Key Highlights

- Consumers' growing preference towards availing private transportation mediums owing to the increase in personal disposable income and GDP per capita, the emergence of online auto platforms, and increasing new vehicle prices serve as the major determinants for the growth of the used car market in Qatar. In 2022, the GDP per capita in Qatar stood at USD 88,046.3, witnessing an expansion of 7.4% CAGR between 2018 and 2022. Further, the average annual salary in Qatar as of August 2023 is estimated to stand at approximately USD 3,570 per month.

- With the increasing financial stability, consumers prefer private transportation mediums to enhance their convenience for personal mobility. However, the spike in new vehicle prices deters some of these customers from purchasing brand-new vehicles, subsequently leading to the surging demand for used cars in Qatar. For instance, new vehicle registrations registered a 15% and 8.2% decline on a yearly and monthly basis, respectively, in February 2023. Further, the registration of new private vehicles stood at 4,286 units in Qatar, which declined 1.5% and 14.1% year-on-year and month-on-month, respectively, in February 2023. Coupled with that, consumers' growing concerns about high inflation, which rose to 5.0% in 2022 compared to 2.3% in 2021, are also acting as a catalyst for the falling demand for used cars in Qatar.

- According to the Planning and Statistics Authority (PSA) in Qatar, used vehicles witnessed positive growth in February 2023. The transfer of ownership stood at 32,553 units in February 2023, which grew 7.1% year-on-year but fell 1.8% month-on-month. It constituted 26% of the clearing of vehicle-related processes in the review period. The used car market in Qatar mostly replicates the same trend of the new car market in terms of brands that the citizens prefer. In the used car market, Toyota, Nissan, Ford, Kia, Mercedes, and Volkswagen remained the popular preferences of consumers willing to purchase used cars.

- One of the major challenges faced by the used car market is the high interest rate of bank loans and the various promotion offers on Chinese cars that have entered the Qatari market over the past few years, which negatively impacts the demand for used cars. Some of the Chinese brands give warranty of up to seven years with in-house finance options and lower prices compared to auto brands from Europe, Asia, and the US, in addition to the sophisticated options. It was estimated that the demand for used cars dropped considerably by 40% in July 2023, post-Ramadan. With the gradual drop in interest rates and various used car platforms offering their used-car financing options, the demand for used cars is expected to surge significantly by the end of 2023. Qatar boasts of possessing one of the highest purchasing powers in the GCC region, which also leads its citizens to avail of luxury vehicles in the market, thereby assisting in expanding the market for used SUVs in the coming years.

- The government's aggressive strategy to promote the electrification of vehicle fleets and ban of petrol/diesel cars to promote the reduction in carbon emissions will aid the demand for used cars across Qatar during the forecast period. Consumers who are willing to purchase cheaper alternatives to new-energy vehicles are increasingly adopting the purchase of used vehicles for convenience in mobility. For instance, in April 2023, Qatari authorities announced its plan to convert 35% of its fleet's total cars and 100% of its public transportation buses to electric as part of "The Qatar National Vision 2030" strategy, aiming to promote the reduction in carbon emission. Further, in January 2023, Qatar General Electricity and Water Corporation (Kahramaa) announced its plan to set up 600 to 1,000 electric vehicle charging stations by 2025 and 2030 to promote the use of electric vehicles (EVs) across the nation. Even with the aggressive stance of the Qatari government to promote the adoption of EVs, the higher cost of electric vehicles adds to the financial burden of the consumer attributed to its excessive battery cost, thereby, in turn, making consumers opt for used cars in the coming years.

Qatar Used Car Market Trends

Rising Adoption of Digital Technologies Will Foster the Growth of the Target Market

- The adoption of advanced technology by tech-savvy young individuals, the emergence of e-commerce marketplaces, and various companies' aggressive strategies to spend on online advertisements are boosting the demand for used cars sold through online platforms. These platforms assist consumers in making informed decisions as end-end information on vehicles is already listed, such as vehicle make, model, kilometers driven, engine capacity, condition, etc.

- Moreover, the optimal internet penetration rate and a high urban population in Qatar contribute to developing an efficient ecosystem wherein vehicle owners can reach out to buyers from different parts of a region and initiate a smooth online sales process without any need to visit a physical location.

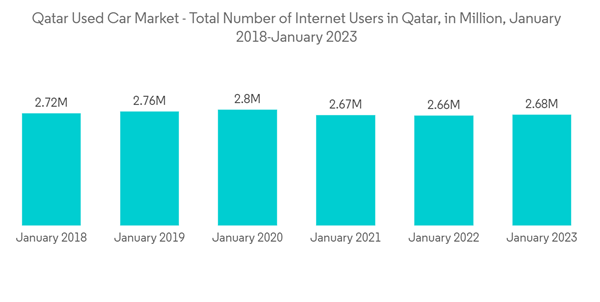

- The number of Internet users in Qatar at the beginning of 2023 reached about 2.68 million, and the Internet penetration rate reached 99 percent. Further, it was also estimated that 96.8 percent of the total population were active social media users, and about 2.56 million of them were aged 18 years and over who possessed the financial capability to purchase a used car during the same review period.

