Key Highlights

- The location-based services (LBS) have emerged significantly during the past few years. It is used for locating friends in an area, locating the nearest restaurant, or advertising sales to shoppers nearby. Location-based services give users access to relevant and up-to-date knowledge about their surroundings and allow businesses to update their customers regarding their orders.

- Owing to the increasing usage of mobile devices, location has become one of the most crucial aspects of marketing. Marketing teams can easily target consumers by using location-based data on qualifiers such as upcoming events in their area, proximity to a store, and many more. Organizations can target consumers personally or geographically, with online or offline messaging based on their physical location using geo-based/location-based marketing. For instance, geo-based marketing may notify a prospect that a product they are assuming is in stock in a nearby store, allowing them to purchase it immediately.

- Location-based services primarily help in optimizing vehicle routing and route progress tracking in real time. They also help in reducing fuel costs by providing the most optimized route. Big Data analytics can be used to combine fleet data, sensor data, and geolocation data to pre-compute the potential risks and send early warnings to drivers. For example, an app that is onboard a vehicle can push a data-driven alert and offer informed recommendations to the driver (for instance, to slow down as the driver approaches a dangerous curve).

- Furthermore, countries such as Spain are among the ones that stringently regulate data and privacy in their countries, in addition to the EU's GDPR. For instance, the Spanish government recently approved the levying of a digital service tax of 3% on earnings from online ads and deals brokered on digital platforms along with the sale of user data; this may apply to companies that have at least EUR 750 million (USD 885 million) in global revenues. Such developments are expected to influence the LBS growth in the region.

- On the contrary, Location-based services are revolutionizing various businesses where resource efficiency is crucial. Individuals' positions may be tracked at all times, and LBS gives the visibility needed to keep people safe. As a result, data security and privacy become increasingly important for users, as misuse might result in disastrous consequences. The frequency of data breaches has risen considerably in recent years due to various applications defying restrictions to gain access to a user's location without their authorization.

- Across Spain, the repercussions of the COVID-19 crisis were immense and unusual. Many auto-retail stores had stayed closed for a month or more, resulting in a decline in profit by the automotive manufacturer, reaching levels not seen in the last two years. It was anticipated that it would take years to recover from this plunge in profitability. The automotive sector, which had been one of the largest benefactors of the LBS market, had experienced a significant impact driven by the COVID-19 pandemic.

Spain Location-Based Services Market Trends

Indoor Location Segment is Expected to Hold Significant Share of the Market

- Indoor location based service is gradually gaining traction due to the increasing penetration of smartphones, the development of sensor technology, and the increase in indoor time. Sensor technology has enabled smart networks to receive data from a smartphone without installing additional devices, making smartphones the most commonly used data source for indoor positioning. These sensors or hot spots are called bluetooth low energy (BLE) beacons, which locate devices and users inside a building. Other kinds of indoor positioning being used by organizations are Wi-Fi and Geomagnetic. Thus, IT managers, marketing managers, facilities personnel, and other stakeholders are responsible for purchasing, installing, and maintaining these systems.

- Indoor tracking applications benefit indoor location tracking/positioning, proximity marketing, and real-time wayfinding for large facilities, such as airports, hospitals, stadiums, and convention centers. Various startups are operating in this domain to cater to the growing demand. For instance, consider the case of Canada-based InnerSpace. The company provides an indoor mapping and navigation platform for retail, healthcare, and commercial. Their positioning technology uses Wi-Fi and BLE signals and implements advanced trilateration and SLAM fingerprinting approaches to provide better indoor positioning for smartphones and wearables.

- Moreover, Spain-based Situm allows users to create maps by uploading indoor cartography. It provides the highest accuracy (0.5 - 3m) and automatic floor-level detection. There is active research on designing and implementing indoor positioning solutions to support the development of future location-based 5G network functionalities and services. Apps can use geofencing to guide their users to their exact location actively and deliver products and services more effectively through optimization of process delivery (As in the case of ride-hailing services or food delivery platforms).

- However, the built-in smartphone sensors' readings are easily affected by the surrounding environment and are occasionally different, adversely influencing indoor positioning accuracy. For instance, the built-in gyroscope sensor and the magnetometer sensor can be used to measure a user's heading direction, which may be different from each other and occasionally from themselves. As a result, this error accumulates, and the user's position may become increasingly inaccurate. Also, the reliability and availability of indoor positioning technologies, up-to-date indoor maps, and privacy problems associated with location data are some of the biggest challenges to indoor LBS.

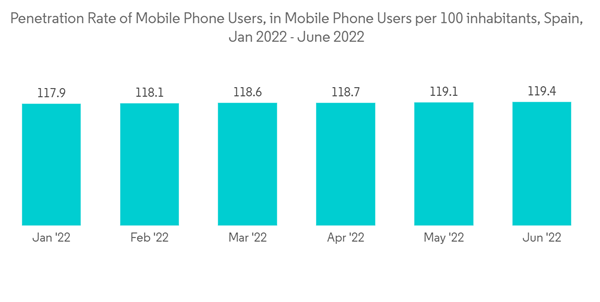

- As per the National Markets and Competition Commission, the mobile penetration rate of smartphones in Spain has been constantly growing over the past years. Starting May 2022, the monthly penetration rate exceeded 119 smartphone users per 100 inhabitants in Spain, up from 116 smartphone users per 100 in May 2021. The evolution of the LBS has seen increased application from maps and audio to more natural interfaces, from navigation systems and mobile guides to more diverse applications (such as social networking, entertainment, education, and advertisement), from location-aware to context-aware, and from technology-oriented to interdisciplinary research.

Healthcare is Expected to Hold Significant Share of the Market

- Wayfinding, asset tracking, and patient tracking are some of the most popular location-based services, allowing healthcare facilities to better satisfy the requirements of patients and their homes while improving the quality of care and operating efficiency. Health service and information providers can react immediately to the varied location of a mobile user by conveying personalized, timely information and services for the user's new roaming region.

- With the help of indoor mapping and navigation products, patients can be assisted in making their way to and through any healthcare facility. Real-time information can be conveyed to the patients depending on where they are in the hospital, allowing them to make appointments on time and find the correct testing area. Patient tracking is especially important for more vulnerable patients, such as people with Alzheimer's or younger children. In the event of an emergency, patients can be discovered immediately to deliver care faster and more efficiently.

- An online healthcare facility locator service can help users discover the nearest hospital or clinic based on their location and healthiness needs and even supply them with operating directions and real-time traffic information. Location-based technologies, such as LogicJunction, play a key role in mHealth initiatives since they provide rich data, improve patient engagement, create opportunities for greater personalization of the healthcare experience, and seamlessly connect people, places, and things. MediNav Navigator v. 2.0 is one of the most popular indoor navigation solutions available for hospitals, with features like accurate turn-by-turn indoor navigation, parking planner, and network-wide wayfinding.

- The increasing popularity of cloud-based Big Data analytics is one of the upcoming trends gaining traction in the market studied. Big Data analytics provide enriching insights into consumer buying patterns so that retailers can increase their sales volume and enhance customer search experiences. Location-as-a-service companies, such as GeoSpice, use big data analytics for offering cloud-based web services and mobile LBS, which can integrate real-time location information and data analytics.

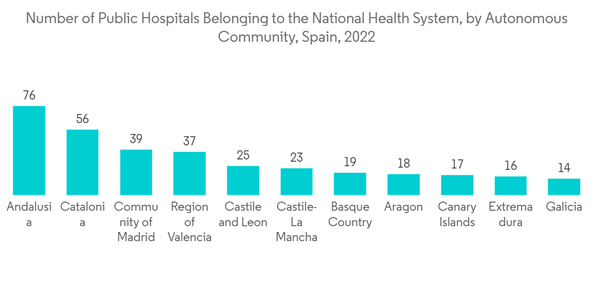

- As per the Ministry of Health, Social Services and Equality, In 2022, there were approximately 387 public healthcare facilities in Spain. Andalusia was the autonomous community with the most public hospitals, accounting for the Spanish National Health System, with 76 institutions. Catalonia and Madrid followed, with 56 public hospitals and 39 state-owned health centers. That same year, the Region of Valencia had around 13,942 hospital beds.

Spain Location-Based Services Industry Overview

The Spain location-based services (LBS) market exhibits a moderate level of consolidation, featuring several key players, including ALE International (Nokia Corporation), Cisco Systems Inc. (Cisco Meraki), Ericsson Inc., Esri Inc., and Aruba Networks (HPE Development LP). These companies are actively engaged in strategic partnerships and product development initiatives aimed at expanding their market presence. Recent developments in the market include:In September 2023, Exail delivered advanced navigation systems to the Spanish Navy's "Turia" Minehunter. The Turia M34 holds a critical role in the Spanish Navy's fleet, primarily focusing on the detection and neutralization of underwater mines to enhance maritime security. By integrating Exail's cutting-edge navigation systems, the Turia M34 gains access to precise, real-time positioning and heading data. This technology empowers the vessel to navigate safely through intricate environments, swiftly adapt to changing conditions, avoid obstacles, and maintain its intended course during mine-clearing operations.

In May 2023, Molecor introduced a new mobile application designed to optimize the management of water networks. This innovative tool has experienced significant growth since its launch on mobile platforms. Its success is attributed to the growing need for increased efficiency in water network management. In an era marked by heightened occurrences of extreme natural events and diminishing water resources, tools like geoTOM are becoming increasingly vital to effectively leverage our water resources and address water-related challenges.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.