Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The global homeowners insurance carriers market encompasses a dynamic landscape shaped by factors such as increasing property values, evolving consumer needs, and the impact of natural disasters. Home insurance carriers operate in a competitive environment, constantly adapting to market trends and leveraging technological advancements to stay relevant.

Rising property values worldwide have intensified the demand for homeowners insurance, as individuals seek to protect their valuable assets. This has led to increased competition among insurance carriers, prompting them to offer innovative products and services. In addition, the market is influenced by the frequency and severity of natural disasters, with carriers adjusting their underwriting strategies to manage associated risks effectively.

Technological innovation plays a crucial role in the industry's evolution. Home insurance carriers are leveraging advancements such as artificial intelligence, data analytics, and smart home technologies to enhance customer experience, streamline operations, and assess risks more accurately. Personalization of coverage has become a focal point, with carriers tailoring policies to individual needs and preferences.

The global homeowners insurance carriers market is characterized by strategic partnerships, mergers, and acquisitions as companies aim to expand their market share and diversify their offerings. These market dynamics create a landscape where adaptability, customer-centric approaches, and risk management strategies are paramount for success in an ever-changing environment. As homeowners seek comprehensive coverage and seamless digital experiences, insurance carriers continue to navigate challenges and opportunities to meet the evolving demands of the global market.

Key Market Drivers

Increasing Property Values

One of the primary drivers of the homeowners insurance market is the continuous rise in property values globally. As residential real estate becomes more valuable, homeowners are increasingly inclined to protect their significant investment through insurance coverage. Higher property values not only contribute to the expansion of the market but also impact the overall coverage limits and premiums. Insurers must assess and underwrite policies based on the current and anticipated values of insured properties, making accurate valuation a critical aspect of risk management.Natural Disasters and Climate Change

The frequency and severity of natural disasters, exacerbated by climate change, significantly impact the homeowners insurance market. Events such as hurricanes, floods, wildfires, and earthquakes pose substantial risks to properties, necessitating comprehensive insurance coverage. Insurance carriers must continually assess and adjust their risk models to account for the changing patterns of natural disasters. Additionally, the increasing occurrence of extreme weather events may lead to higher claims payouts, affecting the profitability and sustainability of insurance companies. As a result, carriers need to employ advanced risk modeling and predictive analytics to better understand and mitigate the impact of climate-related risks on their portfolios.Technological Innovation

Rapid technological advancements play a pivotal role in shaping the homeowners insurance market. Insurers are leveraging technologies such as artificial intelligence (AI), machine learning, data analytics, and the Internet of Things (IoT) to enhance various aspects of their operations. For instance, AI-driven underwriting algorithms help assess risks more accurately, while IoT devices like smart home sensors enable insurers to monitor and prevent potential damages, reducing the frequency and severity of claims. Digital platforms also improve customer interactions, making it easier for homeowners to purchase policies, submit claims, and access information. Insurtech startups, focusing on disruptive technologies, are challenging traditional models and pushing established carriers to innovate to stay competitive.Personalization of Coverage

The growing demand for personalized insurance coverage is reshaping the homeowners insurance market. Homeowners seek tailored policies that align with their specific needs and preferences. Insurers are responding by offering customizable coverage options, allowing policyholders to select features that address their unique risks and circumstances. This shift towards personalized coverage reflects a broader trend in the insurance industry, emphasizing customer-centric approaches. Carriers that can effectively balance customization with risk management will likely gain a competitive edge, as consumers increasingly value policies that align with their individual lifestyles and requirements.Regulatory Environment and Compliance

The homeowners insurance market is heavily influenced by regulatory frameworks that vary across jurisdictions. Governments enact and modify regulations to ensure fair practices, protect consumers, and maintain the stability of the insurance industry. Compliance with these regulations is a critical driver for insurance carriers, impacting their operations, product offerings, and financial stability. Changes in regulatory requirements can affect pricing structures, coverage options, and underwriting practices, necessitating adaptability on the part of insurance companies. Additionally, regulatory scrutiny may increase in response to emerging risks, such as those related to climate change and cybersecurity, requiring insurers to stay abreast of evolving compliance standards.Key Market Challenges

