Key Highlights

- The France construction equipment market is valued at USD 12.69 billion and is anticipated to surpass a net valuation of USD 17.18 billion, registering a CAGR growth of 6.25% during the forecast period.

- Increasing government spending on construction and infrastructure activities, rising foreign direct investments in the construction sector, and developments in road transportation infrastructure owing to the surge in population and urbanization serve as thhe major determinants for the growth of the construction market in France, which, in turn, positively contributes to the surging demand for construction equipment across the country.

- France boasts of one of the highest urbanization rates in the European region, with 82% of its overall population residing in urban areas as of 2022. The high urbanization rate leads to consumers availing various private and public transportation mediums for their commutes, which leads to higher congestion in these cities.

- Therefore, road infrastructure development has become a major focus area for the French government. Coupled with that, developments in cross-border road connectivity are another deterministic area for enhancing the trade ecosystem of a nation. Hence, with increasing the government's focus on developing its road infrastructure network, there exists a massive demand for construction equipment in the country.

- For instance, in May 2023, the government of France announced an investment of Euro 2 billion (USD 2.15 billion) over the next four years to develop the infrastructure for cycling, as well as encourage citizens to increase bicycle use, as part of the 2023-2027 cycling and mobility plan.

- One of the major challenges faced by the construction equipment industry in France is the high cost of replacement and maintenance of the equipment, which becomes a financial burden for construction companies and equipment rental companies. Since this equipment operates for a longer duration and needs to sustain heavy loads at all times, there is constant wear and tear of the equipment, which needs frequent maintenance checks and, in extreme cases, complete replacement of the equipment.

- Thus, construction companies and equipment rental companies owning these machineries need to spend hefty sums to make sure that this equipment is operating efficiently at all times, which increases their cost of operation.

- Coupled with that, falling production of raw materials such as steel owing to declining prices negatively impacts the demand for construction equipment in the French market. For instance, in May 2023, steel enterprises of France reduced steel production by 14.1% compared to April 2023 - to 805 thousand tons.

- The declining production hampers the country's real estate industry due to the unavailability of raw materials, thereby making it difficult for construction companies to meet the stipulated deadline for completion of a real estate project, which, in turn, hampers the growth prospect for construction equipment.

- The government's pragmatic initiatives for infrastructural development across France are anticipated to contribute to the surging demand for construction equipment in the coming years. For instance, in February 2023, France's Ministry of Transport announced an investment of Euro 100 billion (USD 107 billion) in railway infrastructure by 2040 under the New Rail Deal in collaboration with SNCF. The investment aims to revive the country's aging railway sector to deliver more reliable and frequent services. With increasing investment to enhance the infrastructural capability of France, there will exist a massive demand for construction equipment during the forecast period.

France Construction Equipment Market Trends

Increasing Government Spending on Construction and Infrastructure Development

- Increasing investment in the country's real estate sector, commercial sector, and construction sector, among others, is further aiding the surging growth of advanced construction machinery across France. Various development projects, such as the Grand Paris Project, assist in expanding the construction market across the country, thus, in turn, positively impacting the demand for construction equipment.

- For instance, in October 2022, the French government announced a bidding scheme to build or refurbish 5,000 sports facilities across France before the 2024 Olympics and Paralympics. Further, the National Sports Agency (ANS) reported that 2,089 facilities were already co-financed for this project as of October 2022.

- The Grand Paris Project initiative, the largest transportation project in Paris, which is being carried out in phases till 2030, has attracted billions of investments in the construction sector. The project envisages the expansion of Line 14 and the construction of four new automatic Lines. Further, the project outlines a new metro development with an estimated investment of Euro 36.1 billion (USD 47.7 billion), 30% of which is being financed by the French Government through Societe du Grand Paris (SGP) and the remaining 70% by the local authorities through earmarked taxes, subsidies, and loans.

- Coupled with that, rising investment in enhancing the transportation infrastructure of the nation is expected to boost the construction equipment market in France in the coming years. Various private companies operating across France, such as Electron, are actively focusing on enhancing the decarbonized road transportation infrastructure to assist the government in its decarbonization efforts. For instance,

- In July 2023, Bpifrance, the French public sector investment bank, selected Electreon's award-winning Wireless Electric Road System (ERS) for an unprecedented project in France on a section of the A10 highway southwest of Paris. As per the agreement, Electron will deploy both a two-kilometer dynamic wireless charging road and a stationary wireless charging station, along with unveiling its next-generation product with significantly increased power transfer capacity for dense traffic corridors on public highways.

- With the government's consistent effort to build a decarbonized public transport infrastructure, along with the support provided by the private construction companies to assist the government's pragmatic plans, the construction equipment market is anticipated to record surging growth during the forecast period.

