Key Highlights

- The application of location-based solutions in mapping, real-time location systems for tracking and managing traffic, and the development of location-based applications across the end users in the country are fueling the growth of the market.

- The growth of smart cities in the country has fueled the trend of smart mobilities and transportation to handle traffic congestion efficiently in the cities of the UAE, which has raised the demand for location-based services in the country, driving the market during the forecast period. For instance, in August 2023, Abu Dhabi-based Bayanat, an artificial intelligence-powered geospatial data products and services provider, announced its space deal for a self-driving vehicles pilot program to significantly boost the emirate's intelligent city ambition, which would drive the market growth in the country.

- The growth in the number of connected devices, such as smartphones, tablets, watches, and other IoT devices in the country has increased the demand for location-based and personalized channels of communications and service offerings across end users, such as Banks, Retail sectors, healthcare institutions, etc. to offer their marketing and other service offerings through location-based applications by using technologies, including GPS and Geo fencings, among others, which would drive the market growth in the future.

- Additionally, the country's market has been registering significant growth supported by solution innovations, expansion investments, and collaborative business approaches by market vendors. For instance, in April 2023, Intelloger, a global IT solution provider, and Navigine, a global provider of integrated positioning and tracking technologies, partnered to deliver solutions for Real-Time Location Solutions, Asset Tracking, and Indoor Navigation to the Middle East, including the UAE, which would support the market growth in the future.

- However, these solutions use highly sensible business or physical data to provide insights to various end users, including BFSIs, healthcare, and government departments, which generate the risk of data privacy breaches and cyber attacks for the end users, restricting the growth of the market during the forecast period due to the rising concern for data privacy in the country.

- The COVID-19 pandemic increased the need for location-based services as the application of these solutions in tracking and monitoring the spread of the virus through real-time location systems by integrating connecting devices fueled the market growth in the country during the pandemic. Additionally, in the unlocking process after the pandemic, the emergence of mobile applications to help tourists navigate COVID-19-risk zones in Dubai increased the demand for these services, further fueling the market growth in the country.

UAE Location-based Services Market Trends

The development of Smart City Projects in the Country is Driving the Market Growth

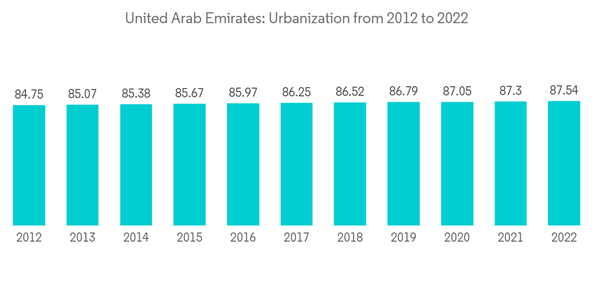

- The country has been registering significant growth in urbanization, including infrastructural development and Smart city planning, among others, raising the need for location-based services in the country due to its applications in mapping and designing a city.

- For instance, in January 2023, the Dubai Municipality started a project called the '3D Infrastructure and Service Lines Map', an integrated model to provide the latest innovative technology and services, showing the importance of mapping in urban planning and would create an opportunity for the market in the future.

- The application of location-based services on urban development by collecting and analyzing large volumes of geospatial data to create detailed maps and visualizations of urban areas, helping city planners and decision-makers to understand better the spatial distribution of various resources, services and infrastructure driving the market in the country inline with development of sustainable smart cities in the country.

- For instance, in August 2023, the country's government introduced a new urban planning law to ensure that Dubai's real estate expansion remains integrated with sustainability principles by preserving natural resources, supporting the need for location-based services for city planning in the country during the forecast period.

- Additionally, the country's government has planned to introduce a structural plan in Dubai called Dubai Urban Plan 2040. Under this plan, the Dubai Municipality would be responsible for regulating the strategic urban planning measures that reflect the economic, social, cultural, and environmental goals and policies, increasing the need for location-based mapping services in the country in the future.

Transportation and Logistics Sector Contributes a Significant Portion to The Market Share

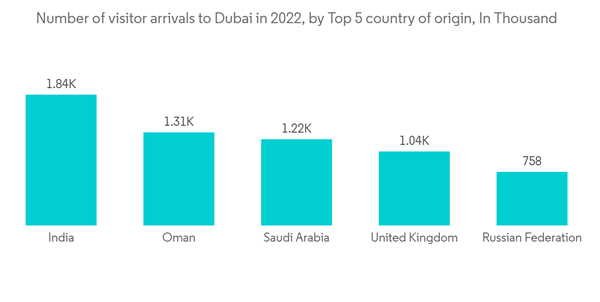

- Smart transportation and logistics are essential for the economic development of the country due to the country's dependency on international trade through its maritime routes. In addition, the growth of international tourists in the country has increased the need for smart transportation networks in the country, creating a demand for location-based services in the transportation and logistics sector of the country.

- For instance, in March 2023, the Department of Municipalities and Transport the country has launched a smartphone application to provide access to Abu Dhabi's maritime safety maps for navigational information, including connectivity routes, speed limits, and designated locations for recreational maritime activities, among others, in real-time.

- Smart transportation systems adoption by the public services and other road transportation providers in the country is driving the market during the forecast period. For instance, in August 2022, Dubai Taxi Corporation introduced its school buses with a range of intelligent features, including surveillance cameras and systems to ensure no child is left on board at the end of a journey and to monitor student movement while in transit through GPS tracking, showing the need for location-based solutions in the transportation sector of the country.

- The demand for perishables that require cold storage is rising in the UAE owing to the growing population and robust tourism, resulting in increased demand for foods without compromising the quality of the product, which has increased the logistic demand in the country, creating an opportunity for the location-based services in the UAE, due to their need in optimizing routes, tracking shipments, and monitoring vehicle performances.

- For instance, in July 2023, A.P. Moller-Maersk, the global integrated logistics company, opened its third Warehousing and distribution (W&D) facility in Dubai, UAE, fueling the number of logistic fleets in the country, which would increase the demand for Smart transportation and support the market growth in the future.

UAE Location-based Services Industry Overview

The UAE Location-based Services market is characterized by a multitude of local and multinational solution providers, resulting in a moderately fragmented landscape. Notably, market vendors have been actively investing in portfolio expansions, often facilitated through contract renewals with end users via partnerships and collaborations. These strategic alliances are instrumental in bolstering the companies' market presence within the country.In May 2023, the Integrated Transport Center, Department of Municipalities and Transport in Abu Dhabi entered into a partnership with Google. This collaboration aims to harness Google's AI data and technology platforms for the analysis of substantial data volumes derived from Google Maps. The primary objective of this collaboration is to forecast traffic patterns and predict areas prone to traffic congestion throughout the country. Such insights are expected to illuminate the growing demand for location-based services provided by market vendors in the UAE, ultimately fostering future market growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.