Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

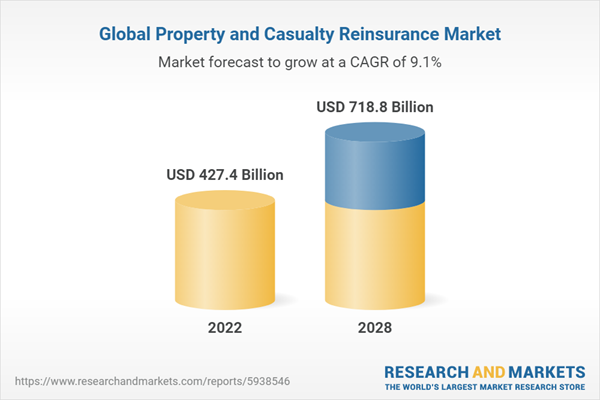

The Global Property and Casualty Reinsurance Market was valued at USD 427.4 billion in 2022 and is anticipated to project robust growth in the forecast period with a CAGR of 9.1% through 2028, reaching USD 718.8 billion. The global property and casualty reinsurance market is a critical component of the broader insurance industry. It plays a pivotal role in managing risks, ensuring financial stability, and providing a safety net for insurers worldwide. This market is characterized by its ability to absorb and diversify risks, providing insurance companies with the capacity to underwrite policies confidently. The global property and casualty reinsurance market has experienced steady growth over the years. As insurers aim to manage their exposure to large losses, the demand for reinsurance continues to increase. The market size is influenced by factors such as natural disasters, regulatory changes, and economic conditions. Property and casualty reinsurance primarily revolves around risk management. It allows insurance companies to transfer a portion of their risk to reinsurers, mitigating the financial impact of catastrophic events, like natural disasters, large-scale accidents, or other unexpected liabilities. Reinsurers diversify their portfolios to spread risk across various lines of business and geographic regions. This diversification minimizes the concentration of risk and helps stabilize their financial positions. For example, a reinsurer may have exposure to property, auto, liability, and other lines of business in different regions of the world. One of the prominent segments within the property and casualty reinsurance market is catastrophe reinsurance. This segment focuses on providing coverage for catastrophic events such as hurricanes, earthquakes, and wildfires. Catastrophe bonds, also known as cat bonds, are a unique feature of this market, allowing insurers to transfer risk to capital markets. Reinsurers bring valuable underwriting expertise to the insurance industry. They evaluate risks, set appropriate pricing, and determine the terms and conditions of policies, helping primary insurers make informed decisions when underwriting new policies.

Key Market Drivers

Increasing Frequency and Severity of Catastrophic Events

One of the primary drivers influencing the global P&C reinsurance market is the escalating frequency and severity of catastrophic events. These events include natural disasters such as hurricanes, wildfires, floods, earthquakes, and extreme weather conditions. Additionally, human-made disasters like industrial accidents, terrorist attacks, and cyber incidents have also become more frequent and costly.

Magnitude of Catastrophic Events: The past few decades have seen a significant increase in the magnitude and financial impact of catastrophic events. This trend is partly attributed to climate change, urbanization, and the increasing concentration of assets in vulnerable areas. These events result in substantial property and casualty losses for insurers, necessitating reinsurance to manage their exposure.

Role of Reinsurance: P&C reinsurers play a crucial role in helping primary insurers manage the financial fallout from catastrophic events. They provide an additional layer of protection, enabling insurance companies to mitigate their losses and maintain solvency. As catastrophic events become more common and severe, the demand for reinsurance coverage increases.

Innovation in Risk Assessment and Modeling: P&C reinsurers are increasingly investing in sophisticated risk assessment and modeling tools to better understand and price the risks associated with catastrophic events. This helps them provide more accurate coverage, reducing the uncertainty faced by primary insurers.

Evolving Regulatory Landscape and Capital Requirements

The regulatory landscape governing the insurance industry is continually evolving, impacting the global P&C reinsurance market. Regulatory changes include updated capital requirements, solvency standards, and risk management guidelines designed to enhance the financial stability and resilience of insurers.

Solvency II: The implementation of Solvency II in Europe, a comprehensive regulatory framework for insurance and reinsurance companies, has influenced global reinsurers by setting new capital adequacy and risk management standards. This framework has spurred other regions to adopt similar measures, increasing capital requirements for reinsurance companies.

Risk-Based Capital (RBC): In the United States, the National Association of Insurance Commissioners (NAIC) has introduced a risk-based capital framework for insurers and reinsurers. The RBC model adjusts capital requirements based on a company's risk profile, which has led to increased capital demands on reinsurers, particularly those writing business in the U.S.

Impact on Reinsurance Capacity: The evolving regulatory landscape has implications for reinsurance capacity. Reinsurers must allocate more capital to meet these requirements, potentially affecting their ability to underwrite large risks. Some reinsurers may choose to retrench from certain lines of business or regions to comply with regulatory standards, influencing the competitive dynamics of the market.

Emerging Risks and Technological Advancements

Emerging risks, such as cyber threats, pandemics, and climate change, are reshaping the global P&C reinsurance market. These evolving risks necessitate innovative reinsurance solutions and drive changes in underwriting practices.

Cyber Risk: With the proliferation of digital technologies and increasing reliance on data, cyber risks have become a significant concern for businesses and insurers. P&C reinsurers are developing specialized cyber reinsurance products to address the unique challenges posed by this evolving risk.

Climate Change: Climate-related risks, including rising sea levels, more frequent and severe natural disasters, and changing weather patterns, are causing insurers to reevaluate their exposure. Reinsurers are adapting by offering climate risk solutions and incentivizing sustainable practices to mitigate losses.

Technological Advancements: Technological innovations, such as artificial intelligence, big data analytics, and the Internet of Things (IoT), are influencing risk assessment and pricing. Reinsurers are leveraging these advancements to gain deeper insights into risk exposures and offer more customized reinsurance solutions.

Pandemic Risk: The COVID-19 pandemic has highlighted the need for reinsurance coverage for pandemic-related business interruptions and liability claims. The P&C reinsurance market is exploring new products and coverages to address these emerging risks.

Key Market Challenges

Increased Frequency and Severity of Catastrophic Events

The P&C reinsurance industry faces an escalating frequency and severity of catastrophic events due to climate change, urbanization, and other factors. Natural disasters, such as hurricanes, floods, wildfires, and earthquakes, have become more common and devastating. These events result in substantial insurance claims, leading to increased demand for reinsurance coverage.

Underwriting Challenges: The heightened frequency and severity of catastrophic events present underwriting challenges. Reinsurers need to accurately assess and price these risks, which can be complex due to the evolving nature of these events.

Risk Accumulation: Concentration of risks in disaster-prone regions can lead to substantial accumulations. Reinsurers must carefully manage their portfolios to avoid overexposure to specific perils and geographies.

Capital Adequacy: Reinsurers must maintain sufficient capital reserves to cover large catastrophic losses. The need for substantial capital reserves limits their capacity to underwrite additional risks.

Pricing Pressures: The increased demand for reinsurance due to catastrophic events can lead to pricing pressures, as reinsurers may need to charge higher premiums to adequately cover the risks. This can strain the relationships between insurers and reinsurers.

Regulatory and Compliance Challenges

The P&C reinsurance market operates within a complex regulatory environment. Regulatory changes, evolving compliance requirements, and the introduction of new international standards impact how reinsurers operate, manage risk, and report financial information.

Global Regulatory Fragmentation: The global nature of reinsurance often leads to compliance challenges. Different regions and countries have varying regulatory requirements, which can be time-consuming and costly for reinsurers to navigate.

Data Privacy and Cybersecurity: The increasing importance of data protection and cybersecurity regulations means that reinsurers must invest in robust data security measures. Regulatory violations can result in hefty fines and reputational damage.

Reserving Requirements: Regulatory authorities may impose stringent reserving requirements, which can tie up capital for extended periods. This affects reinsurers' financial flexibility and their ability to underwrite new risks.

