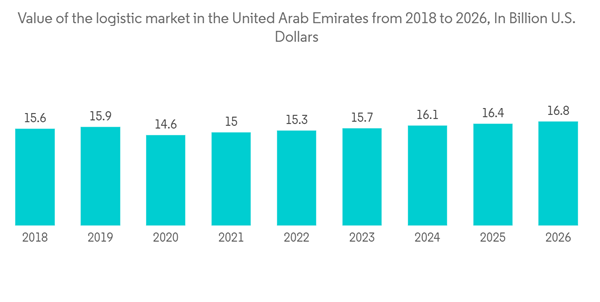

The United Arab Emirates economy rose 7.6% in 2022, nearly double the increase in GDP recorded in 2021 as the Gulf state recovered swiftly from the COVID-19 pandemic. The UAE's foreign trade hit 2.2 trillion dirhams (USD 599 billion) in 2022, up 17% year on year, and it has signed bilateral trade agreements with global partners spanning India, Israel, and Indonesia.

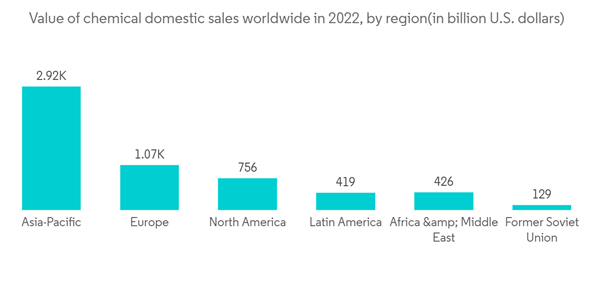

The UAE aims to double the size of its economy by 2031 and diversify away from hydrocarbons. Overall, chemical output in the GCC increased by 2.7% in 2021, reaching 154.1 million tons capacity, owing to a comeback in global demand. With a nine-year compound annual growth rate (CAGR) of 45.1% and 17.8%, respectively, inorganic chemicals and performance polymers and rubbers have led regional historical growth. The good total capacity growth pace will slow to 2.5% in 2022.

Despite the fact that the GCC chemical sector is export-oriented, with 68.8 million tons exported in 2021-22, the area bought 20 million tons, resulting in a positive trade balance of 48.6 million tonnes, up 12% year on year. China and India continue to be the major destinations for GCC chemical exports, accounting for 26% and 14% of overall exports, respectively. Petrochemicals and polymers account for most GCC chemical exports, whereas value-added chemicals are the most often imported chemicals entering the area.

UAE Chemical Logistics Market Trends

Requirement For Specialty Chemical Industry is on the Rise

The manufacture of several chemicals has surged in recent years. The rising use of shale gas as a feedstock in the energy industry has raised the industry's need for shale gas transportation.Technological advancements, diversified applications, and increased demand from the end-user industries are pushing the growth of the specialty chemical industry. Specialty chemicals are added to paint and coating formulations to make applied films functional. Direct-to-metal (DTM) coatings, for example, are becoming more popular for industrial applications because they reduce labor costs and energy intensity by minimizing time and complexity.

This industry is very important to the Gulf Cooperation Council. The growth of smart cities and expanded building projects in Saudi Arabia and the UAE are likely to drive demand for specialty chemicals. Given the anticipated need, the local government is offering significant incentives to parties interested in establishing a specialty chemical business.

Penetration of IoT-Enabled Connected Equipment Is Soaring, As Is The Rise of Tech-Driven Logistical Services:

The market is expanding as a result of rising demand for automation and refurbished green warehouses in the chemical sector for more sustainable business operations. As worries about energy savings and environmental protection rise, chemical firms are fast investing in cost-effective warehousing solutions that mix green standards with smart technology, such as the Internet of Things (IoT), smart sensors, and robots. Additionally, vendors provide digital technology for automating chemical logistics and data processing, resulting in greater productivity, efficiency, and convenience.In logistics services, the use of AI, machine learning, radio-frequency identification (RFID), and Bluetooth, as well as other rapidly developing technologies such as drone deliveries and self-driving automobiles, is increasing. As a result, the chemical logistics market is likely to benefit from increased technical improvements in the logistics industry.

UAE Chemical Logistics Industry Overview

There are multiple big and small players in the United Arab Emirates Chemical Logistics market. The sector is highly fragmented. Given the region's visibility of long-term feedstock supply from national oil companies and competitive feedstock pricing in the lowest cost quartile, which provides margin support and mitigates volatility amid higher input costs globally, regional chemical companies are emerging as better positioned. Some of the major players are A&R Logistics, Agility Logistics, C.H. Robinson, and BDP International, Inc.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.