The increasing demand for cloud computing among SMEs, government regulations for local data security, and growing investment by domestic players are some of the major factors driving the demand for data centers in the country, leading to a growing need for data center storage equipment.

Key Highlights

- Under Construction IT Load Capacity: The upcoming IT load capacity of the Philippines data center market is expected to reach more than 270 MW by 2029.

- Under Construction Raised Floor Space: The country's construction of a raised floor area is expected to increase to 6 million square feet by 2029.

- Planned Submarine Cables: There are close to 12 submarine cable systems connecting Thailand; many are under construction. One such submarine cable that is estimated to start service in 2023 is Southeast Asia-Japan Cable 2 (SJC2), which stretches over 10,500 Kilometers with landing points from Songkhla, Thailand.

Thailand Data Center Storage Market Trends

IT & Telecommunication Segment to Hold Major Share in the Market

- There has been a recent uptick in migration to the cloud as companies transition to more flexible digital workplaces to accommodate increased online demand and remote work. The cloud is the foundation of digital transformation. Thus, cloud services are based in data centers. Therefore, the transition to enterprise cloud is driving the growth of the domestic data center market, thereby increasing the market value of data center storage equipment.

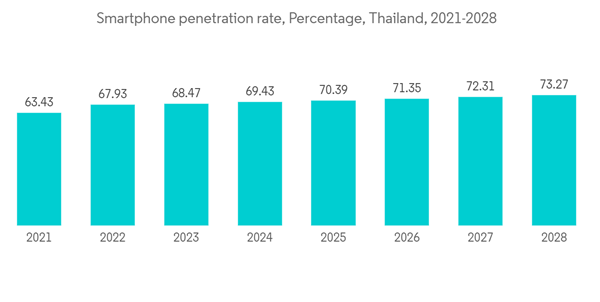

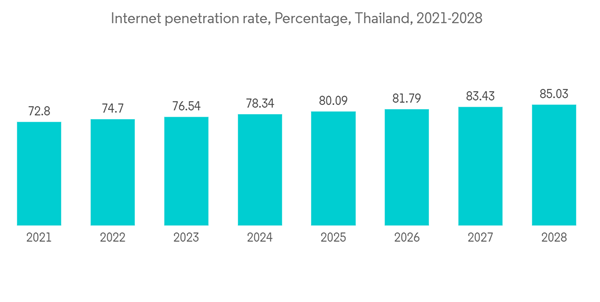

- Thailand shows strong digital readiness with a high penetration rate for internet usage, social media engagement, mobile connections, online shopping, and digital payments. Improved automation technology, smart city initiatives, and implementation of AI across industries are driving investment in data centers. As the number of data centers increases, so does the demand for data center storage in the country.

- With newer partnerships and developments, the usage of 5G in smartphones is increasing. For instance, in July 2022, Ericsson and the King Mongkut University of Technology Thonburi (KMUTT) announced a partnership to support Thai students in building 5G ICT skills for the future. As the pioneer in launching 5G commercial service in Southeast Asia, Thailand is well positioned to develop its ambitious Industry 4.0 wireless ecosystem to enhance the consumer mobile experience and support digitization. The increase in data consumption will increase the need for data storage, thus increasing the need for data center storage equipment and thereby increasing market value.

- With the growth of data-intensive technologies, cloud computing, and digital services, businesses generate and process larger amounts of data. Data centers must scale their storage infrastructure to accommodate this increased workload. This may include adding flash storage and drives to existing data centers or building new data centers. The increase in the number of data centers is directly related to the demand for storage devices in IT infrastructure. As data centers increase, more storage devices are required to meet the growing computing needs.

- Data center workloads are also increasing due to the increasing demand for improved application performance, storage requirements, and mobile data usage due to the growing number of applications and increased internet usage. As a result, more and more businesses around the world are moving to cloud data storage, increasing the demand for data center services. As a result, the use of data center storage is growing in the country.

Hybrid Storage Expected To Hold Significant Share

- The combination of on-premises and cloud storage solutions is known as data center hybrid storage. This approach takes advantage of the best of both environments and provides the flexibility to store and manage data on-premises and in the cloud.

- As businesses continue to grow, data centers are expanding and adapting to meet the growing connectivity needs of various industries and increasing internet use. Companies increasingly rely on hybrid infrastructure and cloud capabilities to seek flexibility, scalability, and remote work capabilities. Data traffic is also increasing, and thereby, the need for storage for businesses is increasing in importance, thus increasing the market value for hybrid storage solutions.

- The rise of cloud storage and audio conferencing services has led more companies to adapt to remote work. This has given rise to data centers that use hybrid storage, introducing hybrid storage that combines the functionality of hard drives and SSDs. The cache is used for frequently accessed data, so it takes advantage of the fast access capabilities of an SSD and the greater storage capacity of a hard drive.

- Hybrid storage helps to effectively utilize storage, reduce overall storage footprint, and optimize storage management. The growing demand for agile, cost-effective, and flexible computing drives the demand for hybrid storage.

- As part of digitalization, SMEs' adoption of big data and IoT technologies has led to a significant increase in procurement of all-flash and hybrid array systems.

Thailand Data Center Storage Industry Overview

The Thailand Data Center Storage is moderately fragmented. The major players in this market hold the majority of the market share. Some significant players are Dell Inc., NetApp Inc., Huawei Technologies Co. Ltd, Kingston Technology Company Inc., and Lenovo Group Limited. These companies leverage strategic collaborative initiatives to increase their market share and increase their profitability.August 2023: Pure Storage launched an expanded, multi-year strategic product and go-to-market partnership with Microsoft that brings Pure Storage Inc. storage capabilities to native Microsoft Azure services by leveraging Azure's new Premium SSD v2 and introducing them to Azure VMware Solution (AVS) in Preview.

May 2023: Kingston Technology announces its grand return to COMPUTEX in Taiwan. Kingston is unveiling a variety of new products at COMPUTEX 2023, including non-binary DDR5 memory, the XS1000 portable SSD, industrial-grade SD cards, data center solutions, and more.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.