Refrigerators and freezers hold a prominent position in the home appliance segment. Household refrigerators are primarily utilized for food storage purposes and to protect food from contamination. The refrigerator manufacturing sector in the United States has remained relatively stable compared to other consumer goods sectors. The increasing disposable income of consumers, the prevalence of smartphones, and the accessibility of high-speed internet are expected to contribute to the expansion of the market for advanced featured refrigerators in the region. The increasing investment in innovation of refrigerating units and decreasing product prices are some of the reasons for the growth of household side-by-side refrigerating appliances. E-commerce has been rapidly increasing its share of refrigeration appliances. Replacement by necessity, the consumer credit market, and the overall health of the economy are driving the market growth.

The side-by-side refrigerator market is experiencing a surge in popularity and is projected to expand significantly in the coming years. Consumers are increasingly looking for stylish and modern kitchen appliances while also requiring larger storage capacities. Additionally, urbanization, improved living standards, and the evolving lifestyle of consumers are all contributing to an increased need for convenience, appealing kitchen appliances, and increased energy efficiency. Manufacturers are expected to continue to introduce innovative product models with advanced capabilities to attract a wider customer base. The integration of AI into the refrigeration system, smart home integration, and sustainable cooling technologies are also expected to contribute to the market growth. Eco-friendly refrigeration systems and the development of Energy Efficient Technologies are also expected to be major growth drivers in the near future.

US Side By Side Refrigerator Market Trends

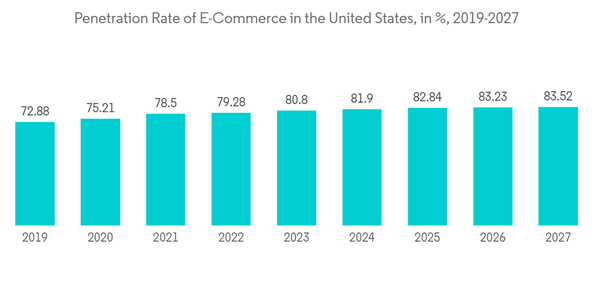

Online Segment is Driving the Market

The US is one of the largest online markets worldwide, with more than 307 million internet users across the country. As a global center of technological innovation and the home of some of the world's top internet companies, the US has been growing its digital population for more than 20 years. Today, more than 90 percent of Americans can access the Internet, and many of them can't imagine life without it.The online segment is expected to grow rapidly in the coming years, driven by the growth of the Internet, smartphones, technological advancement, digitization, the wide range of products available online, and the wide range of discounts and offers. Refrigerator manufacturers are collaborating with other companies to ensure the timely delivery and installation of their products after they have been sold online. The two largest online retailers in the US are Amazon and Walmart. The US population loves shopping online and getting discounts and offers, and there are many secure electronic payment options available. Therefore, the US online market will continue to grow.

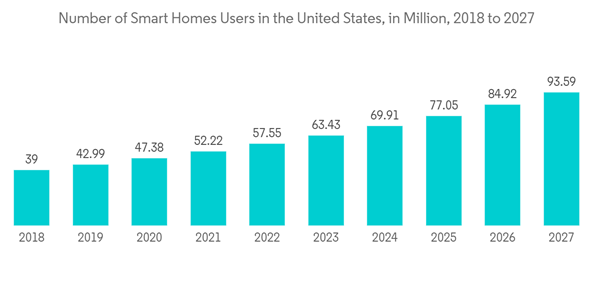

Raise in Number of Smart Homes in United States is Propelling the Market for Smart Refrigerators

The number of households using smart technology appliances is increasing in the US market. As a result, more smart refrigerators are being used than the conventional ones. These refrigerators offer all the features of traditional refrigerators but with additional features, making them more convenient and distinctive. Smart features such as a touch screen that can be converted to a transparent panel with the press of a button, recipe recommendations, and integration with Alexa are becoming increasingly popular. The use of smart tag technology allows users to tag items with data, such as the expiration date of food, which then alerts users when the date approaches the market. Consumers in the market are constantly adapting to the changes in technology and are demanding new features with each innovation.US Side By Side Refrigerator Industry Overview

The United States household side by side refrigerator market is fragmented in nature as a large number of manufacturers are operating in this industry. Some prominent players are Samsung Electronics Co. Ltd., Whirlpool Corp., LG, General Electric Co., Electrolux AB, Bosch Group, and Haier Group Corp., among others. The key manufacturers have been adopting mergers and acquisitions and new product development strategies to strengthen their presence and distribution channels and, thereby, gain a higher market share.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.