Chemical firms from the Gulf Cooperation Council (GCC) should be more robust to rising borrowing and energy prices than their bigger European competitors. In light of the current stresses of rising interest rates and higher energy costs, GCC chemical companies are likely to be more resilient than international peers due to low feedstock prices, long-term supply security, and solid customer and shareholder bases (75%-80% of GCC chemical companies' revenue).

Saudi Arabia's logistics business is worth USD 18 billion by 2022 and its services are extended internationally. The country's substantial transport activity heavily supports Saudi Arabia's economy. Furthermore, the Kingdom of Saudi Arabia (KSA) has implemented several economic reforms in the industry, hastening its progress towards its development program 'Vision 2030.' The program calls for strengthening the Saudi economy by relying less on oil and focusing more on logistics, health, education, and infrastructure, among other things.

Saudi Arabia's freight network is enormous, with an estimated 40,000 vehicles operating in eight countries throughout the Middle East and Central Asia. The ministry oversees a network of 71,500 km of paved roads, 5000 km of which are motorways and 49,000 km of which are single-lane roads. There are also 144,000 km of improved dirt roads. To improve road safety, the ministry has rolled out automated voice-warning signs on 58 km of roads, alerting drivers who veer outside lane markers, use mobile phones, or are driving in inclement weather.

The projected GCC railway, a USD 15.5 billion project that will connect the six nations with a network of 2172 km of track, will handle up to 29 million tonnes of the total 61 million transferred within the area yearly across all modes of transport (see study). It is also projected to help the Kingdom handle its sustainability concerns by reducing CO emissions by 70% to 80% as compared to trucks. According to studies, the project may reduce container and bulk freight costs by up to 30% while also creating up to 80,000 employees. It may also help to clear the shipping lane via the congested Strait of Hormuz.

In 2022 Al Jasser, as minister of transport and logistic services, signed two memoranda of understanding with Jean-Baptiste Djebbari, France’s minister of transport, to collaborate on rail and other upcoming logistics innovations.

As of February 2022, the primary entry point for imports is Jeddah Islamic Port (JIP), which accounts for 26.7% of the total. Because of its location on the Red Sea, Saudi Arabia's west coast serves as the principal entrance point for containers, while its east coast ports serve as the key loading point for energy exports. While JIP is the busiest commercial port, the two King Fahad Industrial Ports - one on the Red Sea and one on the Gulf - remain the busiest industrial ports due to their significance to the petroleum sector.

The construction, which will be completed in 2024 by Dubai Port World (DP World), will increase capacity from 2.4 million TEUs to 3.6 million TEUs. In June 2022, DP World inked a 30-year concession deal with JIP for the building of a logistics park for SR500 million (USD 133.3 million). The 415,000-square-metre facility will feature a container depot capacity of roughly 250,000 TEUs and 100,000 square meters of warehouse storage space.

Saudi Arabia Chemical Logistics Market Trends

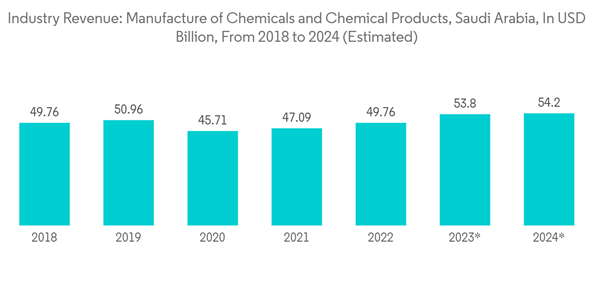

The Rise in Chemical Production is Expected to Propel the Growth of the Chemical Logistics Market

The region's larger chemical companies benefit in general from competitively low feedstock prices, which are priced at significant discounts to the European benchmark, the Dutch TTF, which briefly exceeded USD 70 per million British thermal units (mmbtu) in mid-August 2022, compared to USD 25/mmbtu at the beginning of June 2022 and USD 18/mmbtu at the end of 2021. Saudi Arabia, for example, kept methane and ethane prices stable at USD 1.25 and USD 1.75/mmbtu, respectively. When combined with a strong consumer and shareholder base, the GCC players' profitability outperforms their European counterparts.Higher commodity prices (particularly natural gas) benefit commodity players in the GCC. This is shown in their comparatively excellent performance in 2021 and their rather resilient first-half performance in 2022. Overall market expectations are for publicly traded chemical companies to maintain healthy unadjusted EBITDA margins of around 30% in 2022, compared to 34%-35% in 2021, despite some margin softening this year due to global capacity additions outpacing demand in some segments and high inventory levels.

