The aircraft cockpit display system market is primarily dependent on the demand for new aircraft and upgrades of avionics for existing aircraft. The aviation industry is growing, and the procurement of new aircraft is being done on a large scale in all the regions of the world. It is generating a huge demand for the entire supply chain of the aircraft, which includes the cockpit components.

The market is growing rapidly due to the growing need for enhanced safety, situational awareness, and efficiency. Also, the increasing focus on automated flight control and demand for lightweight components with advanced functionalities and better accuracy are fueling the growth of the market. However, display blackouts due to system failure and increased complexity are projected to restrain the market growth during the forecast period.

Aircraft Cockpit Display System Market Trends

The Multi-Functional Displays Segment to Dominate the Market During the Forecast Period

Modern military aircraft cockpits feature all-glass, large-format multi-functional displays for improving video and imaging options so that the pilots can view multiple video sources ranging from external display processors and video sensors, including FLIR, radar, weapons, and cameras, based on their requirements. With increasing modernizing and upgradation programs taken up by various countries in their defense plans, newer-generation military aircraft are incorporating various types of multi-functional displays to enhance pilot situational awareness. For instance, in July 2021, Russia officially unveiled its new Checkmate fighter, which is expected to take its first flight in 2023, with series production to begin in 2026. The cockpit features one large and several smaller color multi-function displays along with a standard heads-up display. Also, India's upcoming fifth-generation fighter aircraft, Advanced Medium Combat Aircraft (AMCA), will feature a multi-function display (MFD) placed in portrait orientation.Additionally, India is planning to upgrade 200 Sukhoi 30 MKI combat aircraft that was in service for over 20 years. The Super Sukhoi standard upgrade to Indian aircraft will include locally manufactured radars, a full-glass cockpit, and flight-control computers. Thus, the growing adoption of multi-functional displays in military cockpits is expected to drive the market during the forecast period.

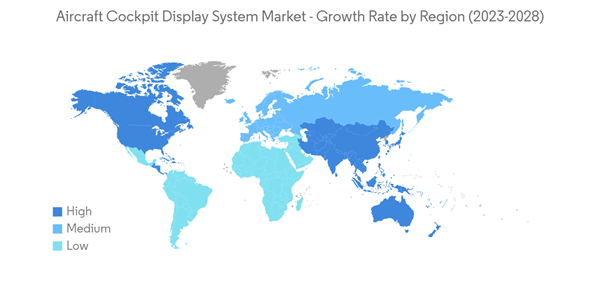

Asia-Pacific is Expected to Register the Highest CAGR During the Forecast Period

Asia-Pacific is anticipated to register the highest growth rate during the forecast period. It is mainly due to the increasing investments from India and China in the aviation sector and the rising demand for commercial aircraft due to increased air traffic. According to IATA, Asia-Pacific Airlines posted a 363.3% YoY increase in international air passenger traffic during 2022, maintaining the strongest year-over-year rate among the regions. Additionally, the capacity rose 129.9%, and the load factor climbed 37.3 percentage points to 74.0% during the same timeframe.In November 2022, China Aviation Supplies (CASC) officially signed a bulk purchasing agreement for 140 Airbus jets. The order worth USD 17 billion deal comprised CASC's pre-existing orders. Also, in July 2022, Airbus confirmed the signature of multiple aircraft orders with Air China, China Eastern, China Southern, and Shenzhen Airlines for a total of 292 A320 family aircraft. It demonstrated an extremely positive recovery momentum for the Chinese aviation market. Such orders for aircraft are expected to drive high demand for aircraft cockpit display systems to be installed on these aircraft, leading to an exponential rise in market growth opportunities during the forecast period.

Aircraft Cockpit Display System Industry Overview

The Aircraft Cockpit Display Systems Market is moderately consolidated with the presence of players such as THALES, Collins Aerospace (RTX Corporation), Elbit Systems Ltd., Garmin Ltd., and Aspen Avionics. The market is forecasted to consolidate during the forecast period on account of inorganic growth via mergers and acquisitions to create MRO conglomerates and enhance service quality. For instance, in 2022, Aspen Avionics agreed in principle to become a member of the AIRO Group of companies. Under this agreement, Aspen Avionics will continue to operate as it does presently, supporting the general aviation market segment. As part of the AIRO Group, Aspen will expand its investments, resources, and new technologies in not only avionics for general aviation but also to offer avionics solutions for manned and unmanned flight platforms for both commercial and military aviation.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.