Bank guarantees encourage international trade by giving different importers and exporters the financial certainty they need to complete transactions. As a result, demand for bank guarantees is always increasing. Furthermore, bank guarantees give sellers the assurance that payments would be paid as agreed, minimizing financial risks and promoting the use of digital solutions throughout the bank guarantee process, which hastened the expansion of the bank guarantee market.

Exchange rate fluctuations and a lack of finance options for small and medium-sized businesses in diverse nations, however, restrain market expansion. On the other hand, it is projected that the sudden increase in import and export activity across a number of nations, together with government backing for greater trade activity and the percentage of trade in the national economy, will present a potential growth opportunity for the bank guarantee market.

The COVID-19 pandemic has had a significant impact on various sectors of the global economy, including the performance bank guarantee market. Many industries faced temporary closures, supply chain disruptions, and reduced business activities. This resulted in a decrease in demand for performance bank guarantees as construction projects, trade deals, and other contractual obligations were delayed or canceled. The uncertainty caused by the pandemic and its economic impact heightened the risk perception among businesses. As a result, both issuers and beneficiaries of performance bank guarantees became more cautious and concerned about the financial stability and ability of parties to fulfill their contractual obligations. This increased risk perception affected the demand for guarantees and the terms under which they were issued.

Performance Bank Guarantee Market Trends

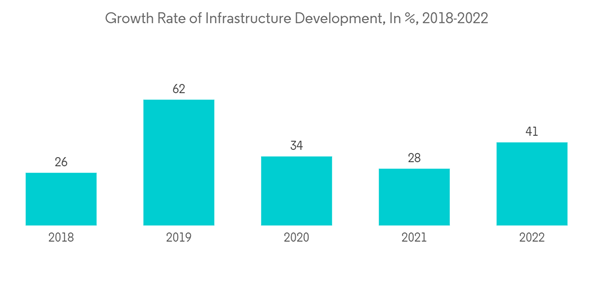

Infrastructure Development is Driving the Market

Infrastructure development plays a significant role in driving the performance bank guarantee market. Infrastructure projects, such as the construction of roads, bridges, airports, railways, power plants, and other public utilities, often require substantial investments.Banks and financial institutions provide project financing by issuing performance bank guarantees to project developers or contractors. These guarantees assure the project owners or funding entities that the project will be completed as per the agreed terms and specifications. The need for performance bank guarantees increases with the scale and complexity of infrastructure projects, driving the demand in the market.

Infrastructure projects typically involve various risks, including delays, cost overruns, and non-performance by contractors or suppliers. Performance bank guarantees act as risk mitigation instruments by providing financial security to project owners or funding entities. In case of non-performance or default, the project owner can invoke the guarantee and recover the financial losses incurred. The availability of performance bank guarantees encourages project owners to undertake infrastructure development projects with reduced risk exposure.

Infrastructure development often involves public-private partnerships, where the private sector collaborates with the government to finance and execute projects. In such arrangements, performance bank guarantees are commonly used to ensure the fulfillment of contractual obligations. The private sector entities providing the guarantees gain confidence in the project's viability and are more willing to participate in PPP initiatives. The growth in infrastructure development through PPPs contributes to the expansion of the performance bank guarantee market.

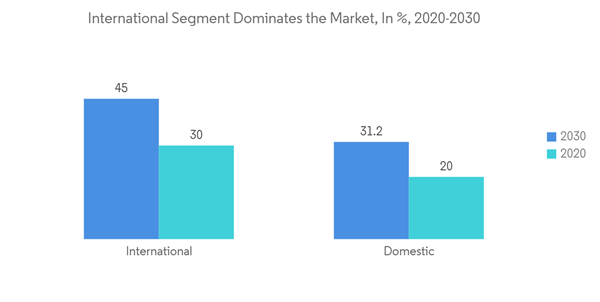

International Trade and Contracts is Driving the Market

International trade involves transactions between parties located in different countries, often with diverse legal systems and business practices. Performance bank guarantees help mitigate the risks associated with non-performance or default by one of the parties involved in international trade contracts. By providing a financial guarantee, banks ensure that the obligations outlined in the contract will be fulfilled. This risk mitigation function enhances trust and confidence between trading partners.In international trade, contracts are fundamental to establishing the rights and obligations of the parties involved. These contracts may involve the purchase and sale of goods, provision of services, or execution of projects.

Performance bank guarantees are frequently used to secure the performance-related obligations outlined in these contracts. For example, an exporter may require a performance bank guarantee from an importer to ensure payment for goods delivered, while an importer may request a performance bank guarantee from a supplier to ensure timely and satisfactory delivery. The reliance on performance bank guarantees increases the certainty and enforceability of contractual obligations, thereby facilitating international trade.

Performance Bank Guarantee Industry Overview

The report covers the major players operating in performance bank guarantee market. The market is consolidated, and the market is expected to grow during the forecast period due to the international trade and investments, infrastructure development and many other factors driving the market. Some prominent players include Citigroup, HSBC Group, Deutsche Bank, DBS Bank, and Wells Fargo & Company.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Citigroup

- DBS Bank

- Deutsche Bank

- HDFC Bank Ltd*

- HSBC Group

- ICICI Bank Limited

- JPMorgan Chase & Co

- Soleil Chartered Bank

- United Overseas Bank Limited

- Wells Fargo & Company