Key Highlights

- The outbreak of COVID-19 led to a significant reduction in output and investments in various major end-user industries of compressor oil, including oil and gas, chemical and petrochemical, and others, due to the reduction in demand as a consequence of nationwide lockdowns and other containment measures. However, the demand substantially improved in 2021 following the opening of economies, which led to increased industrial operations.

- One of the major factors driving the market studied is the increasing investments in the oil and gas industry due to which the demand for plant utilities like compressors has been increasing, thus directly impacting the demand for oil utilized in it.

- On the flip side, the growing popularity of oil-free compressors for operations that require cleaner, dryer air is restraining the demand for the studied market.

- Growing research and development on the usage of bio-based compressor oil, in line with the increasing emphasis on sustainability, is expected to offer various opportunities for the growth of the market over the forecast period.

- In the Asia-Pacific region, China is expected to dominate the market in terms of demand owing to the vivid presence and continuous expansion of various end-user industries.

Asia Pacific Compressor Oil Market Trends

Increasing Investments in the Oil and Gas Industry

- Compressors in the oil and gas industries are primarily used for collecting, pressurizing, and pushing the oil or gas through the refining process or distribution system. These compressors are mainly located in ships and drilling fields, in chemical and process plants, and also in pipes that make up the distribution network. Compressor oil is required to reduce the friction between the moving parts of these compressors and to maintain their efficiency.

- Growing demand for oil and gas is leading to an increase in the number of exploration and refining projects, owing to which the installations of compressors are expected to increase, which will directly impact the demand for compressor oil.

- According to the International Energy Agency (IEA), the global oil demand is expected to reach 104.1 mb/d (million barrels per day) by 2026, with China and India accounting for about half of the growth through 2026, thus supporting market growth in the coming years.

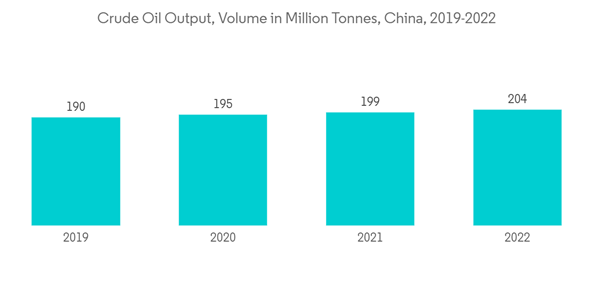

- Also, China National Offshore Oil Corporation's (CNOOC) oil and gas production is expected to rise by more than 6% each year during the period 2022-2024, therefore playing a critical role in China's energy supply security.

- Under the expectation of the growth in demand for oil refining in the coming years, China Petrochemical Corporation, also known as Sinopec, announced plans in 2022 to invest CNY 198 billion (USD 31.10 billion) in the industry. Out of the overall planned investment, the company will invest CNY 81.5 billion (USD 11.38 billion) in upstream exploitation, the crude oil bases in Tahe and Shunbei fields, and natural gas fields in Sichuan province and the Inner Mongolia region.

- The Indian government has announced various plans to meet the growing need for oil and gas. It has allowed 100% foreign direct investment (FDI) in many segments of the sector, including natural gas, petroleum products, and refineries.

- As per the announcement by India’s Petroleum Minister in 2022, the country is aiming to more than double the area under exploration and production of oil and gas to 0.5 million square kilometers by 2025 and to 1 million square kilometers by 2030 with a focus of raising domestic output and reduce reliance on imported fuel.

- Owing to all the factors mentioned above, the market for compressor oil in the Asia-Pacific region is expected to grow significantly over the forecast period.

China to Dominate the Asia-Pacific Compressor Oil Market

- In the mining industry, compressors are used in a variety of operations such as ventilation systems, material conveyors, pneumatic tools, and others. Hence, compressor oil is required in the industry to ensure the proper working of these compressors.

- The mining industry in China is one of the largest in the world. It is the leading producer of over 20 metals, including gold, graphite, iron, aluminum, cement, coal, lead, magnesium, rare earth, etc. In 2022, the mining industry's output increased by 7.3% year on year, as per the data from the National Bureau of Statistics.

- Chinese companies are exploring the world for mining assets with booming demand for lithium, cobalt, and nickel which are the key metals used in batteries for electric and hybrid vehicles.

- For instance, the Xiangyuan lepidolite project in Hunan led by a joint venture formed in 2022, is scheduled to bring online an additional 60 kilotons to 70 kilotons of lithium carbonate production per annum, which will be China's largest domestic hard-rock mine. The onset and completion date for the project has not been revealed yet.

- Consistent growth and investments in the mining industry of the country are indicative of the lucrative demand for compressor oil from the industry.

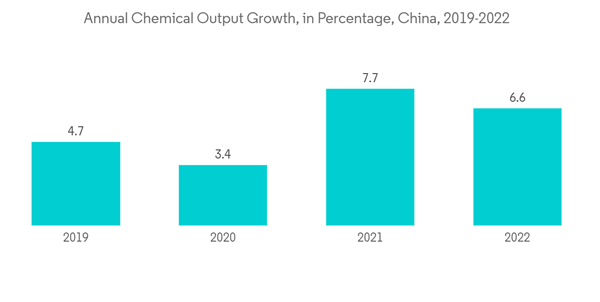

- The use of compressor oils in the chemical and petrochemicals industry guarantees the untroubled functioning of the machine parts and also helps in minimizing the expenses and increasing the lifetime of the machine. Moreover, compressor oils also serve to dissipate the heat generated by the compressors during operations thus reducing the overall power consumption and also from the wear and tear of the machine. Thus, the increase in output in the chemical industry and new investments in the industry are all indicative of a profound demand for compressor oil from the industry.

- China is a hub for chemical processing, accounting for a major part of the chemicals produced globally. As per the data by the BASF Chemical Industry Outlook, in 2022, the output from the chemical industry in China increased by a notable 6.6% from the previous year.

- In November 2022, Clariant partnered with Evonik and ThyssenKrupp Engineering Technology Co., Ltd. for the Qixiang Tengda project, to assist in the development of a new propylene oxide plant designed to have an annual capacity of 300 kilotons. The expected completion date of the project has not been revealed yet.

- With continuous investments in the manufacturing capacity of various chemicals and petrochemicals in China, the demand for products and materials that are utilized in the industry is expected to increase prominently in the coming years.

- All these factors are likely to keep China ahead of other countries in the compressor oil market in the Asia-Pacific region.

Asia Pacific Compressor Oil Industry Overview

The Asia-Pacific Compressor Oil market is partially consolidated in nature. Some of the major players (in no particular order) in the market include Chevron Corporation, FUCHS, HP Lubricants, Indian Oil Corporation Limited, and China Petrochemical Corporation (Sinopec), among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.