The market's development hinges on several factors, including increased outsourcing of pharma warehousing services, heightened emphasis on quality and product sensitivity in the pharmaceutical sector, and warehouse-level automation for improved productivity and accuracy. Pharmaceutical manufacturers worldwide are expanding their production capacity and operations, leading to a heightened need for logistics between retailers and distributors for storing raw materials and finished goods. Outsourcing pharmaceutical warehousing services can reduce logistics costs by 12%, inventory costs by 8%, and logistics fixed asset costs by 20%.

Challenges faced by pharmaceutical supply chain management (SCM) include real-time visibility and technology barriers that affect order accuracy, dependability, inventory management, and compliance. Due to the growing complexity of SCM for pharmaceutical companies, certain SCM functions are outsourced to warehousing and storage service providers. Services like high-pressure processing after packaging and nonthermal pasteurization for micro-organism elimination are in high demand.

The market growth is also propelled by the rising demand for over-the-counter (OTC) medications such as VMS (vitamin, mineral, and supplement) medicines, common cold and cough medicines, gastrointestinal drugs, and dermatology treatments. The increasing importance of fast-track aid in the healthcare sector is another driving force in the pharmaceutical warehousing market.

Pharmaceutical Warehousing Market Trends

Technological Innovation is driving the market

- Constant technological advancements facilitate seamless communication among pharmaceutical companies, connecting manufacturers, warehouses, wholesalers, and other supply chain stakeholders. This streamlines route planning, mitigating disruptions caused by weather, delays, risks, and regulations. Employing radio-frequency identification (RFID) tags for remote logistics tracking enhances pharmaceutical safety, ensuring counterfeit drugs do not infiltrate the market.

- In the realm of cold chain products, high-performance cooling technologies and advanced design features like gaskets and insulations play a crucial role in maintaining desired temperatures while storing medicines.

- Monitoring systems operate 24x7, allowing hospital and healthcare staff to track internal storage temperatures, external ambient conditions, GPS positioning, and device health. Real-time door operations facilitated by web-based interfaces (such as B Connected, Audio-Visual Alarms, and RTMDs) enable swift responses by healthcare professionals.

Increase in Population is driving the market

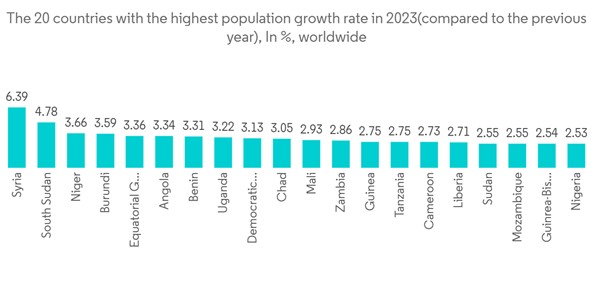

- The United Nations' latest projections suggest a peak global population of around 10.3 billion people by 2050, followed by an anticipated decrease of approximately 1.2 billion individuals by 2080. This population level is expected to stabilize throughout the remainder of the 21st century.

- In 61 countries or regions, a projected population decline of at least one percent over the next 30 years is foreseen due to persistently low fertility rates and, in some cases, increased emigration rates. The recent pandemic has further impacted population dynamics, reducing global life expectancy at birth to 71 years in 2021, down from the previous year's 72.9. The pandemic likely led to short-term declines in pregnancy and childbirth in certain regions.

- By 2050, eight countries - namely the DR Congo, Egypt, Ethiopia, India, Nigeria, Pakistan, the Philippines, and Tanzania - are anticipated to contribute significantly to global population growth. Liu Zhenmin of the United Nations has cautioned that rapid population growth poses challenges to eradicating poverty, reducing hunger and malnutrition, and expanding health and education coverage.

- Considering the escalating effects of global warming and the potential rise in new bacteria and viruses, there's a forecast for increased development of vaccines to combat these evolving threats. Consequently, this development will likely lead to a rise in pharmaceutical warehousing to accommodate the expanded vaccine production.

Pharmaceutical Warehousing Industry Overview

One of the main drivers of the market growth is the increasing demand for pharmaceutical warehousing outsourced services. However, factors such as the need for more effective logistics support in developing countries may limit the growth of the market. Some of the major players operating players are CEVA Logistics, Rhenus SE and Co. and DB Schenker AG.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.