Key Highlights

- The technological advancements and increased disposable income that support movie theaters in developed and developing regions are expected to fuel the growth of the overall market. A movie theater is a complex that is comprised of one or multiple auditoriums for watching movies intended for entertainment. These buildings are commercial and charge for tickets that allow people to watch movies in these theatres. Some theaters are owned and managed by nonprofit organizations with membership programs and charge a fee periodically to watch movies.

- Movie theaters project films on a large screen with sound, music, and perfect lighting for watching movies in the auditorium. The projection of movies may vary in form or quality, which includes 2D, 3D, IMAx or 4DX. Furthermore, multiplexes and buildings with multiple such auditoriums in a single building. This gives people options to watch movies at a single location. In recent years, the number of multiplexes has been on the rise, especially in developed and developing countries worldwide.

- However, Online streaming or OTT of movies and TV shows has increased in popularity in recent years, creating a severe danger to the film theater industry. The general public is progressively turning to these OTT platforms as they can deliver the viewers numerous films for a limited period and at the value of a single movie ticket. This is one of the most significant noteworthy challenges negatively affecting the movie theater market. Other problems and movie piracy are similarly anticipated to hamper the market growth globally.

- The COVID-19 pandemic significantly impacted the filmmaking and cinema industry since the beginning of 2020. The closure of cinemas and the suspension of production caused significant material losses for prominent production companies. Filmmakers had to adapt to new practices, including a growing trend towards digital viewing platforms, social networks, and virtual festivals, which proved to be the best solutions in light of the pandemic. The use of online media, including subscription video-on-demand (SVoD) visual viewing platforms, also increased due to the pandemic.

- The current world of cinematography is contingent on filmmakers trying to adapt to these new practices imposed by the pandemic.

Movie Theatre Market Trends

4DX segment is expected to grow at a higher pace

- The growing acceptance of 4DX multiplexes is primarily driven by the increasing demand for animation and visual effects (VFX) solutions. In the world of filmmaking, there is a noticeable upward trend in production budgets, largely due to the extensive global distribution made possible by digital theaters. Additionally, writers and directors are more open to incorporating scripts that require VFX, leading production companies to undertake ambitious projects that rely heavily on VFX and streamlined platforms. This has also resulted in an expansion of the types of content being distributed.

- The presence of 3D-UHD animated films in theaters, thanks to the application of VFX and animation in film, TV, and advertising, is on the rise. Outsourcing VFX approaches has become more prevalent due to its cost-effectiveness. Consequently, there is a growing emphasis on the "kids" genre, and the popularity of video streaming is expected to drive market demand in emerging economies.

- Modern-day artists require an array of tools and software to create captivating animated content that engages viewers. One notable trend in this regard is Virtual Reality (VR), which has gained significant popularity. More animation studios are incorporating virtual reality into 3D animation, taking the art form to new heights. Virtual reality has made it possible to experience 3D games in a virtual environment, thanks to the fusion of virtual reality and 3D animation.

- The integration of new over-the-top (OTT) services on subscription-based streaming devices in emerging economies is expected to boost the applications of the VFX and animation sector. Companies are actively exploring innovative services dedicated to energy and VFX for OTT content. For example, London-based DNEG has introduced a unique service called Redefine, aimed at bridging the creative services gap between the Western and Eastern markets for film and OTT streaming content.

- With the media sector's emergence, the demand for VFX and animation has expanded significantly within the multimedia ecosystem. Organizations like DNEG are seeking strategic investment partnerships to navigate these changes successfully. In 2022, DNEG inked a multiyear deal to expand its visual effects and virtual production services for Netflix series and feature programming until 2025. As part of this agreement, DNEG will produce content for Netflix and significantly enhance premium VFX services in both domestic and international markets for the streaming giant.

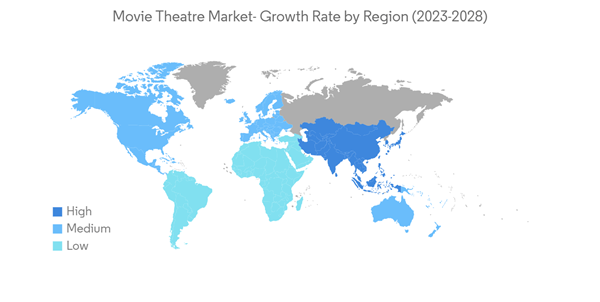

Asia- Pacific to hold the significant share

- Asia-Pacific has a large and rapidly growing population, resulting in a sizable consumer base for the movie theatre industry. The growing middle-class population and rising disposable income in Japan, China, India, South Korea & other South Asian countries have increased the demand for entertainment and leisure activities such as movie theatre experiences.

- Rapid urbanization in the region has created large metropolitan areas with dense populations, commercial establishments, and increased entertainment options. Urban centers cater to a large audience base and provide accessible access to cinemas, providing a favorable environment for the growth of movie theaters.

- In June 2023, The buzz surrounding the first-ever drive-in theatre in Hyderabad has been growing for quite some time, with movie enthusiasts eagerly anticipating its opening. It is arriving at the Rajiv Gandhi International Airport and has been reportedly named the 'Asian Classic.' According to the latest reports, the groundwork for the Asian Classic has been started. It will be constructed on 3 acres of land, which makes it the biggest-ever drive-in theatre in India. The concept of drive-in theatres, where audiences can enjoy films from the comfort of their cars, has gained popularity around the world, and now, Hyderabad is set to have its first-ever drive-in theatre at the RGIA soon.

- Further, in May 2023, leading multiplex operator PVR Pictures was renamed PVR INOX Pictures after a merger between PVR and Inox Leisure. PVR Pictures and Inox Leisure as a merged entity operating 361 cinemas with 1,689 screens across 115 cities till the end of FY23 in Sri Lanka and India. The operator also said that it had added 168 screens in the financial year 2023 between INOX (71 screens) and PVR (97 screens) and 79 screens added in Q4 FY'23 between INOX (26 screens) and PVR (53 screens). PVR INOX Pictures plans to increase investments in content acquisition for the Indian market and develop additional opportunities for under-represented storytellers and independent creators.

- In April 2023, CGV signed an exclusive contract to acquire hundreds of Christie CineLife+ series cinema projectors featuring some of the most energy-efficient luminance systems on the market for its multiplexes located in South Korea, China, Vietnam, and Indonesia over the next three years. With this acquisition, Christie will supply CGV - South Korea's largest cinema chain and the world's fifth-largest multiplex theatre company - with projection systems that bring advanced format capabilities to premium large-format venues and mainstream theatres.

- The rise in population and adoption of new technology in this field and the area's development are owing to the technology's deployment. With the region's advanced technology headquarters, this region will continue to be the leading market in the movie theatre market.

Movie Theatre Industry Overview

Competitive rivalry within the Movie Theatre market is intense, primarily driven by prominent industry leaders such as PVR INOX, Cinepolis, AMC Theatre, Regal Cinemas, and Wanda Cinema. These market giants enjoy a competitive edge through their consistent innovation in product offerings, as they proactively anticipate consumer needs. Their significant market share is a result of substantial investments, strategic mergers and acquisitions, and fruitful partnerships.In September 2023, PVR INOX, India's foremost cinema exhibitor renowned for its exceptional quality, expanded its portfolio by introducing its state-of-the-art ICE THEATERS auditorium in Bangalore. This endeavor follows the successful launch of ICE THEATERS in Delhi and Gurugram, aimed at providing moviegoers with a luxurious and immersive cinematic experience.

In March 2023, Amazon made a significant announcement regarding its intention to acquire the world's largest movie theater chain, AMC. This strategic move comes as AMC Theater grapples with the growing popularity of over-the-top (OTT) platforms worldwide. Wedbush Securities, a U.S.-based financial firm, predicts that this acquisition will bolster the chain's market presence, aligning it more effectively with the contemporary entertainment landscape.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.