Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Innovations such as electric power steering (EPS) systems, known for energy efficiency and responsiveness, and steer-by-wire systems, enabling advanced driver-assistance and autonomous driving capabilities, are reshaping the industry. Government regulations mandating stricter safety and emission standards further propel the adoption of advanced steering technologies. With significant investments in R&D by major players and collaborations within the industry, the market is poised for continued expansion, driven by the need for safer, more efficient, and smarter vehicle systems.

In 2024, global automotive production forecasts reflect a mix of growth and challenges across regions. China's production outlook was raised by 409,000 units, driven by a recovery in sales supported by scrappage subsidies, with a 2.4% growth expected year-over-year. Japan's outlook for 2025 was upgraded by 39,000 units, led by strong momentum from Toyota, while South Korea's forecast for 2024 was cut by 12,000 units due to weaker domestic sales and exports. North America's production outlook remained steady, with Ford and Stellantis reducing their production by 45,000 and 48,000 units, respectively, due to inventory adjustments.

In South America, production was boosted by 23,000 units in 2024, particularly in Brazil and Argentina. However, South Asia saw a reduction of 63,000 units in 2024 due to production issues in the ASEAN market and high inventory levels in India. In Europe, new car registrations remained stable at 9.7 million units, though declines in France, Germany, and Italy were offset by a positive performance in Spain. The battery-electric and plug-in hybrid car markets saw slight declines in market share and volumes in November 2024, reflecting the ongoing challenges in the transition to electrified vehicles.

Key Market Drivers

Increasing Vehicle Production

The global automotive steering systems market is driven by the overall growth of the automotive industry. As the demand for vehicles continues to rise worldwide, there is a corresponding increase in the production of vehicles. This, in turn, drives the demand for steering systems, as every vehicle requires a steering system for maneuverability and control.Technological Advancements

The automotive steering systems market is influenced by continuous technological advancements. Manufacturers are constantly developing innovative steering technologies to enhance vehicle safety, improve fuel efficiency, and provide a better driving experience. Electric power steering (EPS) systems, for example, have gained popularity due to their energy efficiency and improved responsiveness compared to traditional hydraulic power steering systems.Government Regulations

Government regulations and initiatives play a significant role in shaping the global automotive steering systems market. Governments around the world are implementing stricter safety and emission standards, which drive the adoption of advanced steering technologies. For instance, regulations mandating the use of electric power steering systems to improve fuel efficiency and reduce emissions have influenced the market dynamics.Key Market Challenges

Cost Pressure

One of the major challenges in the global automotive steering systems market is cost pressure. Manufacturers face the challenge of developing and producing steering systems that meet the increasing demands for advanced features while keeping the costs competitive. The integration of new technologies and materials can drive up the production costs, making it challenging for manufacturers to strike a balance between innovation and affordability.Technological Complexity

The rapid advancement of steering system technologies introduces complexity in design, development, and manufacturing processes. Integrating advanced features such as electric power steering, steer-by-wire systems, and autonomous driving capabilities requires sophisticated engineering and software expertise. Managing the complexity of these technologies and ensuring their reliability and compatibility with other vehicle systems can be a significant challenge for manufacturers.Safety and Reliability

Steering systems are critical components for vehicle safety and reliability. Any failure or malfunction in the steering system can have severe consequences. Manufacturers face the challenge of ensuring the safety and reliability of steering systems by conducting rigorous testing, adhering to strict quality standards, and addressing potential vulnerabilities. Meeting safety regulations and customer expectations for robust and dependable steering systems is a constant challenge.Key Market Trends

Electric Power Steering (EPS) Dominance

Electric power steering (EPS) systems continue to dominate the global automotive steering systems market. EPS systems offer advantages such as improved fuel efficiency, reduced weight, and enhanced responsiveness compared to traditional hydraulic power steering systems. The trend towards EPS is driven by the increasing demand for fuel-efficient vehicles and the integration of advanced driver-assistance systems (ADAS) that rely on electric steering control.Steer-by-Wire Systems

Steer-by-wire systems are gaining traction in the automotive steering systems market. These systems eliminate the mechanical connection between the steering wheel and the wheels, replacing it with electronic controls. Steer-by-wire systems offer benefits such as increased design flexibility, reduced weight, and the potential for advanced autonomous driving capabilities. As the automotive industry moves towards autonomous vehicles, steer-by-wire systems are expected to play a significant role in enabling advanced driver-assistance features.Integration of Advanced Driver-Assistance Systems (ADAS)

The integration of advanced driver-assistance systems (ADAS) with steering systems is a prominent trend in the automotive industry. Steering systems are being equipped with features such as lane-keeping assist, adaptive cruise control, and automated parking. These technologies enhance vehicle safety, improve driving comfort, and pave the way for autonomous driving. The demand for steering systems that seamlessly integrate with ADAS is expected to grow as ADAS adoption increases.Segmental Insights

Sales Channel Insights

The Original Equipment Manufacturer (OEM) segment dominated the automotive steering systems market due to its integral role in producing advanced and reliable steering components that meet stringent industry standards. OEMs are closely linked with vehicle manufacturers, allowing them to align their steering systems with the specific design, performance, and safety requirements of vehicles. This close collaboration ensures seamless integration of steering systems into the overall vehicle architecture, enhancing efficiency and reducing compatibility issues.One of the primary reasons for OEM dominance is the growing preference for technologically advanced steering systems such as Electric Power Steering (EPS) and steer-by-wire. These systems require high levels of precision, quality, and reliability, which OEMs are well-equipped to deliver. OEMs also benefit from economies of scale, enabling cost-efficient production of high-quality steering systems for mass-market vehicles. Additionally, their strong research and development capabilities allow them to innovate continuously, offering cutting-edge solutions that meet evolving consumer demands for safety, fuel efficiency, and driving comfort.

