Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Prevalence of Chronic Diseases

The prevalence of chronic diseases is a primary driver behind the rapid growth of the Global Blood Preparation Market. Chronic diseases, which encompass a wide range of conditions such as cancer, anemia, hemophilia, and blood disorders, often necessitate frequent blood transfusions as an integral part of their management and treatment. This demand for blood and blood-related products is escalating due to the increasing global burden of chronic diseases.As populations age and lifestyles become increasingly sedentary, the incidence of chronic diseases continues to rise. Conditions like diabetes, cardiovascular diseases, and cancer have become more common, leading to a growing need for blood preparations. For instance, cancer patients often require regular blood transfusions to manage the anemia and low platelet counts associated with chemotherapy, while individuals with blood disorders like sickle cell anemia depend on blood transfusions to alleviate their symptoms and complications.

Key Market Challenges

Stringent Regulatory Compliance

The Global Blood Preparation Market, a crucial pillar of healthcare, faces a formidable challenge in the form of stringent regulatory compliance. While regulations are essential to ensuring the safety and efficacy of blood and blood-related products, the stringent nature of these requirements can impede the market's growth and operational efficiency.Blood preparation involves a complex set of processes, from collection and testing to storage and distribution. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), set stringent standards that must be met to guarantee the safety and quality of blood products. These standards encompass numerous facets of the blood preparation process, including donor eligibility criteria, testing protocols, documentation, and the maintenance of storage and transportation conditions.

Meeting these rigorous regulatory requirements can be a resource-intensive endeavor, particularly for smaller blood banks and healthcare providers. Compliance demands substantial investments in state-of-the-art equipment, quality control measures, staff training, and infrastructure. These expenses can be cost-prohibitive for smaller organizations, potentially limiting their ability to participate in the market. Furthermore, the constant need to adapt to evolving regulations places an ongoing financial burden on stakeholders within the blood preparation industry.

Key Market Trends

Technological Advancements in Blood Preparation

Technological advancements in blood preparation are playing a pivotal role in boosting the Global Blood Preparation Market. Automation, sophisticated equipment, and innovative methods have ushered in a new era of efficiency, safety, and quality within the industry. These advancements are reshaping the landscape of blood collection, processing, and storage, leading to an enhanced market with numerous benefits for healthcare providers and patients alike.Automation, in particular, stands out as a game-changer in the field. Automated blood preparation systems have revolutionized the industry by significantly reducing human error, enhancing precision, and accelerating the speed at which blood components can be prepared. Automated equipment can process large volumes of blood with unmatched precision, resulting in a more consistent and reliable supply of blood products. This not only improves operational efficiency but also reduces the margin of error, ensuring that the final products meet the highest quality and safety standards.

Moreover, innovative methods and technologies have paved the way for more advanced testing and screening processes. The introduction of nucleic acid testing (NAT), for instance, has significantly enhanced the sensitivity and accuracy of detecting infectious agents, such as HIV, hepatitis B and C. This improvement in blood safety has instilled greater confidence among healthcare professionals and the public, reassuring them that blood products are less likely to transmit infections or other complications.

Key Market Players

- Pfizer, Inc.

- Bristol-Myers Squibb Company

- Leo Pharma A/S

- Sanofi

- Xiamen Hisunny Chemical Co., LTD

- AstraZeneca plc

- Baxter International Inc

- Portola Pharmaceuticals, Inc.

- GlaxoSmithKline PLC

- Shandong East Chemical Industry Co.

Report Scope:

In this report, the Global Blood Preparation Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Blood Preparation Market, By Product:

- Whole Blood

- Blood Components

- Blood Derivatives

Blood Preparation Market, By Type:

- Platelet Aggregation Inhibitors

- Fibrinolytics

- Anticoagulants

Blood Preparation Market, By Application:

- Thrombocytosis

- Pulmonary Embolism

- Renal Impairment

- Angina Blood Vessel Complications

- Others

Blood Preparation Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Blood Preparation Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

Pfizer, Inc.- Bristol-Myers Squibb Company

- Leo Pharma A/S

- Sanofi

- Xiamen Hisunny Chemical Co., LTD

- AstraZeneca plc

- Baxter International Inc

- Portola Pharmaceuticals, Inc.

- GlaxoSmithKline PLC

- Shandong East Chemical Industry Co.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | March 2025 |

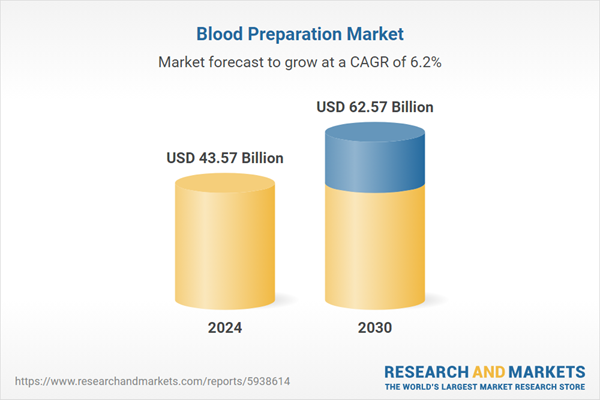

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 43.57 Billion |

| Forecasted Market Value ( USD | $ 62.57 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 2 |