Increasing Frequency and Severity of Natural Disasters

One of the foremost challenges for homeowners insurance carriers is the escalating frequency and severity of natural disasters. Climate change has led to a rise in extreme weather events, including hurricanes, floods, wildfires, and earthquakes. These events pose significant risks to properties, resulting in higher claims payouts for insurers. The unpredictability and intensity of natural disasters make it challenging for insurance companies to accurately assess and manage their exposure to these risks.To address this challenge, insurers must continually update and enhance their risk models. Advanced data analytics, satellite imagery, and climate modeling tools can aid in predicting and understanding the potential impact of natural disasters. Additionally, fostering collaboration with scientific and environmental organizations can contribute to more accurate risk assessments. However, despite these efforts, the increasing severity of climate-related risks may necessitate a reevaluation of traditional insurance models, requiring innovative approaches to ensure the long-term sustainability of the industry.

Technological Disruption and Cybersecurity Risks

The rapid pace of technological innovation presents both opportunities and challenges for homeowners insurance carriers. While technologies such as artificial intelligence and the Internet of Things can enhance risk assessment and customer engagement, they also introduce new vulnerabilities. The integration of smart home devices and reliance on digital platforms expose insurers to cybersecurity risks, including data breaches and privacy concerns.Insurers must invest in robust cybersecurity measures to protect sensitive customer data and maintain trust in the digital ecosystem. Implementing encryption protocols, regularly updating security systems, and collaborating with cybersecurity experts are essential steps in mitigating these risks. Moreover, as technology continues to evolve, insurance companies need to stay ahead of potential threats by adopting proactive cybersecurity strategies and ensuring compliance with data protection regulations.

Changing Demographics and Socioeconomic Trends

Demographic shifts and socioeconomic trends pose challenges for homeowners insurance carriers as they strive to understand and adapt to evolving customer needs. Changes in homeownership patterns, such as an increasing preference for renting over owning, can impact the demand for insurance products. Additionally, an aging population may require different types of coverage and services, while younger generations may prioritize flexible and digital insurance solutions.To address these challenges, insurers must engage in market research to anticipate demographic shifts and tailor their products accordingly. Offering flexible policy options, leveraging digital channels for customer outreach, and providing education on the importance of insurance in various life stages are strategies to capture a diverse customer base. Adapting underwriting criteria to reflect changing socioeconomic realities and exploring partnerships with emerging demographic segments can position insurers to navigate the complexities associated with shifting demographics.

Regulatory Complexity and Compliance

The homeowners insurance industry operates within a complex regulatory environment characterized by variations across jurisdictions. Compliance with diverse and evolving regulations is a considerable challenge for insurance carriers, impacting their product development, pricing strategies, and overall business operations. Regulatory changes, particularly in response to emerging risks such as climate change or cybersecurity threats, can require significant adjustments and resource allocation.To address regulatory challenges, insurance carriers must establish robust compliance frameworks. This involves staying informed about regulatory updates, engaging in proactive dialogue with regulatory bodies, and investing in technologies that facilitate adherence to compliance standards. Collaborating with industry associations and participating in advocacy efforts can also influence regulatory developments in ways that align with the interests of insurers. Developing a nimble and adaptable organizational culture is essential to respond effectively to changes in the regulatory landscape.

Key Market Trends

Digital Transformation and Insurtech Integration

Digital transformation is a pervasive trend in the insurance industry, with homeowners insurance carriers embracing technology to streamline operations, enhance customer experiences, and improve risk assessment. Insurtech (insurance technology) is playing a crucial role in this transformation. Companies are integrating artificial intelligence, machine learning, and data analytics into their processes to automate underwriting, claims processing, and risk modeling.Digital platforms are becoming the primary interface for customers, offering easy access to policy information, claims filing, and communication with insurers. Insurtech startups are challenging traditional models by introducing innovative products and services, fostering increased competition and pushing established carriers to adapt. As the digital landscape evolves, homeowners insurance carriers must continue investing in technology to stay competitive, ensuring they provide seamless, user-friendly experiences while leveraging data-driven insights for improved risk management.

Personalization and Customization of Policies

A growing trend in the homeowners insurance market is the increasing demand for personalized and customizable insurance policies. Homeowners are seeking coverage that aligns with their specific needs, lifestyles, and preferences. Insurers are responding by offering flexible policy options, allowing customers to tailor their coverage based on individual circumstances.Personalization goes beyond coverage amounts; it extends to the use of data and technology to better understand individual risks. Insurers are leveraging data from smart home devices, IoT sensors, and other sources to assess risks more accurately. This trend reflects a broader shift in the insurance industry toward customer-centricity, where insurers aim to build long-term relationships by providing tailored solutions that meet the unique requirements of each policyholder.

