Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Sukuk issuances have diversified beyond traditional sovereign offerings to include corporate, quasi-sovereign, and financial institution-backed instruments, enhancing the market's resilience and investor appeal. Notable growth is seen in sovereign sukuk, as governments seek to finance development projects while complying with Islamic financial tenets. As global interest in responsible and ESG-aligned investing rises, sukuk continue to gain ground as a credible and inclusive financial instrument.

Key Market Drivers

Islamic Finance's Rising Popularity

The increasing global appeal of Islamic finance is a major catalyst for sukuk market growth. Sharia-compliant finance principles prohibit interest and promote ethical investment practices, making sukuk attractive to investors seeking socially responsible alternatives. The rising Muslim population, growing financial literacy, and regulatory support for Islamic financial products have further contributed to broader acceptance. Non-Muslim-majority countries are also showing rising interest, as sukuk provide an investment avenue aligned with global ethical finance trends. The expanding footprint of Islamic finance across various regions is significantly boosting the adoption of sukuk in global capital markets.Key Market Challenges

Lack of Standardization

A major obstacle for the sukuk market is the lack of uniform standards across issuances. Unlike conventional bonds, sukuk structures differ widely depending on the underlying contract type and legal interpretations, adding complexity for issuers and investors alike. This absence of standardization creates due diligence challenges and may discourage participation from international investors accustomed to predictable frameworks. Although institutions such as AAOIFI and IIFM are working toward harmonization, market-wide adoption of consistent practices remains limited. This variability can impede market scalability and hinder cross-border sukuk investment opportunities.Key Market Trends

Green and Sustainable Sukuk

The integration of sustainability into Islamic finance has led to the growing issuance of green and sustainable sukuk. These instruments are structured to finance environmentally and socially responsible projects, such as renewable energy, sustainable infrastructure, and climate-resilient initiatives. Green sukuk align naturally with the principles of Islamic finance, which emphasize stewardship and ethical investing. This trend supports ESG goals while opening the sukuk market to a broader base of investors interested in impact-driven instruments. Governments and private entities are increasingly tapping into this space to fund projects that serve both developmental and environmental objectives.Key Market Players

- Abu Dhabi Islamic Bank PJSC

- Al Baraka Banking Group

- Al-Rajhi Bank

- Banque Saudi Fransi

- Dubai Islamic Bank

- HSBC Holdings Plc

- Kuwait Finance House

- Malayan Banking Berhad

- Qatar International Islamic Bank

- RHB Bank Berhad

Report Scope:

In this report, the Global Sukuk Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Sukuk Market, By Sukuk Type:

- Murabahah Sukuk

- Salam Sukuk

- Istisna Sukuk

- Ijarah Sukuk

- Musharakah Sukuk

- Mudarabah Sukuk

- Others

Sukuk Market, By Currency:

- Turkish Lira

- Indonesian Rupiah

- Saudi Riyal

- Kuwaiti Dinar

- Others

Sukuk Market, By Issuer Type:

- Sovereign

- Corporate

- Financial Institutions

- Quasi-Sovereign

- Others

Sukuk Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Sukuk Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Abu Dhabi Islamic Bank PJSC

- Al Baraka Banking Group

- Al-Rajhi Bank

- Banque Saudi Fransi

- Dubai Islamic Bank

- HSBC Holdings Plc

- Kuwait Finance House

- Malayan Banking Berhad

- Qatar International Islamic Bank

- RHB Bank Berhad

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | June 2025 |

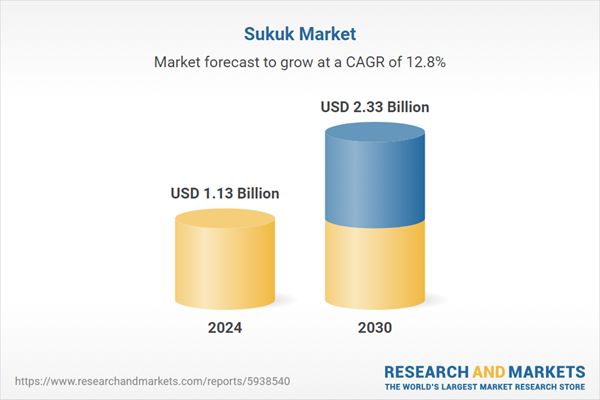

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.13 Billion |

| Forecasted Market Value ( USD | $ 2.33 Billion |

| Compound Annual Growth Rate | 12.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |