IT Load Capacity: The upcoming IT load capacity of the Philippines data center market is expected to reach 954.2 MW by 2029.

- Under Construction Raised Floor Space: The country's construction of raised floor area is expected to increase to 5.3 million sq. ft by 2029.

- Planned Racks: The country's total number of racks to be installed is expected to reach 266.4 K units by 2029. Metro Manila is expected to house the maximum number of racks by 2029.

- Planned Submarine Cables: There are close to 23 submarine cable systems connecting the Philippines, and many are under construction. One such submarine cable that is estimated to start service in 2024 is Apricot, which stretches over 11,972 Kilometers with landing points from Baler and Davao in the Philippines.

Philippines Data Center Server Market Trends

IT and Telecom to Hold Significant Growth

- The demand for data center servers in the IT and telecom industry is rising with increasing network traffic. Telecom data centers are responsible for managing network resources, such as vRAN and 5G packet core, while IT data centers are responsible for the IT applications used by the telecom service.

- Digital transformation is being led by local telecom firms and emerging broadband companies, and these efforts are contributing to strong telecommunications industry growth, leading to major data center demand. The three major telco players have estimated combined capital expenditures of USD 15 billion being spent on the rollout of their services over the next three years. The emerging broadband providers embark on 5G, mobile services infrastructure, and satellite connectivity projects.

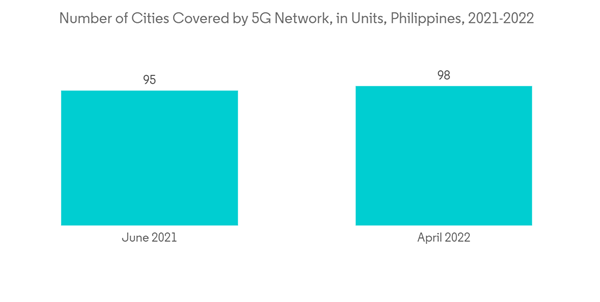

- Filipino telco Globe is recognized as the fastest 5G mobile network in several areas of the Philippines. Globe launched 66 new 5G sites, spanning 74 cities and towns across the Philippines. This expansion has extended its 5G outdoor coverage to 97.21 percent in the National Capital Region and 90.28 percent in key cities in Visayas and Mindanao.

- The Philippines currently has only 22,405 combined cell towers operated by the three major telecom companies. The introduction of the common tower policy is expected to improve the rollout of mobile networks. In addition to the Government's efforts, DICT and the Bases and Conversion Development Authority (BCDA) tendered the first phase of its National Broadband Plan valued at USD 20 million, which is the rollout of a bypass cable and fiber-optic network.

- Overall, with increasing 5G deployment and fiber connectivity, the demand for data center construction is expected to increase, leading to a major demand for data center servers.

Rack Server to Hold Significant Share

- Rack servers are compact and efficient devices that can handle a variety of computing tasks and are commonly used in data center environments, where space is at a premium. In the Philippines, various end-users prefer rack server as it is more cost-effective than blade servers, especially for organizations that don't require the high density and modularity of blade server solutions.

- With cloud technologies viewed as an enabler of digital transformations, 16% of Philippine businesses said they are now more supportive of using cloud-based IT solutions to grow their businesses than they were prior to COVID-19.

- Given the increasing digital adoption, Alibaba Cloud Intelligence intends to invest more in the Philippines after opening a data center. The company was considering expanding the capacity of its data center to accommodate the growing use of digital platforms. Around 88% of the companies use cloud-based solutions in the Philippines, which has a majority of the demand consumption for rack servers.

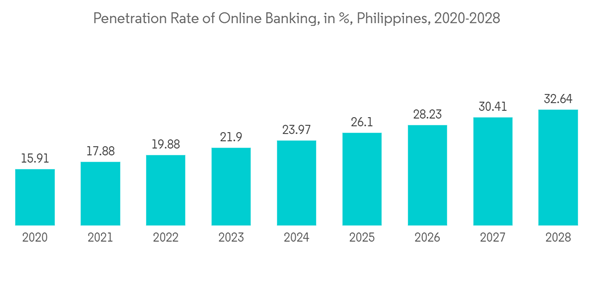

- In 2022, there were over a million micro, small, and medium enterprise (MSME) businesses in the Philippines, reflecting a slight increase from the previous year's total. The enterprises in fintech and IT are increasing under the SME category. Filipinos are embracing digital banking at an unprecedented rate. According to the study by the BSP (Bangko Sentral ng Pilipinas), 51.2% of Filipino adults now own a bank account, and 25.2% of these accounts are digital. Overall, it is expected that increasing SMEs under the above end users shall lead to the demand for rack servers after data center construction.

Philippines Data Center Server Industry Overview

The Philippines data center server market is consolidated among the players and has gained a competitive edge in recent years. A few major players are Hewlett Packard Enterprise, Dell Inc., IBM Corporation, and others. These major players with a prominent market share focus on expanding their customer base across the region. These companies leverage strategic collaborative initiatives to increase their market share and profitability.In July 2023, Supermicro, Inc. announced several new servers to its already broad application-optimized product line. These new servers incorporate the new AmpereOne CPU, with up to 192 single-threaded cores and up to 4 TB of memory capacity. Applications such as databases, telco edge, web servers, caching services, media encoding, and video gaming streaming will benefit from increased cores, faster memory access, higher performance per watt, scalable power management, and the new cloud security features.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.