Under Construction IT Load Capacity: The upcoming IT load capacity of the Hong Kong data center market is expected to reach 1700 MW by 2029.

Under Construction Raised Floor Space: The country's construction of raised floor area is expected to increase to 6 million sq. ft by 2029.

Planned Racks: The country's total number of racks to be installed is expected to reach 230K units by 2029. NCR Ho Chi Minh City is expected to house the maximum number of racks by 2029.

Planned Submarine Cables: There are close to 2 submarine cable systems connecting Hong Kong, and we expect a few cables to come in the near future. One such submarine cable that is estimated to start service in 2025 is Asia Cable Link ALC, which stretches over 6,000 Kilometers with landing points from Hong Kong SAR, Mainland China.

Hong Kong Data Center Server Market Trends

IT & Telecommunication Segment To Hold A Major Share In The Market

- The demand for the cloud segment is expected to increase with the growing demand for analytics, visualization tools, and business services.

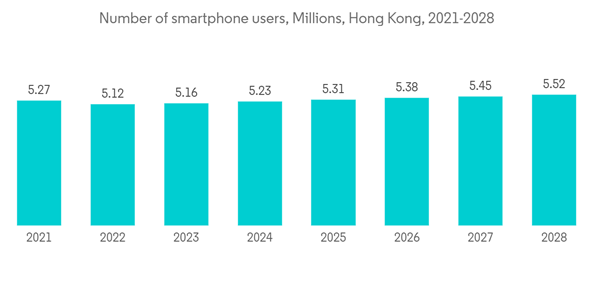

- With 5G being introduced in the country, high bandwidth speed offers led to users opting for multiple smart devices, such as smart wearables, tablets, security systems, smart lighting, and others, which have catalyzed the demand for these devices. Around 96% of the population in Hong Kong currently uses smartphones to access the Internet on a daily basis.

- To meet the surplus demand, automation has to be introduced in the industry as per Industry 4.0 measures. Increasing demand for streaming services, financial services, and smart home automation applications is expected to further catalyze data consumption.

- The increasing number of users of smart devices, such as smartphones and tablets, using varying services such as streaming, browsing, and playing games has led to consumers opting for 4G services, thus diminishing the 3G service market over the years. The implementation of 5G is expected to further increase the data speed with the evolving technology over the years, which is expected to cater to the demand as more industries adopt automation in their companies in the manufacturing sector. Such improvements in the market are expected to create more demand for data center servers in the coming years.

- The Minister of Posts and Telecommunications announced the ministry's plans to connect 2,715 kilometers of submarine fiber optic cable network from Hong Kong to Preah Sihanouk. The project was initiated in 2022 and will be completed by 2024. Considering the above instances, the fiber connectivity network will grow further during the forecast period and creates more requirement for data storage servers.

Blade Servers To Grow At aA Faster Pace In The Coming Years

- Blade servers are designed to save space in data centers. Multiple blade servers can be housed in a single chassis, reducing the physical footprint required for your servers.

- Blade server chassis are typically designed with efficient cooling mechanisms, which can help maintain a consistent temperature in the data center and reduce cooling costs.

- Blade servers often come with integrated management tools that allow for centralized control and monitoring of all servers within the chassis.

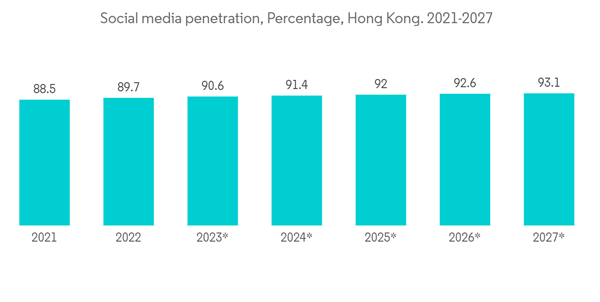

- The growing adoption of technologies such as cloud computing, artificial intelligence (AI), IT services, Internet penetration, and social media users by businesses are propelling the use of servers in data centers.

- Blade servers are generally designed with energy efficiency in mind, helping to reduce power consumption and operational costs.

Hong Kong Data Center Server Industry Overview

The Hong Kong data center server market is relatively low in terms of competition and has some players in the market, such as Dell Inc., Cisco Systems Inc., Kingston Technology Company Inc., Inspur Group., Fujitsu Limited. These major players focus on expanding their customer base in the country. These companies leverage strategic collaborative initiatives to increase their market share and profitability.In May 2023, Cisco introduced UCS X servers that cut data center energy use in half; the combination of the Cisco Intersight infrastructure management platform and Unified Computing System (UCS) X-Series servers reduce data center energy consumption by up to 52% at a 4:1 server consolidation rate.

In March 2022, Inspur Information, a world-leading IT infrastructure solutions provider, and JD Cloud, a digital and intelligent solutions provider, announced they have jointly launched the liquid-cooled rack server ORS3000S at the 2022 Inspur Partner Forum (IPF22).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.