Climate Risk Awareness and Mitigation

The increasing frequency and severity of natural disasters have elevated climate-related risks to the forefront of homeowners insurance considerations. Insurers are recognizing the importance of understanding and mitigating climate risks to ensure the long-term sustainability of their portfolios. This involves advanced risk modeling to assess the potential impact of climate change on insured properties, enabling carriers to make informed underwriting decisions.Some insurance companies are incentivizing homeowners to adopt risk-mitigation measures, such as installing resilient building materials or implementing landscaping practices that reduce the risk of wildfires. Collaborations with climate scientists and environmental organizations are becoming more common to enhance risk assessment capabilities. Addressing climate risks not only protects insurers from increased claims but also contributes to broader sustainability goals, aligning with societal expectations for responsible corporate behavior.

Usage-Based Insurance and IoT Integration

The integration of the Internet of Things (IoT) into homeowners insurance is driving the adoption of usage-based insurance models. IoT devices, such as smart home sensors and security systems, provide real-time data on property conditions. Insurers can use this data to offer more dynamic and personalized coverage, adjusting premiums based on actual risk exposures and homeowners' behavior.Usage-based insurance promotes risk mitigation, as homeowners actively engage in measures to enhance the security and safety of their homes. This trend not only benefits policyholders by potentially lowering premiums but also enables insurers to better understand and manage risks. As IoT technology continues to advance, homeowners insurance carriers are likely to explore new ways to leverage data for improved risk assessment and the development of innovative insurance products.

Evolving Demographics and Lifestyle Changes

Changing demographics and evolving lifestyle preferences are influencing the types of coverage homeowners seek. An increasing number of individuals are opting for non-traditional living arrangements, such as renting or co-living spaces, impacting the demand for homeowners insurance. Insurers are adapting by offering flexible policies that cater to diverse living situations and demographic segments.Additionally, the rise of remote work and the gig economy is influencing insurance needs. Homeowners may now use their residences for work, creating new considerations for coverage related to home offices and business equipment. As demographic and lifestyle trends continue to shift, homeowners insurance carriers must remain agile, adjusting their product offerings to align with the changing needs of a dynamic customer base.

Regulatory Focus on Consumer Protection and Data Privacy

Regulatory frameworks are evolving to address emerging challenges in the homeowners insurance market, particularly concerning consumer protection and data privacy. As the industry becomes more digitally oriented, regulators are scrutinizing how insurers collect, use, and protect customer data. Compliance with data protection regulations, such as the General Data Protection Regulation (GDPR) and similar legislation worldwide, is becoming a key consideration for homeowners insurance carriers.Regulatory bodies are also emphasizing transparency and fairness in policy terms and pricing. Insurers need to ensure that their digital platforms are compliant with evolving regulations and that their data practices prioritize customer privacy. Proactive engagement with regulatory bodies and ongoing monitoring of legislative changes are essential for homeowners insurance carriers to navigate this evolving landscape successfully.

Segmental Insights

Type Insights

The homeowners insurance market is experiencing significant growth, driven by a confluence of key trends that are reshaping the industry landscape. As digitization takes center stage, homeowners insurance carriers are undergoing a fundamental transformation, embracing innovative technologies and insurtech solutions. The integration of artificial intelligence, data analytics, and the Internet of Things is streamlining processes, enhancing risk assessment, and providing a more personalized customer experience.Consumers' increasing desire for tailored insurance solutions has given rise to a growing segment within the market. This demand for customization is met through flexible policy options, allowing homeowners to align coverage with their specific needs and preferences. Additionally, the industry's heightened focus on climate risk awareness and mitigation reflects a commitment to sustainability and responsible risk management.

Moreover, the incorporation of IoT devices and usage-based insurance models represents a paradigm shift, where real-time data from smart home sensors enables dynamic and responsive coverage. These transformative trends, coupled with an evolving understanding of demographic shifts and lifestyle changes, position the homeowners insurance market as a dynamic and expanding segment. Insurers that adeptly navigate these developments are well-positioned to cater to the evolving needs of homeowners and capitalize on the growth opportunities presented by this dynamic market segment.

Source Insights

The role of independent insurance agents is emerging as a growing and influential segment within the homeowners insurance market. These agents, unaffiliated with a specific insurance carrier, provide consumers with a diverse range of policy options from various providers. This approach resonates with homeowners seeking unbiased advice and a personalized approach to their insurance needs.Independent agents are gaining prominence due to their ability to offer tailored solutions that cater to the unique circumstances of individual homeowners. Their expertise and independence allow them to navigate the complexities of the insurance landscape, ensuring that clients receive the most suitable coverage at competitive rates. In an era where personalization is paramount, independent agents provide a valuable service by aligning policies with the diverse needs and preferences of homeowners.

Furthermore, the growth of the independent agent segment is fueled by a desire for a more consultative and relationship-driven approach to insurance. Homeowners appreciate the guidance and advocacy that independent agents offer throughout the insurance process, from policy selection to claims assistance. As this segment continues to expand, independent agents are poised to play a pivotal role in shaping the future of homeowners insurance, emphasizing customer-centric practices and fostering long-term client relationships.

Regional Insights

The North American homeowners insurance market stands as a robust and growing segment, marked by various trends shaping its trajectory. With a dynamic blend of economic prosperity, technological innovation, and evolving consumer demands, North America's homeowners insurance sector is undergoing significant transformations.Rising property values, particularly in urban centers and desirable suburban areas, have spurred an increased demand for homeowners insurance coverage across the continent. This growth is further propelled by a heightened awareness of climate-related risks, as North America grapples with the increasing frequency and severity of natural disasters such as hurricanes, floods, and wildfires. Insurance carriers in the region are adapting by integrating advanced risk modeling and data analytics to better understand and mitigate these evolving risks.

Moreover, the North American market is witnessing a surge in technological adoption, with insurers leveraging digital platforms, artificial intelligence, and IoT devices to enhance customer experiences and streamline operations. The emphasis on personalization and customization of insurance policies resonates strongly with homeowners in the region, reflecting a broader trend toward consumer-centric insurance solutions.

As homeowners in North America seek comprehensive coverage that aligns with their individual needs and preferences, the market continues to evolve, presenting opportunities for insurers to innovate and tailor their offerings. With a confluence of factors driving growth, the North American homeowners insurance segment is poised for continued expansion and adaptation to the changing dynamics of the insurance landscape.

Report Scope

In this report, the Global Homeowners Insurance Carriers market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Homeowners Insurance Carriers Market, By Type:

- Basic Form

- Broad Form

- Special Form

- Others

Homeowners Insurance Carriers Market, By Source:

- Captive

- Independent Agent

- Others

Homeowners Insurance Carriers Market, By Application:

- Enterprise

- Personal

Homeowners Insurance Carriers Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the global Homeowners Insurance Carriers market.Available Customizations:

The analyst offers customization according to specific needs, along with the already-given market data of the Global Homeowners Insurance Carriers Market report.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Admiral Group PLC

- Allianz Australia Limited

- American International Group Inc.

- Amica Mutual Insurance Company

- United Services Automobile Association

- Chubb Limited

- Erie Insurance Exchange

- State Farm Mutual Automobile Insurance Company

- Liberty Mutual Insurance Group

- Government Employees Insurance Company

Table Information

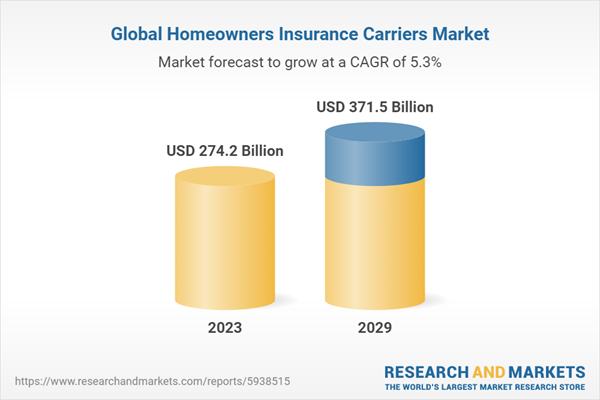

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | January 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 274.2 Billion |

| Forecasted Market Value ( USD | $ 371.5 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |