Key Highlights

- South Korea is witnessing an increasing demand for location-based services for business intelligence and analytics, as it helps improve decision-making, optimize internal business, and increase operational efficiency.

- Growing cellular mobile connections are propelling the demand for Location-based services in South Korea. According to a recent GSMA report, The mobile landscape in South Korea is diverse, with high adoption levels of over 80%. The report also states that 5G adoption will have reached up to 53% in South Korea by the end of the current year.

- There is rapid growth in Internet of Things (IoT) applications as 5G networks expand across South Korea. 5G enables new IoT use cases based on low-latency and high-capacity capabilities. A rise in digital transformation has helped various initiatives, such as intelligent manufacturing, smart cities, energy-efficient construction, and low-impact industrialization in South Korea.

- Smartphones and tablets support Location-based services for global navigation satellite systems (GNSS) applications and equipment such as tracking devices, digital cameras, portable computers, and fitness gear. These devices support navigation and route planning for pedestrian and road navigation. GNSS location technology provides the best accuracy in areas with few telecom towers.

- Location-based advertising helps to increase organizational efficiency, reduce costs, and enhance customer engagement. Therefore, a wide range of mobile operators and application developers in South Korea are interested in using location data as an enabler for numerous enterprise, consumer, and public safety services. Location-based services also help in fraud management and secure authentication, further bolstering their demand in South Korea.

- In the post-COVID-19 scenario, technological advancements, such as real-time locating systems (RTLS), are set to transform the healthcare sector. Location technology can track the usage of soap dispensers for hygiene. The technology then combines hand hygiene data and positioning to notify staff if they have been exposed to infectious diseases. RTLS can also alert staff in monitoring and maintaining optimal medication temperatures.

South Korea Location-based Services Market Trends

Mapping and Navigation to promote the market growth

- Growing demand for mapping and navigation for tracking goods in the industrial sector propels the demand for location-based services in South Korea. Modern locating systems rely on combinations of RFID and beacon technologies. Radio-frequency identification (RFID)-based mapping and navigation utilizes RFID tags for path planning and topological relation maps. Mapping and intelligent navigation is gaining widespread importance in South Korea for robotic applications in various industry verticals.

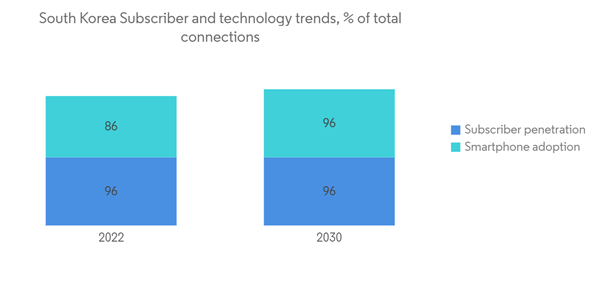

- A recent GSMA report highlights the subscriber and technology trends in South Korea, indicating that the country's subscriber penetration and smartphone adoption is anticipated to grow to 96% by the end of the decade. Such data suggests an increase in the location-based services demand for mapping and navigation during the forecast period.

- The country is witnessing a high demand for wireless communications networks to locate an IoT device. Most IoT locating systems rely on GPS or cellular location services for connectivity. The high cost of cellular connectivity has led to the increased adoption of Wi-Fi location services among enterprises. Unlike RFID-based location systems, Wi-Fi positioning does not require additional hardware since most buildings have Wi-Fi access, which is anticipated to boost its demand more than GPS or cell-tower triangulation.

- South Korea is witnessing a rising demand for location-based services for indoor applications. Wi-Fi signals pass through walls. Access points are usually indoors, and Wi-Fi fingerprints offer more accurate location data than cellular triangulation. Additionally, advantages such as using less power and less drain on batteries will propel the demand for Wi-Fi location services.

- Many market players in South Korea are introducing apps that provide navigation services in English that foreign residents and tourists may find useful. The Seoul subway service operator Seoul Metro recently launched the English version of its mobile app, Seoul Subway. It provides real-time data and a basic map of the Seoul Metropolitan Subway, the rapid transit service for Seoul and its surrounding areas.