OEMs also maintain a competitive edge due to their ability to comply with government regulations and industry standards. As global safety and emission norms become more stringent, automakers increasingly rely on OEMs to provide steering systems that meet these requirements. Furthermore, the long-term partnerships between OEMs and automakers ensure sustained demand, reinforcing their market leadership. The trust, brand reputation, and technological expertise associated with OEM products contribute significantly to their dominant position in the automotive steering systems market.

Regional Insights

Asia-Pacific dominated the automotive steering systems market due to its strong position as a global hub for automotive production and sales. Countries like China, India, Japan, and South Korea are home to some of the largest automobile manufacturers and suppliers, driving the demand for advanced steering systems. The region benefits from high vehicle production volumes, supported by robust industrial infrastructure and cost-efficient manufacturing processes, making it a preferred choice for automakers and component suppliers.The growing middle-class population and rising disposable incomes in emerging economies such as China and India have significantly boosted vehicle ownership, further driving the demand for steering systems. Additionally, the shift toward electric vehicles (EVs) in these markets has accelerated the adoption of advanced steering technologies like Electric Power Steering (EPS), which align with the sustainability goals of the automotive industry.

Government regulations in the Asia-Pacific region also play a vital role in shaping the market. Policies promoting road safety, fuel efficiency, and emissions control are encouraging the adoption of innovative steering systems. For instance, governments in the region are incentivizing the use of EPS to reduce fuel consumption and improve vehicle performance.

Moreover, Asia-Pacific benefits from a highly competitive and rapidly evolving automotive supply chain. The presence of global and regional steering system manufacturers fosters innovation and ensures the availability of cost-effective solutions. These factors, combined with a rapidly growing automotive sector, position Asia-Pacific as the leading region in the global automotive steering systems market. For Instance, According to ACEA (Association des Constructeurs Européens d’Automobiles), China was the third-largest market for EU vehicle exports by value in 2023, following the US (first) and the UK (second).

In 2023, the EU imported 438,034 battery-electric cars from China, worth EUR 9.7 billion. During the same period, the EU exported 11,499 battery-electric cars to China, valued at EUR 852.3 million. The share of Chinese-made cars in EU battery-electric sales has increased significantly, rising from approximately 3% to over 20% in the last three years. Chinese brands now account for around 8% of this market share.

Key Market Players

- ZF Friedrichshafen AG

- Mitsubishi Electric Corporation

- HL Mando Corp.

- JTEKT Corporation

- Nexteer Automotive Corporation

- thyssenkrupp AG

- Robert Bosch GmbH

- Hitachi Astemo, Ltd.

- Magna International Inc.

- Aisin Seiki Co., Ltd.

Report Scope:

In this report, the Global Automotive Steering Systems Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Automotive Steering Systems Market, By Steering System:

- Manual

- Electrically Powered

- Electro-Hydraulic Powered

- Hydraulic Powered

Automotive Steering Systems Market, By Component:

- Hydraulic Pump

- Steering Sensor & Column

- Electric Motor

- Others

Automotive Steering Systems Market, By Sales Channel:

- OEM

- Aftermarket

Automotive Steering Systems Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe & CIS

- France

- Germany

- Spain

- Italy

- United Kingdom

- Asia-Pacific

- China

- Japan

- India

- Vietnam

- South Korea

- Thailand

- Australia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- South America

- Brazil

- Argentina

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Steering Systems Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ZF Friedrichshafen AG

- Mitsubishi Electric Corporation

- HL Mando Corp.

- JTEKT Corporation

- Nexteer Automotive Corporation

- thyssenkrupp AG

- Robert Bosch GmbH

- Hitachi Astemo, Ltd.

- Magna International Inc.

- Aisin Seiki Co., Ltd.

Table Information

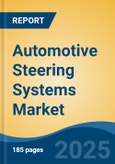

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2025 |

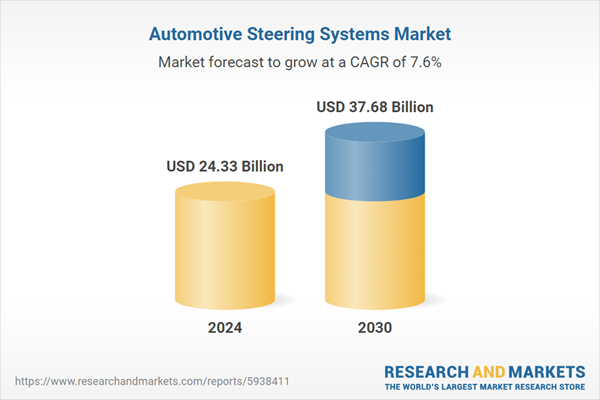

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 24.33 Billion |

| Forecasted Market Value ( USD | $ 37.68 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |