Key Highlights

- The upcoming IT load capacity of the Ireland data center construction market is expected to reach over 270 MW by 2029.

- The country's construction of raised floor area is expected to increase by 0.9 million sq. ft by 2029.

- The country's total number of racks to be installed is expected to reach 49,737 units by 2029. Tel Aviv is expected to house the maximum number of racks by 2029.

- There are close to 3 submarine cable systems connecting Israel, and many are under construction. One such submarine cable, estimated to be built by the end of 2024, is Blue, which stretches over 4,696 Kilometers with landing points in Tel Aviv.

Israel Data Center Rack Market Trends

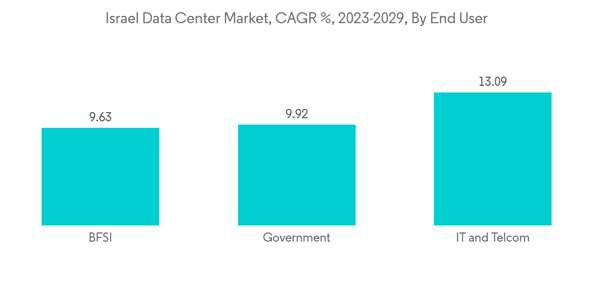

IT and Telecom to have significant market share

- The manufacturing industry accounted for an IT load capacity of 40.3 MW in 2022, constituting a significant share of the total IT load utilization. This is down to different manufacturing sectors choosing digitalization, including aerospace and defense, telecommunications equipment, aviation communications, chemical products, computer hardware and software, and others.

- By the end of March 2022, Israel was among 8 countries in the MENA region to launch commercial 5G. The industry-grade demand for a minimal latency rate would drive the growth of the telecom industry in the country. Similarly, as 5G gains traction for the general public too, it would generate more demand for the data centers to provide the platform, facilitating the system requirements for the same.

- As reported in October 2022, Google Cloud facilitates cloud services for the Israeli government ministries, justifying the 28.82 MW of IT load capacity accounted for by the government sector.

Full Rack has Majority Market Share

- In Israel, due to growing space scarcity between various companies, the full rack has a majority of market share. In order to cope with increasing rack capacity due to the rapid growth of mobile broadband and increase in Big Data Analytics combined with cloud computing, which makes it necessary to build a fully rack equipped data center.

- Companies increasingly rely on data centres for efficient management of their databases and storage, as they generate significant amounts of data every day. The main driving factor for data centre rack usage is therefore the increased deployment of fully configured data centres. Also, growth of the market is being influenced by growing demand for IT services and investments made by large companies.

- At first, there was a limited focus on rack space in data centres; only size and cost were taken into account during deployment. Nevertheless, there is an opportunity for increased use of rack space in the data center as more and more users from different sectors such as online banking, telecommunications, media and entertainment, and others are adopting applications with higher density.

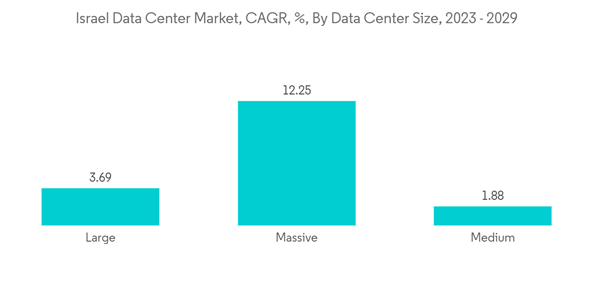

- Further, the total data center size reached an IT load capacity of 129.4 MW in 2021. It is expected to rise from 142.4 MW in 2022 to 277.2 MW in 2029 at a CAGR of 9.55%.

- As the market grows, it caters to the increasing needs of global platforms and companies, creating a demand for larger data centers and gradually establishing the need for massive data centers. Technologies like blockchain, cloud, and Big Data used by Israeli startups require more computing space, creating demand for bigger capacity facilities.

- The facilities to be built in the coming years may include massive data center facilities with a 3 MW IT load capacity. This would invite more investment from other service providers. Large cloud services aggregators like Google, Amazon Web Services, and Oracle introducing advanced data center facilities continue to shape the market for growth. This is expected to create opportunites for the rack vendors stuided in the market.

Israel Data Center Rack Industry Overview

The Israel Data Center Rack Market is fairly consolidated with significant players such as Rittal GMBH & Co.KG, Schneider Electric SE, Legrand SA, Dell Inc., and Hewlett Packard Enterprise.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.