Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Demand for Energy Exploration and Production

The global offshore drilling riser market is significantly driven by the increasing demand for energy exploration and production. As the global population continues to grow, so does the demand for energy resources. Traditional onshore oil and gas reserves are becoming increasingly depleted, leading the industry to explore offshore reserves to meet the rising energy needs.Offshore drilling risers play a crucial role in extracting hydrocarbons from beneath the seabed. These risers provide a conduit for the transfer of drilling fluids, control the wellbore pressure, and enable the extraction of oil and gas from deep-sea reservoirs. The exploration of deep and ultra-deepwater reserves, made possible by advanced offshore drilling technologies, has become a key focus for many energy companies. As a result, the demand for efficient and reliable offshore drilling risers has grown significantly.

Furthermore, advancements in drilling technologies, such as managed pressure drilling (MPD) and dual-gradient drilling, have expanded the capabilities of offshore drilling rigs, making them more efficient and capable of operating in challenging environments. This technological progress further fuels the demand for advanced offshore drilling risers, as they need to accommodate the requirements of these sophisticated drilling techniques.

Growing Investments in Offshore Oil and Gas Projects

Another key driver of the global offshore drilling riser market is the growing investments in offshore oil and gas projects. The offshore sector has witnessed increased capital expenditure as energy companies seek to tap into new reserves and exploit existing ones more efficiently. Large-scale offshore projects, particularly in regions with untapped deepwater reservoirs, have become a focal point for investment.These projects involve substantial capital investments in drilling equipment, infrastructure, and technology to extract hydrocarbons from beneath the ocean floor. Offshore drilling risers are critical components in these projects, providing a link between the drilling platform and the wellbore. The rise in investments, driven by the potential for significant reserves in offshore fields, directly correlates with the demand for advanced and reliable offshore drilling risers.

Moreover, the exploration and development of unconventional resources, such as pre-salt and shale reserves, contribute to the increased investments in offshore projects. As these projects require specialized drilling techniques and equipment, including advanced riser systems, the market for offshore drilling risers continues to experience growth.

Technological Advancements and Innovation in Riser Design

Technological advancements and innovation in riser design represent a crucial driver for the global offshore drilling riser market. As the industry faces the challenges of drilling in deeper waters and harsher environments, there is a constant need for improved technologies that enhance the efficiency, safety, and reliability of offshore drilling operations.In recent years, manufacturers and service providers in the offshore drilling riser market have invested heavily in research and development to introduce innovative solutions. Advanced materials, such as high-strength alloys and composites, are being employed to enhance the strength and durability of riser systems, allowing them to withstand the extreme conditions encountered in deepwater drilling.

Additionally, innovations in riser design aim to address issues related to fatigue, corrosion, and wellbore stability. Flexible riser systems, for instance, offer increased adaptability to the dynamic seabed conditions and reduce the impact of vessel movements on the drilling operation.

Furthermore, the integration of smart technologies, such as sensors and real-time monitoring systems, into riser designs enhances the ability to detect potential issues early on, improving overall safety and reducing downtime. The continuous pursuit of technological excellence and innovation within the offshore drilling riser market not only meets the evolving needs of the industry but also opens up new avenues for growth and expansion.

Key Market Challenges

Harsh Environmental Conditions and Deepwater Challenges

One of the primary challenges facing the global offshore drilling riser market is the inherent difficulty of operating in harsh environmental conditions and deepwater environments. Offshore drilling activities often take place in remote locations characterized by unpredictable weather patterns, extreme temperatures, high waves, and strong currents. These challenging conditions can pose significant operational risks and increase the complexity of drilling operations.In deepwater exploration, where drilling occurs at depths exceeding 500 meters, the challenges become even more pronounced. The pressure, temperature, and geological conditions at these depths demand specialized equipment capable of withstanding immense forces. Traditional riser systems face limitations in such environments, requiring constant innovation to develop risers that can endure the extreme conditions associated with deepwater drilling.

Moreover, the increased water depth introduces additional technical challenges related to the weight and buoyancy of riser components, as well as the need for effective buoyancy control systems. The development and deployment of reliable riser systems capable of handling the complexities of deepwater drilling remain a substantial challenge for the industry.

Regulatory and Environmental Compliance

The global offshore drilling riser market is confronted with a significant challenge related to regulatory and environmental compliance. The exploration and extraction of hydrocarbons from offshore reserves are subject to stringent regulations imposed by various national and international bodies. These regulations are designed to ensure the safety of operations, protect the environment, and mitigate potential risks associated with offshore drilling activities.Compliance with these regulations involves meeting strict standards for equipment design, operational procedures, and environmental protection measures. Offshore drilling risers, being integral components of drilling systems, must adhere to these regulations to ensure safe and sustainable operations. This adherence adds complexity to the design, manufacturing, and deployment of offshore drilling risers, as companies must invest in research and development to meet evolving compliance requirements.