Accounting Standards: Evolving accounting standards, such as the implementation of International Financial Reporting Standards (IFRS) or U.S. Generally Accepted Accounting Principles (GAAP), can impact how reinsurers report their financial performance.

Low Interest Rates and Investment Income Challenges

The prolonged period of historically low interest rates and investment income poses a challenge for P&C reinsurers. Reinsurers typically invest premium income to generate returns that offset underwriting losses. In a low-interest-rate environment, achieving adequate investment returns becomes more challenging.

Pressure on Profitability: Low interest rates limit reinsurers' ability to generate investment income, which can pressure their overall profitability. In such an environment, underwriting profits become even more crucial.

Asset-Liability Mismatch: Reinsurers may face an asset-liability duration mismatch, as their investment portfolios may not align with the duration of their insurance and reinsurance liabilities. This mismatch can result in increased investment risk.

Search for Yield: In search of higher yields, reinsurers may be compelled to take on more investment risk, such as investing in riskier asset classes. This exposes them to potential losses.

Capital Management: To optimize investment returns, reinsurers need to employ effective capital management strategies, such as asset-liability matching, alternative investments, or risk management solutions.

Key Market Trends

Evolving Risk Landscape and Increased Demand for Customization

The global property and casualty reinsurance market is witnessing a notable trend in response to the evolving risk landscape. The insurance industry is being challenged by a wide range of risks, including natural disasters, cyber threats, and the impact of climate change. As a result, primary insurance companies and reinsurers are increasingly seeking tailored solutions to address these complex and diverse risks.

Reinsurers are offering more customized reinsurance products, allowing primary insurers to better align coverage with their specific needs. For example, parametric insurance, which pays out based on predefined triggers like earthquake magnitudes or hurricane wind speeds, is gaining popularity. This customization allows primary insurers to have greater control over their risk exposure and provides more effective coverage for policyholders. As the risk landscape continues to evolve, the trend of tailoring reinsurance solutions is expected to grow, leading to more innovative and flexible risk transfer options.

Growing Emphasis on Technology and Data Analytics

Technology and data analytics are playing an increasingly vital role in the property and casualty reinsurance market. Insurtech innovations and the use of advanced data analytics are helping reinsurers better assess risk, price policies accurately, and streamline operations.

The integration of big data and artificial intelligence (AI) is enabling insurers and reinsurers to gain deeper insights into risk factors and pricing strategies. Predictive analytics is being used to anticipate potential losses and assess the likelihood of future claims, which, in turn, helps reinsurers set more competitive premiums while maintaining profitability.

Moreover, technology is enhancing the efficiency of underwriting and claims processing, making the entire insurance process smoother and more cost-effective. Blockchain technology is being explored to improve transparency and reduce fraud, while the Internet of Things (IoT) is providing insurers with real-time data on insured properties and assets, enabling better risk management.

As technology continues to advance, the property and casualty reinsurance market is expected to further leverage these innovations to optimize risk assessment, pricing, and claims handling, ultimately leading to more competitive and efficient operations.

Sustainable and ESG (Environmental, Social, and Governance) Considerations

In line with the global shift towards sustainability and responsible investing, the property and casualty reinsurance market is experiencing a trend towards integrating environmental, social, and governance (ESG) factors into risk assessment and underwriting. Climate change, social issues, and ethical governance are becoming significant concerns for reinsurers and their clients.

Reinsurers are increasingly factoring climate-related risks into their underwriting processes. The growing frequency and severity of weather-related events have made climate risk a focal point in reinsurance discussions. Reinsurers are incorporating climate modeling and scenario analysis to assess their exposure to climate-related events, allowing them to better manage and price such risks.

Additionally, ESG criteria are being used to assess the broader risk profile of insured entities. Reinsurers are considering the ESG practices and performance of their clients, which can affect their insurability and the terms of coverage. Companies with strong ESG practices may be rewarded with more favorable terms, while those with poor ESG ratings may face higher premiums or limitations in coverage.

