The Asia-Pacific student accommodation market has generated revenue of USD 3.7 billion in the current year and is poised to register a CAGR of 5.1% for the forecast period.

Students' mobility was temporarily affected by travel restrictions during the pandemic, with some international students unable to move back into their university accommodation and others stranded overseas transitioning to online learning. Uncertainty remains over travel restrictions, especially from China, which has the highest number of students in higher education institutions, especially in Australia and Japan. Still, there have been encouraging signs in recent months, with borders reopening and students returning to in-person learning. The post-COVID-19 environment had a positive effect on a variety of factors, including the lifting of flight and travel restrictions, the lifting of quarantine measures, the reopening of restaurants, the commencement of indoor and outdoor events, and the resumption of the overall halt. As a result, the market has experienced a post-COVID-19 boom.

The Asia-Pacific region has been experiencing a steady increase in international and domestic student enrollment, driving the demand for student accommodation. Major cities with renowned universities have been hotspots for this trend. Student accommodation options in the region vary widely, from traditional dormitories to purpose-built student housing (PBSA), private apartments, and homestays. PBSA has been gaining popularity due to its amenities and services tailored to students.

The student housing sector in Asia Pacific has attracted significant investment from both domestic and international investors. This has led to the development of modern and sophisticated student housing complexes.

International Education: Many students travel abroad for their education, creating a strong demand for purpose-built student accommodation (PBSA) and other housing options near universities and colleges. As tuition fees rise, students are more inclined to share accommodation costs by living in group housing or PBSA, making it a cost-effective option.

This product will be delivered within 2 business days.

Students' mobility was temporarily affected by travel restrictions during the pandemic, with some international students unable to move back into their university accommodation and others stranded overseas transitioning to online learning. Uncertainty remains over travel restrictions, especially from China, which has the highest number of students in higher education institutions, especially in Australia and Japan. Still, there have been encouraging signs in recent months, with borders reopening and students returning to in-person learning. The post-COVID-19 environment had a positive effect on a variety of factors, including the lifting of flight and travel restrictions, the lifting of quarantine measures, the reopening of restaurants, the commencement of indoor and outdoor events, and the resumption of the overall halt. As a result, the market has experienced a post-COVID-19 boom.

The Asia-Pacific region has been experiencing a steady increase in international and domestic student enrollment, driving the demand for student accommodation. Major cities with renowned universities have been hotspots for this trend. Student accommodation options in the region vary widely, from traditional dormitories to purpose-built student housing (PBSA), private apartments, and homestays. PBSA has been gaining popularity due to its amenities and services tailored to students.

The student housing sector in Asia Pacific has attracted significant investment from both domestic and international investors. This has led to the development of modern and sophisticated student housing complexes.

Asia-Pacific Student Accommodation Market Trends

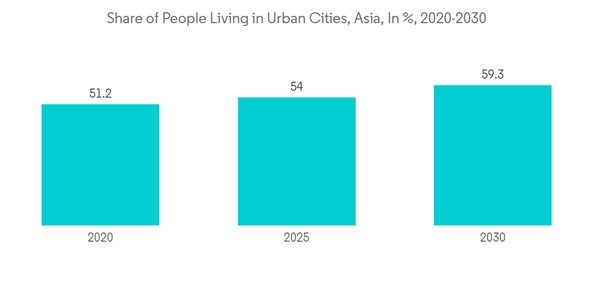

Urbanization helping to grow the Market

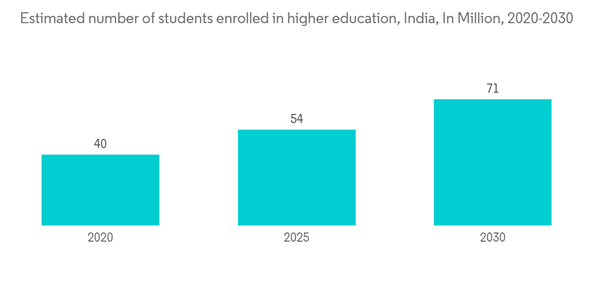

Rapid urbanization has led to the development of universities and colleges in urban areas, increasing the need for student housing in city centers. Students are increasingly looking for accommodations that offer a higher quality of life, including modern facilities, security, and amenities such as gyms, communal spaces, and study areas. Investment Opportunities: The potential for stable rental income and high occupancy rates has attracted significant investment in the student accommodation sector from institutional investors and real estate developers.Higher Education Enrolment Booming the Market

An increase in the number of students pursuing higher education drives demand for student accommodation. Both domestic and international student enrollments impact the market.International Education: Many students travel abroad for their education, creating a strong demand for purpose-built student accommodation (PBSA) and other housing options near universities and colleges. As tuition fees rise, students are more inclined to share accommodation costs by living in group housing or PBSA, making it a cost-effective option.

Asia-Pacific Student Accommodation Industry Overview

The report covers major players operating in the Asia-Pacific student accommodation market. In terms of market share, few major players currently dominate the market. However, with technological advancements and innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping into new markets. Some major players are Mapletree Investments, STUHO, Nest Student Housing, Prime Student Living, My Student Villa, etc.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION

4 MARKET INSIGHTS AND DYNAMICS

5 MARKET SEGMENTATION

6 COMPETITIVE LANDSCAPE

Methodology

LOADING...