Location Based Services for Retail to Hold a Significant Market Share

- In South Korea, retailers are incorporating advanced technologies into specialized apps that tap into customers' locations, showing them relevant information and providing directions in-store. Location-based services (LBS) incentivize consumers to enter physical retail stores and streamline their experience. Location-based services provide many opportunities for retailers, gaining rapid adoption to create a cross-channel environment. Accessible and user-friendly technology, such as Wi-Fi access points to bring all technologies into a single network infrastructure, is witnessing massive growth.

- As the use of mobile is increasing rapidly in the country, marketers have a unique opportunity to reach customers in real-time and captivate them with creative advertising that offers them the chance to interact with their favorite brands. Location-based services are a great way to drive in-store traffic, and retailers keep their offers simple by utilizing things like check-ins and offering valuable discounts.

- Last year, Apple previewed Apple Myeongdong, its largest store in South Korea. This new space will invite customers to discover Apple's latest products. With the opening of the new retail center, the company aims to deepen its relationship with South Korean customers. This is anticipated to create a new demand for location-based services.

- The Ministry of Trade, Industry, and Energy (MOTIE) recently announced that Korea's retail sales achieved an overall growth of 6.4 percent in March this year. Offline and online sales expanded by 6.6 percent and 6.1 percent, respectively. Department store chains, hypermarket chains, convenience store chains, and "super supermarket" (SSM) operators witnessed a surge in sales. The growth is attributed to factors including increasing spring season outdoor activities and growing demand for cosmetics and fashion.

- The rapid growth of the omnichannel retail industry and e-commerce sector in South Korea has increased the demand for third-party logistics and transportation in the retail supply chain. LBS, such as asset tracking and management, is growing in demand from organizations transporting different equipment, supplies, and materials from one site to another or over long distances.

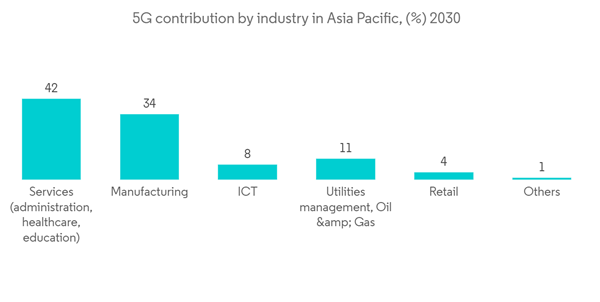

- According to The Mobile Economy Asia Pacific report, various industry verticals such as ICT, manufacturing, retail, and services sectors in South Korea are expected to benefit by incorporating 5G use cases in businesses. The pandemic increased the demand for e-commerce due to the country's changing consumer consumption patterns. As a result, the need for efficient location-based services and warehouse management systems in the South Korean retail sector has massively increased.

South Korea Location-based Services Industry Overview

The South Korea location-based services market exhibits fragmentation due to the presence of numerous companies. Among the prominent players are Cisco Systems Inc., Ericsson Inc., IBM Corporation, AT&T Inc., Qualcomm Technologies, Inc., Microsoft, Oracle, HERE, Vodafone Limited, Hewlett Packard Enterprise Development LP (Aruba Networking), and others. These key industry players are continually innovating their product offerings and engaging in strategic partnerships and collaborations to secure a competitive edge.In August 2023, Doosan Logistics Solutions Co. (DLS), a South Korean system integrator specializing in turnkey solutions, successfully secured the second expansion project for the Nike Icheon Customer Service Center (CSC). The project encompasses the implementation of order storage and retrieval (OSR) shuttles, conveyors, and warehouse control systems (WCS). DLS is known for providing end-to-end logistics automation solutions, from the initial design phase to the installation of automated equipment and WCS. An integral part of this project involves integrating DLS's software with Nike Korea's existing warehouse management system (WMS). As part of its expansion strategy, DLS is committed to delivering cutting-edge logistics automation systems and intelligent factory solutions to meet the evolving demands of its customers.

In February 2023, HERE Technologies, a leading location data platform provider, entered into a strategic partnership with Cognizant aimed at delivering real-time location insights and analytics to Cognizant's customers across various industries, including retail, ride-hailing, logistics, manufacturing, and automotive sectors. Leveraging location insights and analytics, businesses can enhance their ability to reach and serve their customers with precision. Cognizant will harness the robust data visualization and exchange capabilities offered by the HERE location platform, including access to real-time traffic data, weather information, and comprehensive road attribute data. This collaboration empowers Cognizant to develop intelligent solutions to address the unique needs of its customer base.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.