- Qatar boasts one of the highest urbanization rates in the GCC region, with 99% of its overall population residing in urban areas as of 2022. These consumers are highly tech-savvy, and most of them have the financial capability to make an informed decision to purchase a vehicle for their mobility. Owing to these factors, the online used car market in Qatar is expected to showcase positive growth in the coming years.

- Further, the high expatriate population in Qatar, which stood at 88.5% at the beginning of 2023, also assists the growth of the used car market in the country as these consumers prefer availing lower-priced used vehicles over expensive brand-new models for their shorter stay in the country mainly for better employment and financial opportunity.

- To gain a competitive advantage in the lucrative online used car market, various players from the GCC region, such as the United Arab Emirates (UAE) and Saudi Arabia, are actively engaging in integrating the cross-border sales opportunity in Qatar with a high focus on marketing. With the increasing internet penetration and usage of online classified platforms for making purchasing decisions, consumers can buy second-hand cars from their neighboring countries, which helps them get a better price for used car models. Although the prospect for both the new and used car industry in Qatar is limited due to its low population, Qatari companies also have an opportunity to expand their business presence by providing cross-border sales service to its neighboring GCC countries, which will assist them in enhancing their business performance.

- Further, improved offerings such as an enormous number of photos and videos of the used vehicles being sold through online platforms and easy online instant finance, insurance, and warranty service are expected to fuel the demand for used cars in Qatar in the coming years.

Used Sports Utility Vehicles (SUVs) to Gain Traction in Qatar Used Car Market

- Based on vehicle type, used sports utility vehicles (SUVs) and multi-purpose vehicles (MPVs) are expected to witness a rapid boom in the coming years, especially due to the growing popularity of SUVs in Qatar. Consumers in Qatar prefer availing luxury vehicles owing to their aesthetics, due to which there exists a strong demand for SUVs in the country. Although the demand for new hatchback and sedan models is also popular among expatriates, with the increasing personal disposable income of consumers, used SUVs are expected to witness a surge in the coming years.

- The price of a new hatchback and sedan model most often matches the price of a used SUV vehicle at online classified platforms, especially after various promotional offers extended to the customers along with financing options. For instance, the price of a used 2013 Nissan Pathfinder SUV was sold at QAR 29,999 (USD 8,239) in August 2023 at one of the online used car classified platforms, Yallamotor.

- Further, it was witnessed that used SUVs with a vehicle age of two to four years were the most favored vehicle type among consumers in Qatar. At the outset of the football World Cup in 2022, there existed a huge demand for used SUVs to rent them to tourism companies specializing in transporting delegations to events and tourist places.

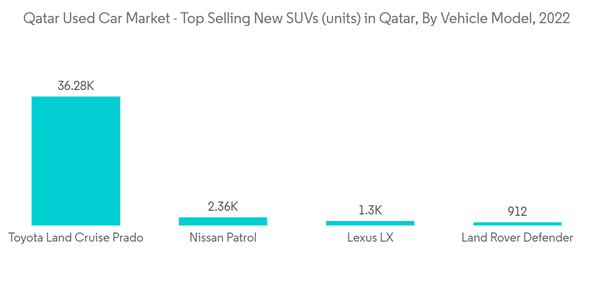

- Coupled with that, new SUV sales in Qatar also witnessed positive growth in recent years, which, in turn, positively impacts the used car market in the long run, as with the growing age of the vehicle, there exists a prospect for new SUVs to be sold in the used car market during the forecast period. In 2022, it was estimated that Toyota Land Cruiser Prado, Nissan Patrol, Lexus LX, and Land Rover Defender were the top-selling new SUV models in Qatar in 2022. As these vehicles tend to age, they will find their potential use case in the used car market during the forecast period. In the coming years, used SUV models of Japanese and European make such as Toyota, Nissan, and Kia, among other areas, are expected to gain significant traction during the forecast period.

Qatar Used Car Industry Overview

The market is moderately fragmented and competitive, with the presence of various used car dealerships and online used car platforms operating across Qatar. Some of the major players include Qmotor, Yallamotor, Automall Qatar, AutoZ Qatar, Oasis Cars, Dubizzle, CarSemsar, Edition Motors, Qatar Living, Qatarsale, Autobahn Qatar, and Elite Motors, among others. These players compete based on various parameters such as used car prices, online presence, value-added offerings such as warranty and financing options, commissions charged, number of listings on their platform, and ready information on the performance and conditions of used vehicles, among others.Various companies operating in the ecosystem are actively engaging in enhancing their brand presence to expand their business capability across Qatar. For instance,

In August 2023, Elite Motors, a Qatari-based new and used car dealership platform, announced its partnership with The Qatar Basketball Federation (QBF) and Beyond Sports, the sports development unit of Beyond Perspective (Qatar's first specialized multi-camera live stream company) to promote QBF-organized games till 2027. As part of the partnership agreement, Elite Motors will be providing transportation and logistical support to the federation, among others.

In June 2021, Doha Marketing Services Company (Domasco), a member of the Al Futtaim Group and a leading player in the automobile industry in Qatar, opened its first dedicated showroom for multi-brand pre-owned cars named Automall. Consumers will be able to purchase any car for cash or trade-in the existing car for a pre-owned car. The platform further declared that consumers will be able to sell or purchase vehicles of all make and brand.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.