Electric Drive Segment of the Market to Gain Traction during the Forecast Period

- The extensive focus of the French government to achieve a carbon-neutral economy is aiding the rapid transformation in various sectors in adopting a new energy ecosystem. With the aggressive strategy adopted by the government of France to achieve a reduction in carbon emissions, there will exist a greater demand for advanced products used in various sectors, which helps in the reduction of carbon content in the environment.

- For instance, in May 2023, The French government unveiled a plan to accelerate cuts to its greenhouse gas emissions, targeting a reduction of 50 percent by 2030 compared with 1990 levels. The plan unveiled by the government portrayed a roadmap that included detailed figures for reductions for individual sectors of the economy, ranging from the transport industry to households.

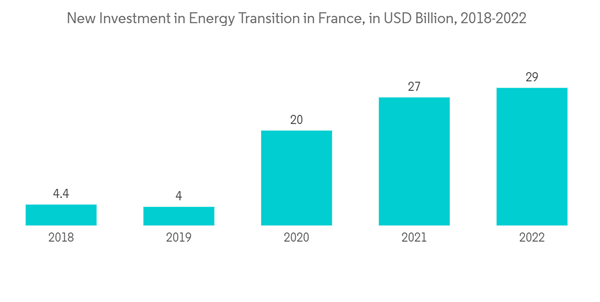

- It is witnessed that new energy investment, against the backdrop of the government's aggressive push towards achieving a carbon-free economy, assisted the increasing investment in the energy transition projects across France. In 2022, new investment in energy transition in France stood at USD 29 billion, which expanded with a CAGR of 45.8% between 2018-2022.

- With the shifting focus towards adopting a new energy ecosystem, various companies operating in different industries are actively promoting the use of products and equipment to help in air pollution reduction. Construction equipment companies operating in space are investing hefty sums in developing new products that are operated via an electric drive type, which is expected to record surging growth in the coming years. For instance,

- In November 2022, Caterpillar announced the launch of its first battery electric 793 large mining truck. The demonstration of the equipment was carried out at the company's Tucson Proving Ground.

- In October 2022, Komatsu unveiled its first 20-tonne battery electric excavator, named PC210LCE, at the ConExpo. The excavator features a lithium-ion battery technology developed by Proterra, having a 451 kWh battery capacity, designed for up to eight hours of operating time.

- These electric construction equipment products being developed by international manufacturers are being made available to French customers via their dealership network operating in the country.

- With the increasing focus on decarbonization, there will exist a greater demand for electric drive-type equipment in the coming years as more and more construction and rental companies include these products in their fleet, thereby expected to positively contribute to the growth of the electric drive-type segment of the market during the forecast period.

France Construction Equipment Industry Overview

The construction equipment market in France exhibits moderate fragmentation and fierce competition, featuring a diverse array of international companies. These companies either operate through dealership networks or have established manufacturing facilities within the country. Among the prominent players in this sector are Caterpillar, Komatsu, Liebherr, Volvo Construction Equipment, Kobelco, XCMG, JCB, Hitachi Construction Machinery, Kubota, and Hyundai Construction Equipment, among others. These industry leaders engage in competitive strategies, vying for supremacy based on a range of criteria, including equipment quality, pricing, dealership network reach, geographic coverage, post-sales services, product diversification, and value-added offerings such as Equipment as a Service (EaaS).

Many of these companies are actively investing substantial resources in research and development activities to bolster their brand presence and develop innovative construction equipment products tailored for the French market. Here are a few notable examples:

In August 2023, Caterpillar unveiled its latest offering, the 988 GC wheel loader. This new product is designed to provide dependable and efficient operation, empowering customers to move larger volumes of materials while minimizing the cost per hour, thereby accelerating their return on investment. This loader boasts up to a 5% reduction in fuel consumption and a remarkable 15% decrease in maintenance expenses compared to the Cat 988K model.

In May 2023, Hitachi Construction Machinery Europe (HCME) announced the rebranding of Cobemat SAS, a construction equipment dealership situated in France. This strategic move followed the successful acquisition of Cobemat in April 2023. Under the terms of the acquisition, Cobemat will continue its operations as an HCME subsidiary, adopting the new name Hitachi Construction Machinery France (HCMF). Additionally, as part of this agreement, all activities associated with MTS, another subsidiary of Cobemat included in the acquisition, will be seamlessly integrated into HCMF.

In April 2023, Liebherr-France SAS introduced its Generation 8 R 924 and R 945 crawler excavators during the ConExpo 2023 event. These excavators were developed and manufactured at the company's facility in Colmar, France. Liebherr highlighted that its Generation 8 crawler excavators feature a heavier counterweight, increased bucket capacities, and enhanced digging and tractive forces compared to their predecessors, signifying substantial improvements in performance and capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.