Segmental Insights

Type Insights

Direct selling has become a significant player in the global property and casualty reinsurance market, marking a paradigm shift in the way insurance products and services are distributed and accessed. The rise of direct selling in this sector has been driven by various factors, including technological advancements, changing consumer preferences, and the need for more efficient and cost-effective distribution methods.

Key Factors Contributing to the Dominance of Direct Selling in the Global Property and Casualty Reinsurance Market:

Technological Advancements: The advent of the digital age has transformed the insurance landscape. Direct selling leverages digital technologies to reach a broader audience, enabling insurers and reinsurers to connect directly with policyholders and businesses. Online platforms, mobile apps, and websites provide convenient channels for purchasing property and casualty reinsurance products.

Disintermediation: Direct selling eliminates the need for intermediaries such as agents and brokers, streamlining the distribution process. This disintermediation leads to cost savings, as commissions and fees associated with traditional sales methods are reduced. This cost efficiency can benefit both insurance providers and policyholders.

Accessibility and Convenience: Direct selling offers policyholders the convenience of purchasing insurance products from the comfort of their homes or offices. Consumers can research, compare, and buy property and casualty reinsurance policies online, 24/7, without the need for face-to-face meetings or telephone consultations.

Customization and Transparency: Direct selling platforms allow insurers and reinsurers to offer a wide range of customized insurance products, catering to the unique needs of policyholders. Additionally, these platforms often provide transparency in terms of policy features, pricing, and terms and conditions, empowering customers to make informed decisions.

Expanding Market Reach: Direct selling extends the reach of insurance providers beyond geographical boundaries. It allows companies to tap into previously underserved or remote markets, reaching a diverse range of policyholders who may not have had easy access to insurance options.

Cost Efficiency: By reducing the need for intermediaries and administrative overhead, direct selling can result in cost savings for both insurance companies and consumers. Lower operational costs can translate into more competitive pricing for policyholders.

Data Analytics and Personalization: Direct selling platforms often incorporate data analytics to assess risk and underwrite policies. This enables insurers to provide personalized coverage options, tailoring solutions to individual or business needs based on data-driven insights.

Regulatory Support: Many regions have adjusted regulatory frameworks to accommodate direct selling in the insurance sector. Regulatory support has facilitated the growth of this distribution model while ensuring consumer protection and industry standards.

Consumer Education: Direct selling often involves educating policyholders about insurance options and the importance of coverage. This educational component enhances consumer awareness and encourages individuals and businesses to proactively seek and purchase property and casualty reinsurance.

Application Insights

Small reinsurers have carved out a significant share in the global property and casualty reinsurance market, challenging the dominance of larger, more established reinsurers. This development reflects the evolving dynamics within the reinsurance industry and the growing relevance of smaller players.

Key Factors Contributing to the Significance of Small Reinsurers in the Global Property and Casualty Reinsurance Market:

Niche Expertise: Small reinsurers often focus on niche markets or specialty lines of business, leveraging their expertise in these areas. Their in-depth knowledge and specialization allow them to effectively underwrite risks that larger reinsurers may not be as familiar with, providing tailored solutions to clients.

Personalized Service: Smaller reinsurers are known for their personalized, client-centric approach. They can offer a higher level of customer service and responsiveness, making them attractive to insurance companies seeking more direct and flexible partnerships.

Agility and Innovation: Small reinsurers are generally more agile and quick to adapt to changing market conditions. This agility allows them to respond swiftly to emerging risks, create innovative reinsurance solutions, and adjust their underwriting strategies, giving them a competitive edge in a dynamic industry.

Lower Overheads: Smaller reinsurers typically have lower overhead costs than their larger counterparts. This cost advantage enables them to offer competitive pricing to cedents and potentially more favorable terms in reinsurance agreements.

Regional and Specialty Focus: Many small reinsurers concentrate on specific regions or markets. They understand the nuances of these regions, and their focus on specialized lines of business helps them build strong, local relationships with cedents.

Syndicate and Collaborative Approaches: Smaller reinsurers often collaborate with larger companies, forming syndicates or partnerships to pool resources and capacity. These alliances allow them to underwrite larger risks while sharing the exposure and risk, broadening their reach and competitiveness.

Capital Efficiency: Small reinsurers efficiently manage their capital resources, deploying them judiciously to support their underwriting activities. This approach ensures that they have adequate capacity to cover their commitments while avoiding the excesses that can strain larger reinsurers.

Expanding Market Presence: Small reinsurers are continually expanding their market presence, both geographically and across different lines of business. They have seized opportunities in emerging markets and increasingly explore innovative coverage areas to grow their portfolios.

Regional Insights

- North America undeniably wields a significant share in the global Property and Casualty (P&C) reinsurance market. This region's strong presence in the industry is driven by a combination of factors, including the size and diversity of its insurance market, robust regulatory framework, and the need to manage risk effectively in a variety of sectors.

- Key Factors Contributing to North America's Dominance in the Global Property and Casualty Reinsurance Market:

- Size and Diversity of the Insurance Market: North America boasts one of the world's largest and most diverse insurance markets. With a multitude of insurance carriers, brokers, and policyholders operating in the region, there is a substantial demand for reinsurance services. The breadth of coverage and the unique risk exposures in North America necessitate a robust P&C reinsurance sector.

- Catastrophe Risk Management: North America faces a diverse range of catastrophe risks, including hurricanes, earthquakes, wildfires, and severe weather events. Reinsurance plays a critical role in helping insurance companies manage these risks, particularly in areas prone to natural disasters, such as the Gulf Coast, California, and the Atlantic seaboard.

- Regulatory Framework: North America has well-established and stable regulatory frameworks for the insurance and reinsurance sectors. This stability fosters confidence among reinsurers and insurers, encouraging market participation and investment. Regulatory oversight ensures fair practices, solvency, and capital adequacy, making the region an attractive destination for reinsurance activities.

- Technological Innovation: North American insurance and reinsurance companies are at the forefront of technological innovation. The use of data analytics, predictive modeling, and advanced risk assessment tools enables more precise underwriting, risk management, and claims processing. These advancements enhance the efficiency and effectiveness of P&C reinsurance operations in the region.

- Diverse Industrial Landscape: North America's diverse industrial landscape, including manufacturing, real estate, agriculture, and technology, creates a wide array of risk exposures. The need for specialized reinsurance products and services tailored to different sectors further contributes to the region's prominence in the global market.

- High-Value Assets: North America is home to a multitude of high-value assets, including commercial real estate, infrastructure projects, and large industrial complexes. Insuring and reinsuring these assets against various perils require the involvement of experienced P&C reinsurers capable of managing substantial exposures.

- Regulatory Capital Requirements: Stringent regulatory capital requirements in North America incentivize insurance companies to use reinsurance as a risk management tool. Reinsurance enables insurers to optimize their capital positions, enhance solvency, and expand capacity for underwriting new policies.

- Mergers and Acquisitions: North America has witnessed a series of mergers and acquisitions in the insurance and reinsurance industry, leading to the consolidation of market players. This consolidation has resulted in the emergence of larger, more diversified reinsurers with substantial market share, both domestically and internationally.

Report Scope

In this report, the global property and casualty reinsurance market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Property and Casualty Reinsurance Market, By Type:

- Direct Selling

- Intermediary Selling

Property and Casualty Reinsurance Market, By Application:

- Small Reinsurers

- Midsized Reinsurers

Property and Casualty Reinsurance Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the global property and casualty reinsurance market.

Available Customizations:

The analyst offers customization according to specific needs, along with the already-given market data of the Global Property and Casualty Reinsurance market report.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Berkshire Hathaway Inc.

- BMS Group Limited

- China Reinsurance Corporation

- Everest Re Group Ltd.

- Hannover Re

- Lloyd’s of London

- Munich Reinsurance Company

- PartnerRe Ltd.

- Swiss Re

- Reinsurance Group of America

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2024 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 427.4 Billion |

| Forecasted Market Value ( USD | $ 718.8 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |