Key Highlights

- The surge in the expansion of location-based services in the country is expected to be fueled by increasing social media usage, smartphone use, and the ease of accessibility of GPS technology. The need for an analytical solution is increased by the emergence of LBS and the evaluation of real-time geo-data.

- For instance, organizations can easily plan or manage their marketing campaigns based on client location data for the closest store or offers that are exclusive to a given location. Retailers are likely to be beneficiaries of these innovative revenue growth opportunities, which will augment the location-based services (LBS) market growth throughout the forecasted period.

- In addition to this, the emergence of on-demand services like ride-hailing, food delivery, or home service is highly dependent upon location technologies that leverage users' locations and can effectively connect providers with consumers at all times.

- Also, significant vendors are also engaged in a number of strategic developments to increase their market share. For instance, in April 2022, in order to launch the next generation of GPS SmartSole, based on the LTE Cat M1 technology, GTX Corp, a provider of location-based GPS personal and asset tracking systems, and ProteGear.com, a German IT GPS tracking company, have announced their collaboration.

- Government privacy laws and regulations currently pose a serious threat to location-based services. The majority of software programmers are now aware of both the industry standards of self-regulation and the growing body of international privacy regulations that regulate its use.

Germany Location-based Services Market Trends

Growing Demand for Geo-based Marketing

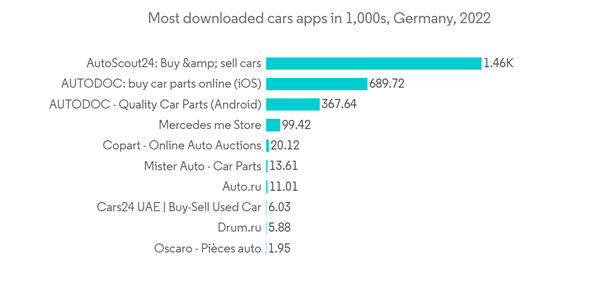

- The increased demand for geo-based marketing mainly drives the adoption and development of geolocation services in this country. Location-based services (LBS) use the location of the user's geographical position to provide personalized, relevant offers, information, and advertising.

- Geo-based marketing uses location data, which is based on physical proximity to businesses or points of interest, in order to reach customers. Businesses will be able to send highly targeted and quick marketing messages to potential clients through this approach.

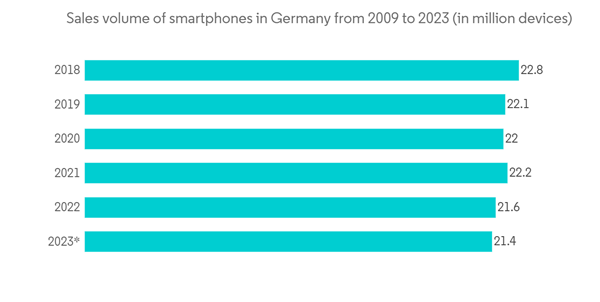

- Moreover, the surge in usage of smartphones and other mobile devices equipped with GPS technology has substantially contributed to LBS. On the basis of real-time or historical location information, mobile apps and platforms can collect data on users' locations with a view to providing them with tailored content, recommendations, and advertisements.

- Furthermore, healthcare organizations leverage geo-based marketing to identify given communities or areas that need health services or education. By concentrating resources on these areas, providers can increase awareness, provide health screenings, or provide preventive care programs tailored to the demands of the local population.

- During the COVID-19 pandemic, several countries, including Germany, developed and deployed contact tracing apps to help curb the spread of the virus. Germany's "Corona-Warn-App" is an excellent example of a location-based service. It uses Bluetooth technology to detect and log interactions with other app users in close proximity. If a user tests positive for COVID-19, the app sends notifications to individuals who may have been exposed, providing guidance on testing and self-isolation. This technology relies on location data to alert users about potential exposure risks while preserving their privacy. It demonstrates how location-based services can be used for public health purposes, contributing to the safety and well-being of the population.

Transportation and Logistics sector holds a substantial share in the market

- With a view to improving their operations and increasing efficiency, the transportation and logistics sector is increasingly taking advantage of LBS services. LBS provides companies with effective route optimization, efficient allocation of resources, and improved overall fleet management by enabling real-time vehicle tracking and monitoring. The precise location data, speed, and other pertinent information on the vehicle are provided by GPS trackers integrated into location-based services.

- By tracking the location of goods and assets at individual stages, LBS makes it possible to provide a more complete view of the supply chain. Logistic managers can monitor the movements of goods, foresee potential delays, and perform proactive exceptions on an ad hoc basis.

- In May 2022, Pozyx, a provider of real-time location systems and advanced real-time tracking solutions, introduced its new Pozyx Software Platform, which is a future-proof asset tracking and identification solution for seamless indoor and outdoor tracking based on the omlox hub and assists multiple location technologies.

- Overall, location services have become a key aspect in the transport and logistics sector, which enables efficient operations, improves customer experience, and enhances supply chain management.

Germany Location-based Services Industry Overview

In the dynamic Germany location-based services (LBS) market, several key competitors vie for market share. Notable players such as HERE Technologies, TomTom, Google, and Apple dominate with their robust mapping and navigation solutions. Additionally, emerging companies like Sygic and Geospatial Insight offer innovative approaches, while telecommunications giants like Deutsche Telekom also contribute to the evolving competitive landscape. The constant evolution of location-based technologies keeps the competition fierce, fostering innovation and enhancing services for consumers and businesses alike.In December 2022, to enhance the seamless interaction experience within car infotainment systems, 4.screen and SKODA are taking significant strides by expanding their partnership within the German market. This collaboration sees the integration of the 4.screen feature into 180,000 SKODA vehicles, enabling drivers to easily access relevant content from a wide range of renowned enterprises. By connecting 180,000 ŠKODA vehicles across Germany, 4.screen delivers location-based offers directly to drivers via the in-car infotainment system.

In August 2022, Belgian IIoT firm Sensolus entered into a collaboration with German telecommunications giant Deutsche Telekom to introduce an advanced asset-tracking solution. Sensolus' extensive portfolio of GPS trackers is designed to withstand challenging environmental conditions and boasts intelligent motion and tilt detection systems. These trackers can be further enhanced with additional sensors to collect data such as temperature and filling levels, making them a versatile solution for various industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.