Furthermore, the potential environmental impact of offshore drilling activities, including the risk of oil spills, requires continuous monitoring and mitigation efforts. Risers play a crucial role in preventing and responding to such incidents. Striking a balance between meeting regulatory requirements, ensuring environmental sustainability, and maintaining cost-effectiveness remains a constant challenge for stakeholders in the global offshore drilling riser market.

Cost and Financial Viability

The financial viability of offshore drilling projects, including the associated costs of drilling risers, is a significant challenge for the global market. The development and deployment of advanced riser systems capable of meeting the demands of deepwater exploration involve substantial capital expenditures. The complexity of offshore drilling operations, coupled with the need for specialized equipment and materials, contributes to the high costs associated with riser manufacturing, installation, and maintenance.In a market influenced by fluctuations in oil and gas prices, companies face the challenge of balancing the need for cutting-edge technology with the imperative to control costs. Economic considerations often play a decisive role in the decision-making process for offshore drilling projects. As a result, stakeholders in the offshore drilling riser market must continually seek ways to optimize manufacturing processes, enhance operational efficiency, and explore cost-effective solutions without compromising safety or environmental compliance.

Additionally, the cyclical nature of the oil and gas industry, marked by periods of boom and bust, poses challenges for companies to maintain financial stability and profitability. The uncertainty surrounding future oil prices and global economic conditions adds an element of risk to the financial planning and investment strategies of companies operating in the offshore drilling riser market. Navigating these financial challenges while delivering reliable and technologically advanced riser systems remains a critical concern for industry participants.

Key Market Trends

Adoption of Digitalization and Automation in Riser Systems

A notable trend in the global offshore drilling riser market is the increasing adoption of digitalization and automation in riser systems. As the oil and gas industry embraces Industry 4.0 principles, offshore drilling operations are undergoing a transformative shift towards smart and connected technologies. Riser systems are no exception, with a growing emphasis on integrating digital solutions to enhance efficiency, safety, and decision-making processes.Digitalization involves the use of sensors, data analytics, and real-time monitoring systems to collect and analyze information from various components of the riser system. This data-driven approach allows operators to gain insights into the performance of the riser, predict potential issues, and optimize maintenance schedules. The implementation of digital twin technology, which creates a virtual replica of the riser system, enables real-time simulations and troubleshooting, contributing to improved reliability and reduced downtime.

Automation plays a crucial role in enhancing the operational capabilities of offshore drilling risers. Automated control systems can optimize drilling parameters, respond to changing environmental conditions, and improve the overall safety of drilling operations. Automated riser tensioning, for example, ensures precise and dynamic control of tension levels, enhancing the riser's ability to accommodate vessel movements and maintain stability during drilling activities.

The integration of digitalization and automation not only enhances the performance of offshore drilling risers but also contributes to the broader goals of reducing operational costs and minimizing environmental impact. As this trend continues to gain momentum, industry stakeholders are likely to invest further in developing and implementing advanced digital and automated solutions to stay competitive in the evolving offshore drilling landscape.

Focus on Sustainability and Environmentally Friendly Practices

A significant trend in the global offshore drilling riser market is the increasing focus on sustainability and environmentally friendly practices. The oil and gas industry, traditionally associated with environmental concerns, is undergoing a paradigm shift towards more sustainable and responsible operations. This shift is driven by a combination of regulatory pressures, stakeholder expectations, and the industry's recognition of the need to address environmental challenges.In the context of offshore drilling risers, sustainability trends manifest in various ways. One key aspect is the development and use of environmentally friendly materials in riser construction. Manufacturers are exploring alternatives to traditional materials, such as high-strength composites and corrosion-resistant alloys, to reduce the environmental impact of riser production and enhance recyclability.

Additionally, the industry is investing in technologies and practices that minimize the environmental footprint of drilling operations. This includes the development of closed-loop drilling systems that aim to reduce the discharge of drilling fluids into the ocean, mitigating the impact on marine ecosystems. Riser systems are integral to these efforts, as they are instrumental in controlling the flow of drilling fluids and preventing unintended environmental consequences.

The adoption of sustainable practices also extends to the decommissioning phase of offshore drilling projects. Companies are exploring innovative solutions for riser removal and recycling to minimize the environmental impact of decommissioned equipment.

As sustainability continues to be a key driver of business decisions, the offshore drilling riser market is expected to witness an increased emphasis on eco-friendly solutions and practices. Stakeholders across the value chain, from manufacturers to operators, are likely to align their strategies with global sustainability goals, shaping the future of the offshore drilling riser market.

Segmental Insights

Type Insights

The Marine Drilling Riser segment emerged as the dominating segment in 2023. The growing demand for energy has led the offshore oil and gas industry to explore deeper waters where untapped reserves are located. Marine drilling risers are essential for accessing these deepwater reservoirs, providing a conduit for drilling fluids, controlling wellbore pressure, and enabling the extraction of hydrocarbons. As exploration activities focus on deep and ultra-deepwater reserves, the demand for advanced Marine Drilling Risers capable of withstanding the challenges of these environments is on the rise.A notable trend in the Marine Drilling Riser segment is the development and adoption of hybrid riser systems. Hybrid risers combine elements of different riser types, such as steel and flexible sections, to provide a more versatile solution. These hybrid systems aim to optimize the benefits of both steel and flexible risers, offering improved fatigue resistance, enhanced flexibility, and cost-effectiveness. As deepwater drilling projects become more prevalent, the versatility of hybrid riser systems makes them an attractive choice for offshore operators.

Application Insights

The Deep Water segment is projected to experience rapid growth during the forecast period. One of the primary drivers of the Deepwater segment is the presence of vast untapped hydrocarbon reserves in deepwater basins. As shallow-water reserves become depleted, the industry has shifted its focus to explore and exploit deepwater and ultra-deepwater reservoirs. Deepwater drilling offers the potential for significant discoveries, and the demand for specialized riser systems capable of operating in these challenging conditions has consequently surged.A notable trend in the Deepwater segment is the development and adoption of enhanced riser technologies. This includes the use of High-Pressure High-Temperature (HPHT) risers designed to withstand the extreme conditions encountered in deepwater drilling. Manufacturers are incorporating advanced materials, coatings, and innovative design features to improve the performance and longevity of riser systems in deepwater environments.

Regional Insights

North America emerged as the dominating region in 2023, holding the largest market share. The North American region, particularly the Gulf of Mexico, has been at the forefront of technological advancements in offshore drilling. The industry has developed extensive expertise in deepwater exploration and production, supported by a robust ecosystem of service providers, equipment manufacturers, and research institutions. This technological prowess has propelled the adoption of cutting-edge offshore drilling risers, with a focus on advanced materials, design innovations, and safety features.As offshore fields in North America mature, there is a growing focus on decommissioning activities. The retirement and removal of aging infrastructure, including riser systems, present opportunities for companies specialized in decommissioning services. The trend towards environmentally responsible decommissioning practices, which involve the safe removal and disposal of risers, is gaining prominence in the Global offshore drilling riser market.

The North American offshore drilling sector is witnessing a trend towards the digitalization of operations and the adoption of data analytics. Companies are leveraging advanced technologies, such as sensors and real-time monitoring systems, to collect and analyze data from drilling operations, including the performance of riser systems. This trend is driving the integration of digital solutions to enhance efficiency, reduce downtime, and optimize maintenance schedules for offshore drilling risers.

The North American segment of the global offshore drilling riser market is characterized by abundant offshore reserves, technological leadership, and the challenges associated with regulatory compliance and economic factors. Ongoing trends in decommissioning practices, digitalization, and data analytics are likely to shape the future landscape of the Global offshore drilling riser market as the industry navigates evolving market conditions and regulatory requirements.

Report Scope

In this report, the Global Offshore Drilling Riser Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Offshore Drilling Riser Market, By Type:

- Marine Drilling Riser

- Tie-back Drilling Riser

Offshore Drilling Riser Market, By Application:

- Shallow Water

- Deep Water

- Ultra Deep Water

Offshore Drilling Riser Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Netherlands

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Thailand

- Malaysia

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Offshore Drilling Riser Market.Available Customizations:

The analyst offers customization according to specific needs, along with the already-given market data of the Global Offshore Drilling Riser Market report.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Tenaris S.A

- Schlumberger NV

- Aker Solutions

- Parker Hannifin Corp

- Dril-Quip, Inc.

- Baker Hughes Co

- Claxton Engineering Services Limited

- Subsea 7, Inc.

- Weatherford International plc

- TechnipFMC plc

Table Information

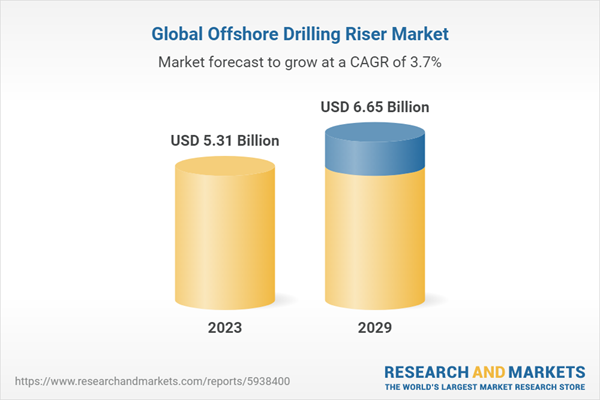

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | January 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 5.31 Billion |

| Forecasted Market Value ( USD | $ 6.65 Billion |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |