Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The global business travel accident insurance market is experiencing notable growth as businesses recognize the importance of protecting their employees during international and domestic travel. With the increasing globalization of businesses and the rise in corporate travel, companies are becoming more aware of the potential risks and liabilities associated with employee mobility.

Business travel accident insurance provides coverage for unforeseen events such as accidents, medical emergencies, and even death that may occur while an employee is on a business trip. This insurance is designed to alleviate financial burdens on both the employee and the employer, offering a range of benefits such as medical expense coverage, emergency evacuation, and accidental death and dismemberment benefits.

Factors driving the expansion of this market include the growing frequency of business travel, the rising awareness of duty of care towards employees, and the need for companies to mitigate potential legal and financial consequences. As competition intensifies, insurance providers are developing innovative and customizable policies to cater to diverse corporate needs.

Additionally, the COVID-19 pandemic has underscored the importance of travel insurance, with an increased focus on health and safety. Companies are now seeking comprehensive coverage that includes protection against pandemics and other health-related risks, further shaping the evolution of the business travel accident insurance market. Overall, the market is poised for sustained growth as businesses prioritize employee well-being and risk management in an ever-changing global business landscape.

Key Market Drivers

Increasing Corporate Travel

One of the primary drivers of the business travel accident insurance market's growth is the surge in corporate travel. Globalization has led to businesses expanding their operations internationally, necessitating frequent travel for employees. Whether it's attending conferences, meeting clients, or exploring new markets, business travel has become an integral part of corporate operations. As the number of business trips rises, so does the awareness among companies about the potential risks employees face during these journeys.Rising Awareness of Duty of Care

The duty of care concept has gained prominence as organizations acknowledge their responsibility to ensure the safety and well-being of their employees. In this context, business travel accident insurance plays a crucial role. Companies are increasingly recognizing the moral and legal imperative to protect employees during work-related travel. Providing comprehensive insurance coverage not only safeguards the workforce but also contributes to the overall corporate reputation and employee satisfaction. As duty of care becomes a central concern for businesses, the demand for robust travel insurance solutions continues to grow.Mitigating Legal and Financial Consequences

The potential legal and financial consequences of accidents or emergencies during business travel are substantial. Without adequate insurance coverage, companies may find themselves exposed to litigation, compensation claims, and reputational damage. Business travel accident insurance acts as a risk mitigation tool, offering financial protection in the form of medical expense coverage, emergency evacuation, and accidental death benefits. This proactive approach helps companies avoid the financial fallout associated with unforeseen events during business trips, contributing to the market's sustained growth.Evolving Regulatory Landscape

The regulatory landscape governing international business travel is dynamic, with governments and regulatory bodies implementing measures to enhance safety and security for travelers. Compliance with these regulations often involves demonstrating a commitment to employee well-being, including the provision of adequate insurance coverage. As regulations evolve, businesses are compelled to revisit and reinforce their travel risk management strategies. This has led to a growing demand for business travel accident insurance that not only meets current regulatory requirements but also anticipates future changes in the regulatory environment.COVID-19 Pandemic's Impact and Focus on Health and Safety

The COVID-19 pandemic has had a profound impact on the business travel landscape. The heightened awareness of health and safety risks has led to a paradigm shift in how companies approach employee travel. Business travel accident insurance has adapted to include coverage for pandemic-related risks, such as medical expenses related to COVID-19, quarantine costs, and trip cancellations due to pandemics. The pandemic has reinforced the importance of having comprehensive insurance coverage that addresses not only traditional risks but also emerging threats to employee health and safety.As businesses navigate the complexities of the post-pandemic world, the demand for insurance products that offer holistic coverage has increased. Companies are now seeking policies that provide a comprehensive safety net, covering a spectrum of risks from accidents and medical emergencies to pandemic-related disruptions. This expanded scope of coverage reflects a broader trend in the market towards offering more inclusive and adaptable insurance solutions.

Key Market Challenges

Complexity and Customization

The complexity of business travel and the diverse needs of different organizations pose a considerable challenge for insurance providers. Businesses vary widely in their operations, industries, and the nature of their travel requirements. As a result, creating standardized insurance solutions that cater to the unique needs of each client can be challenging.Moreover, the demand for customization is on the rise. Businesses are seeking tailored insurance plans that address specific risks associated with their industry, the regions they operate in, and the profiles of their traveling employees. Balancing the need for comprehensive coverage with the intricacies of customization requires insurance providers to invest in robust underwriting processes, advanced risk modeling, and flexible policy structures.

Navigating this challenge involves striking a delicate balance between offering comprehensive coverage and tailoring plans to meet the specific demands of diverse businesses. It requires insurance providers to stay agile and innovative in their approach, utilizing technology to streamline customization processes and provide clients with the flexibility they seek.

Rapidly Changing Risk Landscape

The risk landscape for business travel is dynamic and constantly evolving. Emerging risks, geopolitical uncertainties, and global health crises, as demonstrated by the COVID-19 pandemic, underscore the need for insurance solutions that can adapt to unforeseen challenges. The rapid pace of change in the business environment, including technological advancements and shifts in global politics, adds another layer of complexity.Insurance providers must stay ahead of these changes to offer relevant and effective coverage. Anticipating and modeling new risks requires a proactive and data-driven approach. As the nature of business travel continues to evolve, with employees embarking on different types of trips and facing diverse risks, insurers need to invest in research and development to identify and address emerging challenges.

The challenge lies in not only keeping pace with the evolving risk landscape but also in developing insurance products that provide forward-looking coverage. This demands a collaborative effort between insurers, risk management experts, and businesses to ensure that insurance policies remain adaptive and resilient in the face of the ever-changing global business environment.

Lack of Employee Awareness and Engagement

Despite the importance of business travel accident insurance, there is often a lack of awareness among employees about the coverage available to them. Many travelers may not fully understand the scope of their insurance policies, the procedures for filing claims, or the specific benefits they are entitled to in case of an emergency. This lack of awareness can result in delays in seeking medical assistance, confusion during emergencies, and underutilization of the insurance coverage.Addressing this challenge requires a concerted effort from both employers and insurers. Companies need to prioritize employee education about the importance of travel insurance, the details of their coverage, and the steps to take in case of an emergency. Employers can enhance engagement by conducting regular training sessions, disseminating informative materials, and utilizing digital platforms to communicate important information to their traveling workforce.

Insurers, on the other hand, can play a role in simplifying policy documents, providing user-friendly platforms for accessing information, and offering robust customer support services. Improving employee awareness and engagement not only enhances the value of insurance coverage but also contributes to a smoother claims process and overall satisfaction among the insured.

Cost Management and Affordability

As businesses face economic uncertainties and budget constraints, cost management becomes a critical consideration in purchasing insurance coverage. The challenge is to strike a balance between providing comprehensive protection for employees and managing the associated costs. Insurance premiums, especially for policies with extensive coverage, can be a significant expense for companies with large traveling workforces.Insurers must work collaboratively with businesses to find cost-effective solutions without compromising the quality of coverage. This may involve conducting thorough risk assessments, implementing risk mitigation strategies, and exploring innovative pricing models. Additionally, insurers can offer tiered coverage options that allow businesses to choose plans based on their specific risk profiles and budget constraints.

Addressing the challenge of cost management requires open communication between insurers and businesses to ensure that insurance solutions are not only affordable but also aligned with the financial objectives of the organizations. It also involves exploring technological solutions, such as data analytics, to optimize risk assessments and pricing strategies.

Key Market Trends

Integration of Technology for Enhanced Services

The integration of technology is revolutionizing the way business travel accident insurance is offered and experienced. Insurers are leveraging cutting-edge technologies such as artificial intelligence (AI), data analytics, and mobile applications to streamline processes, enhance customer experiences, and provide real-time support during emergencies.AI-driven chatbots and virtual assistants are being used to handle routine inquiries, allowing insurers to focus on complex customer needs. Mobile apps enable travelers to access policy information, file claims, and receive assistance on the go. Additionally, data analytics is playing a crucial role in risk assessment, helping insurers better understand the travel patterns of employees and tailor coverage accordingly.

As technology continues to advance, we can expect further integration of innovative solutions, including wearable devices for real-time health monitoring, geolocation services for enhanced travel safety, and blockchain for secure and transparent claims processing.

Pandemic-Related Coverage and Health Security

The COVID-19 pandemic has significantly impacted the business travel landscape, prompting a fundamental shift in the way insurers approach coverage. Health security has become a central focus, and businesses are increasingly seeking insurance policies that provide comprehensive coverage for pandemic-related risks.Insurers are adapting policies to include coverage for medical expenses related to COVID-19, quarantine costs, and trip cancellations due to pandemic-related disruptions. The pandemic has underscored the importance of health protection for travelers, and this trend is likely to persist as businesses prioritize the well-being of their employees.

Beyond the current pandemic, the experience gained is influencing the development of insurance products that address a broader range of health-related risks, ensuring that coverage remains relevant in an increasingly health-conscious business environment.

Personalized and Flexible Coverage Options

The one-size-fits-all approach to insurance is giving way to a more personalized and flexible model. Businesses are seeking insurance solutions that can be tailored to the specific needs of their workforce, considering factors such as the nature of travel, destinations, and employee profiles.Insurers are responding by offering modular and customizable coverage options. This allows businesses to choose the level of coverage that aligns with their risk tolerance and the needs of their employees. Whether it's adjusting coverage for specific regions, including additional benefits, or tailoring policies for different employee roles, the trend towards personalized and flexible coverage is gaining traction.

This shift not only enhances the value of insurance for businesses but also fosters a collaborative relationship between insurers and clients, ensuring that coverage remains relevant in the face of changing business dynamics.

Sustainability and Environmental Considerations

Sustainability is becoming a key consideration for businesses across various sectors, and the travel industry is no exception. As corporate responsibility takes center stage, businesses are looking for insurance providers that align with their commitment to environmental sustainability.Insurers are responding by incorporating sustainability initiatives into their offerings. This may include coverage for carbon offset programs, eco-friendly travel options, and support for environmentally responsible practices. The aim is to provide businesses with insurance solutions that not only protect employees but also contribute to broader sustainability goals.

The focus on sustainability is likely to grow, with businesses seeking insurance partners that share their values and actively contribute to minimizing the environmental impact of business travel.

Remote Work and Flexible Policies

The rise of remote work and flexible work arrangements is influencing the business travel landscape. As businesses embrace virtual collaboration tools and remote work becomes more prevalent, the nature and frequency of business travel are evolving.Insurers are adapting by offering policies that reflect the changing dynamics of work-related travel. This includes coverage for virtual meetings, extended periods of remote work, and flexibility in policy terms to accommodate the shifting needs of businesses.

The challenge lies in accurately assessing and managing risks associated with a more dynamic and dispersed workforce. Insurers are exploring innovative approaches to underwriting that consider the evolving nature of work, ensuring that coverage remains relevant and effective in a world where traditional boundaries between office and home are increasingly blurred.

Cybersecurity Coverage for Digital Risks

As businesses become more digitally interconnected, the risks associated with cyber threats during travel have gained prominence. The trend towards remote work and reliance on digital platforms for communication and collaboration has heightened the vulnerability of employees to cyber risks while on business trips.Insurers are responding by integrating cybersecurity coverage into business travel accident insurance policies. This includes protection against cyberattacks, data breaches, and other digital risks that employees may encounter during their travels. Businesses are recognizing the need for comprehensive coverage that extends beyond traditional risks to encompass the evolving landscape of cybersecurity threats.

This trend reflects the growing awareness of the interconnected nature of risks in the modern business environment. As businesses prioritize digital security, the integration of cybersecurity coverage into business travel accident insurance is likely to become a standard feature, ensuring that employees are protected in an increasingly digital and interconnected world.

Segmental Insights

Type Insights

Annual multi-trip coverage has emerged as a rapidly growing segment in the business travel accident insurance market, reflecting the evolving needs of businesses and frequent travelers. This type of coverage is designed to provide a cost-effective and convenient solution for organizations with employees engaged in multiple trips throughout the year.Businesses are increasingly recognizing the practicality of annual multi-trip coverage, as it eliminates the need to purchase separate policies for each journey. This not only streamlines administrative processes but also offers potential cost savings. The flexibility of this coverage accommodates the dynamic nature of modern business, where employees engage in various trips, meetings, and conferences regularly.

Moreover, annual multi-trip coverage provides a continuous safety net for employees, ensuring they are protected throughout the year without the hassle of securing insurance for every individual trip. This simplicity and efficiency contribute to the rising popularity of this insurance segment.

Insurers are responding to this trend by enhancing annual multi-trip policies to include comprehensive coverage options, such as pandemic-related protection, flexible terms, and additional benefits tailored to frequent business travelers. As businesses increasingly prioritize efficiency and comprehensive protection for their mobile workforce, the annual multi-trip coverage segment is poised for sustained growth in the evolving landscape of business travel accident insurance.

Distribution Channel Insights

The role of insurance companies within the business travel accident insurance market is rapidly evolving, presenting a growing segment that is integral to meeting the diverse needs of businesses and their traveling employees. As the demand for comprehensive coverage intensifies, insurance companies are playing a pivotal role in shaping innovative solutions that address the complexities of the modern business travel landscape.Insurance providers are leveraging technology to streamline processes, enhance customer experiences, and facilitate real-time support during emergencies. The integration of artificial intelligence, data analytics, and mobile applications has enabled insurers to offer more personalized and flexible coverage options. This includes tailoring policies to meet the specific needs of businesses, such as customizable coverage for different industries, regions, and employee profiles.

Furthermore, insurance companies are actively responding to the heightened focus on health security, incorporating pandemic-related coverage into their offerings. This adaptability demonstrates a commitment to meeting the evolving demands of businesses in the post-COVID-19 era.

As sustainability becomes a prominent consideration for businesses, insurance companies are also exploring ways to align with corporate responsibility initiatives. This involves integrating sustainability practices into insurance products, such as coverage for carbon offset programs and support for eco-friendly travel options.

In conclusion, the growing segment of insurance companies within the business travel accident insurance market is characterized by technological innovation, customization, and responsiveness to emerging trends. These companies are not only meeting the current demands of businesses but are also actively shaping the future of comprehensive and adaptive coverage for the mobile workforce.

Regional Insights

Europe is emerging as a dynamic and growing segment within the business travel accident insurance market, reflecting the region's increasing focus on comprehensive coverage for corporate travelers. With the resurgence of business activities and a thriving corporate environment, European businesses are recognizing the importance of safeguarding their employees during both domestic and international travel.The demand for business travel accident insurance in Europe is being fueled by the continent's economic interconnectedness and the rising frequency of corporate travel. As businesses expand their operations across borders, there is a heightened awareness of the potential risks and liabilities associated with employee mobility.

Furthermore, the European business landscape is characterized by diverse industries, each with its unique set of travel requirements. This diversity has led to a growing need for customizable insurance solutions that cater to specific industry demands, regional considerations, and the profiles of traveling employees.

Insurance providers in Europe are responding to this demand by offering tailored policies that encompass a range of benefits, including coverage for medical emergencies, trip cancellations, and pandemic-related risks. The adaptability of these insurance offerings aligns with the dynamic nature of business travel in Europe, making it a crucial and growing segment within the broader market. As businesses prioritize the well-being of their workforce, the European business travel accident insurance market is poised for continued expansion and innovation.

Report Scope

In this report, the Global Business Travel Accident Insurance market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Business Travel Accident Insurance Market, By Type:

- Single Trip Coverage

- Annual Multi-Trip Coverage

- Others

Business Travel Accident Insurance Market, By Distribution Channel:

- Insurance Company

- Insurance Broker

- Banks

- Insurance Aggregators

- Others

Business Travel Accident Insurance Market, By End User:

- Corporations

- Government and International Travelers

- Employees

Business Travel Accident Insurance Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the global Business Travel Accident Insurance market.Available Customizations:

The analyst offers customization according to specific needs, along with the already-given market data of the Global Business Travel Accident Insurance Market report.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Visitors Coverage Inc.

- Tata Aig General Insurance Company Limited

- Arch Capital Group Ltd.

- AXA SA

- Chubb

- MetLife Services and Solutions, LLC.

- Zurich American Insurance Company

- Starr International Company, Inc.

- American International Group, Inc.

- The Hartford

Table Information

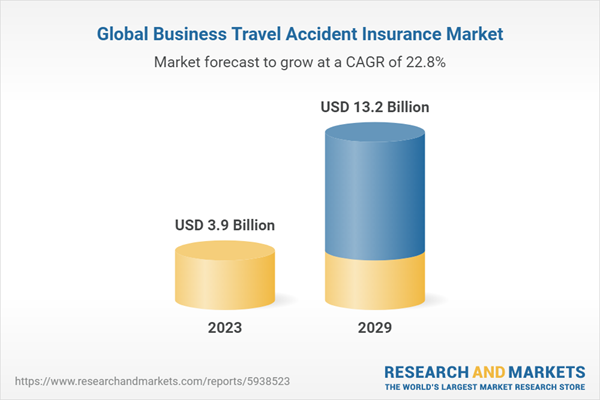

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | January 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 3.9 Billion |

| Forecasted Market Value ( USD | $ 13.2 Billion |

| Compound Annual Growth Rate | 22.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |