Key Highlights

- The increasing demand for cloud computing among SMEs, government regulations for local data security, and growing investment by domestic players are some of the major factors driving the demand for data centers in the country.

- The upcoming IT load capacity of the Singapore data center market is expected to reach more than 1000 MW by 2029. The country's construction of raised floor area is expected to increase above 3.3 million sq. ft by 2029.

- The country's total number of racks to be installed is expected to reach above 1,65,000 units by 2029. East and West Singapore are expected to house the maximum number of racks by 2029. The climate in Singapore is hot, muggy, and cloudy. Throughout the year, temperatures typically fluctuate between 24 and 30°C, rarely dropping below 24°C or above 30°C. Depending upon climatic conditions, the DC cooling is processed in the DC facilities.

- There are close to 76 submarine cable systems connecting Singapore, and many are under construction. In June 2023, with three new landing sites, Singapore announced plans to double its submarine cable capacity over the next decade.

Singapore Data Center Cooling Market Trends

Liquid-based Cooling is the Fastest Growing Segment

- Liquid cooling takes advantage of the superior heat transfer properties of water or other liquids to support efficient and cost-effective cooling of high-density racks, up to 3000 times more effective than using air. Long proven in mainframe and gaming applications, liquid cooling is increasingly being used to protect rack servers in data centers across the region.

- Technological advancements are carried out in the data center cooling sector within the country. For instance, in August 2023, Digital Realty used electrolysis to purify the water used in Singapore's cooling towers, saving over 1 million liters each month. The company treats its SIN10-dated cooling water using electrolysis rather than chemicals. This prevents scaling and allows water to flow through the cooling system more often before being discharged as wastewater.

- Technological advances have made liquid cooling easier to maintain, more scalable, and more affordable, reducing data center liquid consumption by more than 15% in tropical climates and by 80% in greener areas. The energy used for liquid cooling can be recycled to heat buildings and water, and advanced artificial refrigerants can effectively reduce the carbon footprint of air conditioners.

- Further, in April 2023, NTU scientists developed this new method that combines highly efficient heat dissipation mechanisms such as evaporation and boiling to directly cool the central processing unit (CPU) using a spray of non-conductive liquids without heat sinks. The gas and excess liquid are then collected in a closed system, condensed to a liquid at tropical ambient temperatures (approximately 30°C), and returned to the system for reuse.

- Water cooling can be essential in minimizing emissions and reducing climate disturbance. Data centers using water as a cooling substance use about 10% less energy than most air-cooled data centers, emitting about 10% less CO2. In 2021, water cooling could reduce energy-related CO2 emissions in the data center portfolio by about 300,000 tonnes. Thus, technological advancement, benefits of liquid cooling, and growth in DC facilities would increase the demand for liquid cooling in DC facilities in the country.

IT & Telecommunication is The Largest Segment

- The Singapore government is pivotal in stimulating demand and utilization of technology and telecommunications across the country by launching forward-thinking projects such as the Smart Nation Initiative, Digital Economy Framework, Digital Government Blueprint, and Industrial Transformation Map.

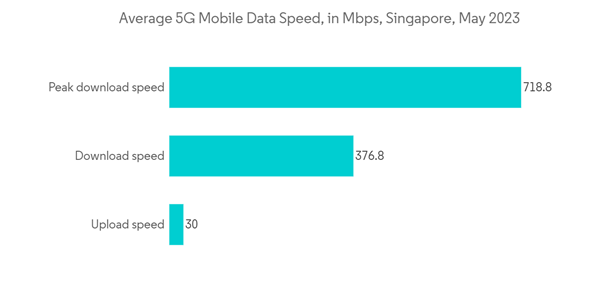

- Singapore continues to roll out 5G. 5G networks and services are expected to be the cornerstone of the telecom industry's development over the next few years as service providers look for new ways to attract customers to the market. Singapore is expected to expand standalone 5G coverage to seaports such as anchorages, fairways, terminals, and wharves by mid-2025 to facilitate 5G deployment in shipping.

- Singapore's road to becoming a smart nation started in 2014 to improve people's lives and open up new opportunities. Governments are using cutting-edge technologies and solutions to modernize city-states in terms of healthcare, transportation, urban life, government services, and businesses. Since then, Singapore has adopted several digital strategies and regulations and has implemented significant national projects and initiatives to boost productivity while focusing on sustainability.

- Furthermore, Chinese cloud service provider Alibaba Cloud has launched its cloud computer in Singapore, eliminating the need for powerful desktop hardware to perform compute-intensive tasks. All connectivity and storage will be managed by Alibaba Cloud, which is targeting organizations involved in medical research, financial modeling, and oil and gas simulations, among other use cases. Such instances are expected to increase the demand for the cloud industry in the market.

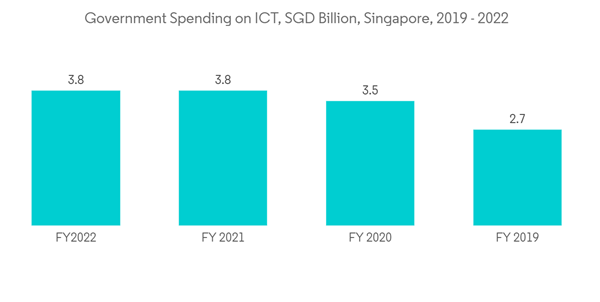

- Government Technology Agency of Singapore primarily focuses on the digital transformation of the public sector using advanced data and communication tech to improve the daily lives of Singaporeans. Plans such as the Smart Nation Initiative, the Digital Economy Framework, the Digital Government Blueprint, and the Industrial Transformation Map (ITM) continue to drive the demand for technology and telecommunications adoption across the country.

Singapore Data Center Cooling Industry Overview

The Singapore data center cooling market is moderately competitive and has gained a competitive edge in recent years. Currently, a handful of major players, including Stulz GmbH, Schneider Electric SE, Vertiv Group Corp., Rittal GmbH & Co. KG, and Mitsubishi Electric Hydronics & IT Cooling Systems SpA, dominate the market in terms of market share.In August 2023, Digital Realty, a leading provider of data center, colocation, and connectivity solutions, introduced an innovative cooling tower concept at its SIN10 data center. This initiative is aimed at achieving new benchmarks in water conservation and enhancing efficiency within its Singapore data center operations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.