Furthermore, national oil companies are investing in the development of gas fields to increase gas production, which aids in the provision of raw materials for electricity and petrochemical production. In particular, Saudi Aramco announced in March 2022, as part of its long-term strategy, that it is considering potentially increasing gas production by 50% by 2030 and is investing to increase gas production for electricity and petrochemical production by developing gas fields unrelated to oil production.

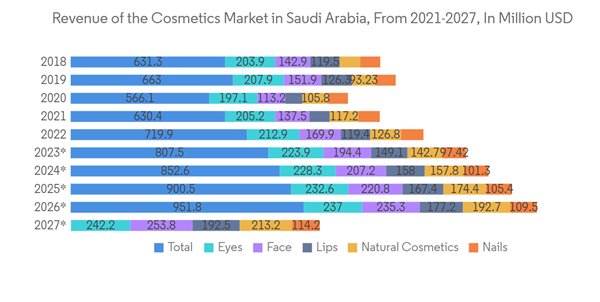

Rising Demand from Various End-User Industries

Despite global financial difficulties influencing the building industry, Saudi Arabia's construction industry remains a leader in the Middle Eastern area. In Saudi Arabia, construction production growth is predicted to be around 3.5% in 2022. Construction chemicals are usually used to increase the speed of work in construction projects that are in the planning stages or to give strength and stability to new projects. Bulk chemicals are critical components for constructing complex structures and have completely revolutionized the construction sector.Government projects such as King Salman Park, Neom City, Red Sea Project, Jabal, and other infrastructure projects are increasing the demand for products made from petrochemical or bulk chemicals such as adhesives, tiles, and others, thereby supporting the growth of Saudi Arabia's bulk chemical market.

Butyric acid, along with acetic acid and propionic acid, is one of the three most prevalent short-chain fatty acids (SCFAs) in the stomach. Around 90–95% of the SCFAs in the gut, which are created when gut-friendly bacteria break down dietary fiber, are made up of these saturated fatty acids. Butyric acid is used to give buttery overtones to food tastes, and its esters are frequently used as food additives to boost fruit aroma.

Butyric acid is widely known for its anticancer qualities since it stimulates morphological and biochemical differentiation in several cells while concurrently reducing neoplastic tendencies. According to Arab News, the pharmaceutical business in the Kingdom is expected to export more than SR 1.5 million per year and grow at a pace of 5% per year, with more than 40 recognized pharmaceutical enterprises in Saudi Arabia supplying 36% of the country's medical needs. As a result, demand for butyric acid is expected to rise in Saudi Arabia, driving market development.

In December 2022, Saudi Basic Chemical Industries (SABIC) announced the opening of a new unit, the Saudi Industrial Chemicals factory situated in Jeddah. This new factory helps SABIC in producing dioctyl terephthalate from ethyl hexanol.

Saudi Arabia Chemical Logistics Industry Overview

There are multiple big and small players in the Saudi Arabia Chemical Logistics market. The sector is highly fragmented. The sector has been observing many innovative and digital trends in recent years, like adopting big data analytics and IoT technologies to further fuel the growth of the chemical logistics industry. Given the region's visibility of long-term feedstock supply from national oil companies and competitive feedstock pricing in the lowest cost quartile, which provides margin support and mitigates volatility amid higher input costs globally, regional chemical companies are emerging as better positioned. Some of the major players are A&R Logistics, Agility Logistics, Al-Futtaim Logistics, C.H. Robinson, and BDP International, Inc.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.