Key Highlights

- Europe is still one of the most significant users of single-use plastics for packaging solutions, with countries such as the United Kingdom, France, and Germany leading the demand. Single-use plastics are mainly used to package drinking water in the area. Additionally, the increasing urbanization, changing dietary trends, the decreased availability of leisure time, and the increasing disposable income of those living in the regions contribute to the growing demand for single-use packaging solutions, especially in food, beverage, and consumer products.

- The demand for single-use packaging is growing owing to the evolving technology in food service with QSRs. Online food delivery has become a billion-dollar business. Aggregator platforms like Takeaway.com or Delivery Hero have expanded by selling reliable infrastructure solutions and attractive restaurant commission rates. Platform-to-consumer delivery companies like Deliveroo or Uber Eats operate a more cost-intensive business model but are taking care of the whole delivery logistics. Those companies have also gained track over the last years, especially in densely populated regions. Both models will likely converge with a more robust demand for packaging solutions between in-house and third-party solutions.

- Moreover, the beverage industry is growing and becoming more dynamic in Europe. It is expected to significantly drive the market for single-use paper cups and paper cup carriers. Several prominent companies are supplying a variety of paper cups to fulfill the rising demand for on-the-go beverages across Europe. In addition, ordering drinks for takeaway and home delivery has grown in popularity. Likewise, cups, along with cup carriers, stirrers, and straws that are long-lasting and attractive, are observed to be in high demand.

- Single-use packaging, containers with antimicrobial chemicals, and packaging that requires less human interaction may gain popularity post-pandemic. For on-premise eating, for example, food service restaurants may use resealable throwaway packaging to carry leftovers home without being repackaged. Post-pandemic, off-premise sales via take-out and delivery applications are becoming increasingly crucial.

- The European Commission has proposed new rules across the EU to eliminate packaging waste by 2030, with a target of 15% less packaging waste by 2040 than in 2018. If passed, the revised legislation would ban the single-use of food and beverages served in restaurants and cafeterias and the single-use of fruits and vegetables, which could limit the market and the use of plastic single-use packaging in Europe. The proposal also aims to make packaging fully recyclable in 2030, with mandatory minimums for recycled content in new packaging.

- Meanwhile, the war between Russia and Ukraine has resulted in economic sanctions against European nations, high commodity prices, supply chain disruptions, and impacts on many markets. Some European countries are very reliant on imports of food and energy, making them particularly susceptible to economic shocks brought on by the Ukraine crisis. The war between Russia and Ukraine has made raw material prices and energy costs rise in several countries with production facilities, high commodity prices, supply chain disruptions, and impacts on many markets. According to the Center for Strategic and International Studies, the war restricted food exports from Ukraine and Russia and increased the prices of these commodities. The rising cost of packaging materials and items has resulted in a decline in profit across the supply chain.

Europe Single-use Packaging Market Trends

Rising number of QSRs in the region

- The Quick Service Restaurant (QSR) and European restaurant industry is characterized by high competition, with various international and domestic brands competing for customers. A few of the most prominent QSR chains in Europe are McDonald's, KFC, and Subway, as well as Burger King and Domino's Pizza. The European QSR market is projected to expand in the coming years due to various factors, including evolving consumer preferences, a heightened need for convenience, and the introduction of new products and services, which will significantly impact the single-use packaging market.

- Single-use packaging in QSRs has become vital to a globally fast-paced life. With less time for meal preparation at home, more people rely on fast food for meals. Single-use packaging allows food service establishments to package meals in a sensible, safe, and cost-effective manner while providing customers with a convenient and efficient way to transport meals.

- Further, operators of quick service services have a strong presence throughout the day, including breakfast, lunch, and dinner, allowing them to generate sales throughout the day and thus significantly increase the demand for packaging. In addition, the key growth drivers for single-use packaging in the forecasted period are continued consumer adoption of technology, such as delivery apps and digital ordering solutions, and improved home working opportunities for delivered breakfast and lunch occasions.

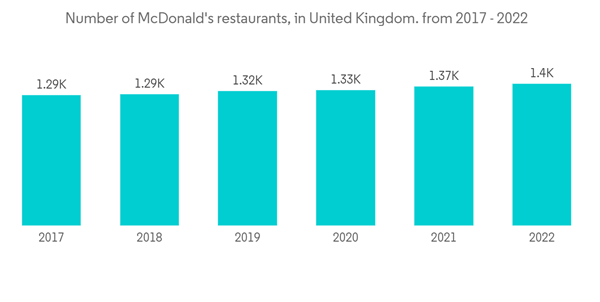

- Most menu items available in QSRs are consumed directly from containers or packages. Consumers choose to eat fast food because it is convenient, prepared quickly, a good value, and inexpensive. Therefore, single-use packaging is an integral part of the food product and, from a consumer's perspective, must be consistent with their motives and expectations for eating fast food. With the growing demand for ready-to-go and fast food, the number of QSRs is also increasing. For instance, fast food chain McDonald's has increased the number of stores in the United Kingdom due to the ongoing demand. In 2022, McDonald's had 1397 stores, which increased significantly from 1285 stores in 2017.

- It's estimated that 2.5 billion disposable cups and 50 billion disposable plastic boxes are consumed annually in the UK's takeaway industry, with less than one percent recycled. According to Eat and ClubZero, the reusable cups and food containers used in this partnership will use up to half the amount of CO2 and are entirely recyclable compared to single-use plastic-lined cups and food boxes. Due to the ban on certain products in Europe and to provide a sustainable single-use packaging system in November 2022, Just Eat expanded its partnership with Club Zero to bring a returnable packing system to corporate offices. The block is designed to deliver a zero-waste experience through a simple packaging return scheme. The expansion will likely cover over 80 restaurant and cafe locations in London and the surrounding areas.

Beverage Segment is Expected to Witness Significant Growth

- One of the major factors driving the market growth is the rising demand for single-use paper cups in the increasing trend of consumption of on-the-go beverages. Consumption on the go has continuously increased alongside rising urbanization, associated with frenetic habits. A rise in consumer demand for paper cup packaged beverage products has been witnessed in countries such as Italy, the United Kingdom, and France.

- Paper-based disposable cups can be divided into two categories: hot and cold. Hot paper cups are mainly used in packaging hot drinks such as coffee, tea, and hot chocolate. The hot paper cups are lightweight, partly coated with a PE resin lining, and have heat seal-ability, anti-blocking, and thermal insulation properties. Some hot paper cups have sleeves, others don't, and some are constructed with lids. Hot paper cups are ideal for coffee shops and other places where hot drinks are served. Due to the high demand for hot drinks, many companies are developing new marketing strategies using single-use paper cups in the region.

- Further, single-use cold paper cups are commonly used to serve beverages such as juices, water, and non-alcoholic soft drinks. These disposable cups are equipped with moisture barrier bags. They are designed with a wax-coated layer of paper to provide rigidity, protection from leaks and absorption, and an additional insulation layer. Many cups in various patterns and sizes feature tightly rolled rims to ensure a leak-free and leak-proof drinking experience, similar to that of poly-coated cup holders. These cups are specifically designed to store cold beverages and are suitable for serving sodas, liqueurs, lemonades, and milkshakes.

- As coffee shops and food service establishments were required to use disposable cups to reduce the danger of reusable cups' infection during the COVID-19 pandemic, demand for paper cups increased. Disposable cups were in great need during the pandemic due to a rise in online meal delivery, and their use was encouraged to ensure good sanitation and contact-free delivery.

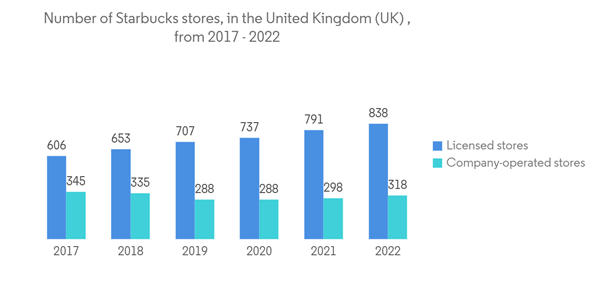

- The growing tendency of missing breakfast or eating it quickly on the go in the United Kingdom presents potential, particularly 'grab and go' foods and drinks that give flavor, convenience, and nutrition to both the young and the elderly. In this growing demand for on-the-go drinks, many well-established companies are increasing their presence in the United Kingdom and other European regions. For instance, Starbucks, the coffee retail chain, has risen significantly in outlets. It has nearly 838 company-owned store outlets in the United Kingdom, which increased from 606 in 2017. With the growing number of stores, the demand for single-use packaging is rising yearly.

Europe Single-use Packaging Industry Overview

The European single-use packaging market is fragmented, comprising several global and regional players like Berry Global Inc, Amcor Group GmbH, Huhtamäki Oyj, Hotpack Packaging Industries LLC, and more, vying for attention in a contested market space. This market is characterized by low product differentiation, growing levels of product penetration, and high levels of competition.In July 2023, Graphic Packaging, a consumer packaging company specializing in fiber-based packaging solutions, joined forces with ABP, a food processor, to create two lines of refrigerated meat packaging for Aldi, a United Kingdom supermarket giant. The pressed board tray lines, designed for Aldi's core line and premium steak line, are designed to reduce the use of plastic packaging by approximately 90% compared to the existing packaging format, aligning with Aldi's objective of eliminating 2 billion plastic packaging pieces from their supply chain by the end of 2025.

In June 2023, Waddington Europe, a division of Novolex, a leading European thermoplastic packaging specialist, established itself as the supplier of a complete selection of soft fruit punnets for the UK market. These punnets are designed to be more recyclable and less plastic-intensive than traditional punnets. They are available in various sizes, including oversized, square, and standard rectangular punnets, all manufactured using Waddington's innovative mono-material cushion technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.