Key Highlights

- The increasing demand for cloud computing among SMEs, government regulations for local data security, and growing investment by domestic players are some of the major factors driving the demand for data centers in the country.

- The upcoming IT load capacity of the Spain market is expected to reach 399 MW by 2029. The country's construction of raised floor area is expected to increase more than 1.9 million sq. ft by 2029.

- The country's total number of racks to be installed is expected to reach 99,730 units by 2029. Madrid will likely house the maximum number of racks by 2029. There are close to 33 submarine cable systems connecting Spain, and many are under construction.

Spain Data Center Networking Market Trends

IT & Telecommunication Segment to Hold Major Share in the Market

- The first 5G network in Spain was deployed in 2019, with 4G introduced in 2013. Since their launch, both 4G and 5G networks have witnessed significant speed improvements. High-speed internet access, facilitated by broadband and cable connections, is readily available at affordable rates, fostering digital penetration and contributing to the country's economic growth. With ample room for connectivity enhancements, Spain's data center market is poised to expand as data demand and speed requirements increase. This, in turn, will boost the market value of data center networking solutions.

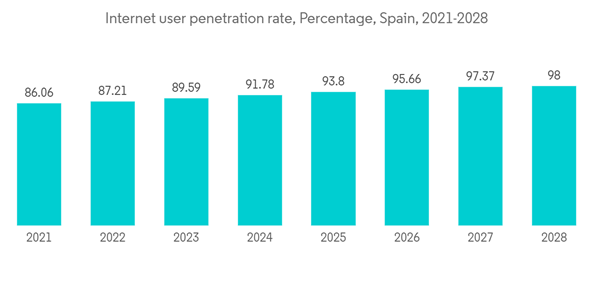

- In alignment with the connectivity plan, it is expected that 100% of the population will have access to high-speed broadband by 2025. This initiative will enhance connectivity in businesses and industrial parks while offering incentives, such as coupons, to encourage small and medium-sized enterprises (SMEs) to embrace digitalization. Consequently, there will be a surge in enterprise demand, translating into a rapid increase in the infrastructure and resources required for data centers, including servers, routers, and other essential components.

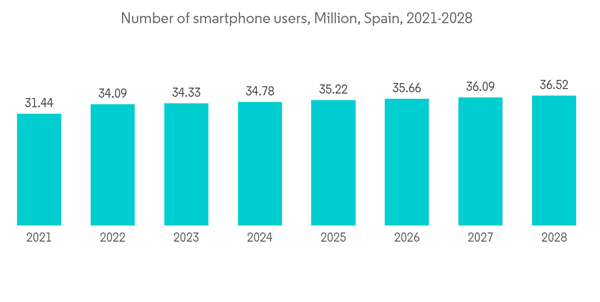

- The growth in the telecom subscriber base and the rising number of smartphone users are key drivers of increased data generation, which, in turn, fuels the demand for data center network solutions in the country.

- Additionally, the growth is propelled by the widespread adoption of cloud computing technologies, digitization, virtualization, and various storage system services. With the continuous expansion of data volumes, the necessity for storage and backup solutions continues to grow. Many storage arrays now have cloud equivalents that can be easily replicated and provide failover capabilities when needed. Examples of such solutions include Hewlett Packard Enterprise Cloud Volumes (Nimble), IBM Spectrum Virtualize, and Oracle Cloud Storage utilizing Oracle ZFS Storage Appliance.

- Furthermore, the burgeoning fields of artificial intelligence (AI), the Internet of Things (IoT), and big data workloads are fostering demand for innovative data center network infrastructure solutions within data facilities. This trend encourages providers to consistently innovate their network portfolios to adapt to the evolving landscape and deliver greater efficiency, scalability, and reliability.

Ethernet Switches to Hold Significant Share in the Market

- Ethernet technology is a versatile and midrange solution that effectively addresses the escalating connectivity demands within data centers. As a result, the expansion of data centers has led to a surge in the need for high-bandwidth switches.

- The utilization of ethernet switches is poised to experience substantial growth, primarily driven by the increased adoption of power over ethernet (PoE) across a wide range of applications. Furthermore, the proliferation of internet connectivity, the evolution of cloud networks, and the integration of residential and commercial networks contribute to this trend.

- The surging investment in the IT sector, the ongoing digital transformation, and the expansion of various businesses, including telecommunications, data centers, and cloud computing, are driving the widespread adoption of ethernet switches.

- Ethernet switches find application across diverse industrial infrastructure scenarios, such as smart grids, surveillance and security systems, smart rail and transportation, and various utilities. These switches play a pivotal role in substation automation within smart grids by simplifying the cabling complexities between power transmission and distribution devices.

- A significant factor fueling the growth of this segment is the operational flexibility offered by ethernet switches, ranging from 10 Mbit/s to a remarkable 400 Gbit/s. For instance, while residential high-speed Internet services currently offer speeds of up to approximately 60 Mbps for copper-based services, fiber-optic services deliver nearly gigabit ethernet speeds. This growing demand for Ethernet technology is further propelling the adoption of ethernet switches.

Spain Data Center Networking Industry Overview

The data center industry is currently undergoing a significant transformation, marked by increasing fragmentation and intense competition among both established vendors and new entrants. This shift is largely driven by the expanding influence of cloud computing, which has piqued the interest of investors looking to capitalize on the sector's growth. Notable industry leaders include Cisco Systems Inc., Juniper Networks Inc., Arista Networks Inc., VMware Inc., and NEC Corporation.In June 2023, Cisco Inc. introduced the Cisco Nexus 9800 Series modular switches, thereby expanding their Cisco Nexus 9000 Series portfolio. This addition features a new chassis that can accommodate high-speed and high-port-density line cards, reflecting Cisco's commitment to meeting the evolving needs of the data center market.

In September 2023, Juniper Networks introduced new capabilities for their Juniper® Apstra® platform, aimed at enhancing the experience of operators. These enhancements are designed to streamline the deployment and management of private data center infrastructures, reflecting Juniper's dedication to facilitating more efficient and user-friendly operations within the data center industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.