Key Highlights

- The global education/student loans market is valued at USD 3,800 billion in the current year and is expected to register a CAGR of 9.2% during the forecast period.

- A student loan is the amount of money that is obtained to cover the expenses related to higher education or postsecondary education. They cover the cost of tuition and other educational costs. When students are in college, payments are frequently postponed, and depending on the lender, they mayy occasionally be postponed for an additional six months after receiving a degree.

- One of the advantages of the student loan is that it motivates educated but underprivileged people to continue their studies and find rewarding work, advancing their careers. These loans are designed so that the student does not have to repay the loan immediately but instead must do so once their education is complete by deducting payments from their income.

- Education remains a vital investment for future opportunities, so the student loan market responds to the imperative of bridging financial gaps to access education and enhance career prospects. The student loan market is driven by various factors, such as the pursuit of higher education, rising tuition costs, and the financial challenges faced by students.

- As living costs rise and colleges in various countries like Germany, Australia, and Canada raise their fees, students are forced to borrow more. The interest rate can be considerably lower than other loans, and the repayment plan can be postponed while the borrower is still enrolled in school, setting it apart from other loans.

Student Loans Market Trends

High Education Costs is Driving the Market

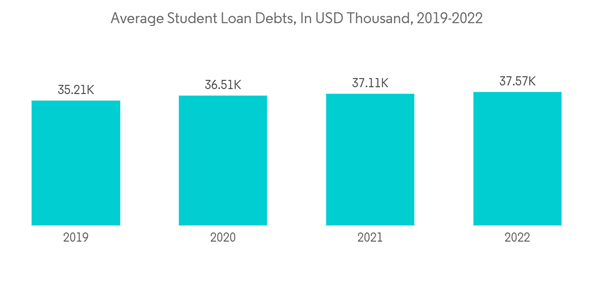

- Student loan debt is now the second-highest consumer debt category after mortgages. The growing demand for higher education results in a continued rise in tuition and fees and other related expenses to get a college degree. For many families, footing the bill by using their savings or investments will not suffice, which is why they need to rely on student loans. The average student loan debt grew as the total debt grew, and indebted borrower numbers stayed roughly the same.

- Since the spring of last year, the average student loan debt increased by 2.74%. During that same period, the average private student loan debt decreased by 14.58%, largely due to Wells Fargo's departure from the student loan market. All postsecondary students, including those earning certificates and associate's degrees, borrow at least USD 15,000 to pay for classes.

- Australia has been recognized as one of the most expensive countries in the world for international students. From tuition fees to living expenses, studying here is costly. In the previous year, 36 out of 45 universities in Australia ranked in the QS World University Rankings. The median monthly payment among student loan holders is USD 250. University graduates owe an average of USD 33,500 a year after they leave school. The average private nonprofit university student borrows USD 33,700 to complete a bachelor's degree.

Senior Student Loans Continue to Rise

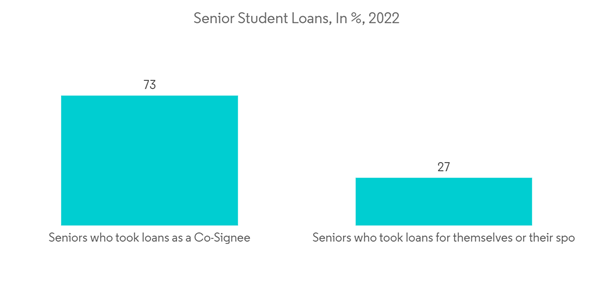

- Crippling student debt is not exclusive to the young population. People aged 60-69 years old have as much debt as people in their 30s, averaging USD 35,637 in the previous year for the former and USD 36,406 for the latter. Senior student debt increased by a drastic 1.256% from USD 6.3 billion to USD 85.4 billion in only 13 years. According to The Consumer Financial Protection Bureau (CFPB), 73% of seniors co-signed loans for other people, usually their child or grandchild, while 27% obtained loans for their spouse or themselves.

- There are issues particular to older borrowers when it comes to repaying their student loan debt that younger borrowers might need to experience. For example, 9% of seniors delayed seeking healthcare services, while 31% had to either stop saving for retirement or use their nest eggs due to student loan debt.

- Moreover, since most student loan debt cannot be discharged in bankruptcy, some seniors suddenly found lenders garnishing part of their Social Security benefits or a portion of their tax refunds. In 2021, nearly 40% of senior borrowers were in default. With still so much debt to repay and not enough resources to utilize, more seniors might find it harder to achieve a comfortable retirement.

Student Loans Industry Overview

The global education/student loans market is fragmented. In many countries, student loans are offered by a variety of lenders, including government agencies, banks, and private financial institutions. There is a diverse range of loans with different terms and conditions that are available to students. Some of the major players in the market are Earnest, Juno, Credible, Citizens Bank, and Discover.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Citizens Bank

- College Ave*

- Credible

- Discover

- Earnest

- Federal Student Aid

- Juno

- Mpower

- Prodigy

- Sallie Mae