The COVID-19 pandemic was an incomparable global public health emergency. It impacted almost every industry sector, including healthcare distribution, mainly due to disruptions to the healthcare supply chain. However, the companies took various actions to manage these disruptions in the supply chain through their strategic partners and manufacturer suppliers. For instance, as per the report published by Cardinal Health in December 2021, the company worked closely with its manufacturer suppliers to help ensure a healthy supply of products. In addition, as per the same source, the company installed a new warehouse management system in many distribution centers to manage the challenges in the healthcare supply chain. As a result, the market originally had a modest negative impact but is anticipated to develop due to corporate strategies for addressing supply chain difficulties over the coming years.

With the large economic burden of chronic diseases, technological advancement in distribution, favorable R&D investment scenario, and subsequent increase in drug launches are the main driving factors of the healthcare distribution market. For instance, in 2022, the National Institution of Chronic Disease and Data reported that nearly 60% of American adults suffer from at least one chronic disease, and about 40% of adults include multiple chronic conditions (MCC). Chronic conditions like diabetes, cancer, and cardiovascular disease are the leading causes of morbidity in the United States. Hence, proper management and diagnosis of these diseases are needed with various healthcare products necessary for effective healthcare distribution services. Thus, increasing cases of chronic disease are driving the healthcare distribution market.

Technological advancements and new distribution strategies of market players are expected to boost the healthcare distribution market. For instance, in May 2022, Nippon Express Co., Ltd. launched a logistics service capable of handling goods requiring ultra-low temperatures (-20 C to -85 C) for the pharmaceutical industry. With this, the company provided a pharmaceutical distribution platform with strict temperatures. Hence, these new platforms in healthcare distribution are expected to hold significant growth in the market over the forecast period.

However, the high cost and investment associated with healthcare distribution services are expected to hamper the overall growth of this market.

Healthcare Distribution Market Trends

Retail Pharmacy is Expected to Witness a Significant Growth Over the Forecast Period

Retail pharmacies (often known as community pharmacies) supply and sell medicine and medical-related products to the general public and medical practitioners, as well as other goods such as toiletries, cosmetics, small medical devices, and veterinary products. The retail pharmacy deals with many prescriptions and is thus expected to drive this market. In developed countries, the high availability of healthcare schemes and programs led to a significant increase in the number of prescriptions.Furthermore, the new agreements among the market players for distributing healthcare products in retail pharmacies likely propel the market to grow. For instance, in September 2022, McKesson Corporation signed an agreement in principle to extend its partnership with CVS Health to distribute pharmaceuticals to retail and other pharmacies and distribution centers through June 2027. Similarly, in June 2022, BD (Becton, Dickinson, and Company) and Frazier Healthcare Partners entered a definitive agreement for BD to acquire Parata Systems. It is an innovative provider of pharmacy automation solutions for hospitals, retail pharmacies, and other healthcare settings. Thus, these agreements help supply healthcare products efficiently, which is expected to boost market growth.

Moreover, the growing incidence of chronic diseases like hypertension, diabetes, cardiovascular diseases, and cancer, which require prolonged medication, is directly related to increased prescriptions. It can further drive the growth of the retail pharmacy market during the forecast period. For instance, DiabetesAtlas.org 2021 reported that about 536.6 million people were estimated to suffer from diabetes in 2021, and this number will increase to 642.7 million by 2030. Thus, the high prevalence rate of chronic diseases like diabetes increases the need for various pharmaceuticals that can be procured from retail pharmacies and is expected to grow in the segment over the forecast period.

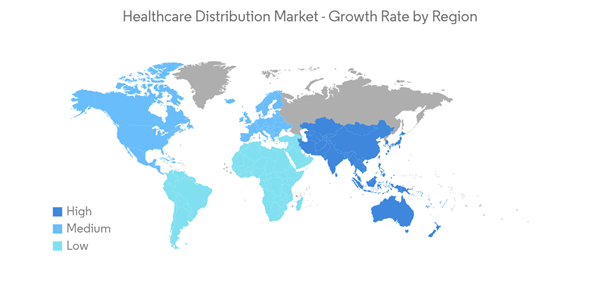

North America is Expected to hold Significant Share in the Market Over the Forecast Period

North America is expected to hold a significant market share owing to factors such as the rapid expansion of the pharmaceutical and biopharmaceutical industry, rising demand for specialty drugs and generics, and large-scale adoption of advanced technologies such as Artificial Intelligence and blockchain in the healthcare sector.The use of artificial intelligence technology boosted distribution practices globally. For instance, the article published by the journal SAGE in September 2021 summarizes that by using Artificial intelligence technology, businesses can offer shipment updates to customers. When tracking technology fails, an (Artificial Intelligence) AI system can track the delay in the delivery so companies can easily estimate delivery time to their customers. These updates on product delivery through AI increase the distribution services and likely boost the market to growth.

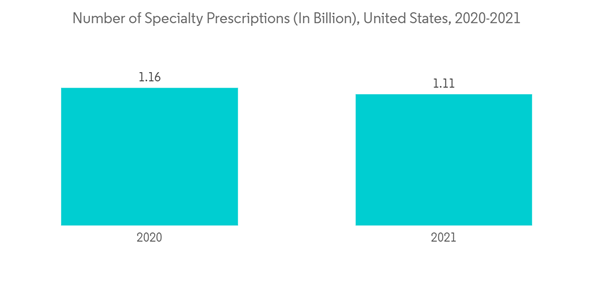

Furthermore, the significant number of prescriptions in the region increases the demand for various healthcare products and distribution services. For instance, as per the report published by AssureCare LLC in November 2022, in the United States, around 6.47 billion prescriptions were dispensed in 2021, which is high and is expected to increase more over the coming years. In addition, the new regional distribution agreements increase the services and likely boost the market. For instance, in March 2023, Endonovo Therapeutics, Inc. signed a Service-Disabled Veteran-Owned Small Business (SDVOSB) Government Reseller Agreement (Agreement or Contract) with Academy Medical, Inc. of West Palm Beach, FL, to distribute SofPulse medical devices to ensure its availability to the Veterans Health Administration (VHA) and Department of Defense (DoD) contracts. Thus, increasing prescriptions and new agreements to distribute healthcare products will likely raise the demand for healthcare distribution services and boost the market growth over the forecast period.

Healthcare Distribution Industry Overview

The healthcare distribution market is fragmented in nature due to the presence of several companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international as well as local companies that hold the market shares and are well known as McKesson Corporation, Cardinal Health, Morris and Dickson Company, Smith Drug Company, Owens and Minor Inc., Patterson Companies, PHOENIX Group, Owens, Medline Industries, and other Companies.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.