Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Conversely, substantial acquisition costs and strict regulatory frameworks notably hinder broader market penetration, especially within resource-limited environments. These financial and legal obstacles frequently postpone the commercial launch of novel applications and restrict access for smaller healthcare facilities. To illustrate the magnitude of this sector, the American Society of Plastic Surgeons reported that in 2024, practitioners executed over 3.7 million skin resurfacing procedures and 3.1 million laser-based skin treatments, highlighting the extensive application of these systems in contemporary medical practice.

Market Drivers

A primary catalyst for market growth is the surging demand for aesthetic laser treatments and cosmetic surgeries, fueled by increasing social acceptance of non-invasive beauty enhancements. Patients show a growing preference for energy-based devices used in hair removal, skin tightening, and scar revision, valued for their minimal downtime and lower risks compared to traditional surgery. This trend is further accelerated by the rise of medical spas and the wider availability of advanced laser platforms designed for various skin types. According to the 'Global Survey on Aesthetic/Cosmetic Procedures' by the International Society of Aesthetic Plastic Surgery (ISAPS) in June 2025, practitioners conducted approximately 20.5 million non-surgical procedures globally in 2024, demonstrating a strong demand for these interventions.Concurrently, the market's scope is broadening as laser applications expand into dentistry, urology, and other therapeutic fields. Manufacturers are engineering specialized solid-state and fiber lasers capable of precise tissue ablation for issues like kidney stones and soft tissue lesions, thereby shortening recovery times and enhancing patient results.

This diversification enables providers to deliver comprehensive care, bolstering the commercial value of laser systems across various medical disciplines. Evidence of this sector-specific expansion is found in El.En. S.p.A.'s 'Six Months Financial Report as of June 30, 2025', released in September 2025, which noted a 5.7% revenue increase in the medical laser sector for the first half of the year. Additionally, Sisram Medical's '2024 Annual Results' from March 2025 reported a total annual revenue of US$349.1 million, emphasizing the significant financial presence of energy-based medical device providers.

Market Challenges

High acquisition expenses and rigorous regulatory frameworks act as significant impediments to the expansion of the global medical laser systems market. These financial and legal challenges considerably restrict the capacity of private practitioners and smaller healthcare facilities to acquire essential equipment. The considerable capital needed to purchase laser devices frequently surpasses the budgets of independent clinics, effectively limiting market adoption to well-funded institutions. Furthermore, stringent regulatory approval procedures delay the introduction of new technologies, slowing commercial availability and deferring revenue generation for manufacturers who must satisfy complex compliance standards before reaching end-users.This inability to widely implement technology due to cost and regulation creates a bottleneck that suppresses potential market growth, even amidst high consumer demand. According to the International Society of Aesthetic Plastic Surgery, practitioners performed roughly 20.5 million non-surgical procedures worldwide in 2024. Although this volume reflects a robust patient appetite for aesthetic treatments, the substantial barriers to entry prevent a wider array of service providers from investing in the requisite laser systems, thereby hindering the sector's overall growth trajectory and restricting accessibility in resource-constrained settings.

Market Trends

The rise of Ultrafast Femtosecond and Picosecond Laser Technologies is fundamentally transforming the market by facilitating procedures characterized by unprecedented precision and minimal thermal damage. These systems, utilizing ultrashort pulse durations, are increasingly favored for delicate applications such as corneal refractive surgery and pigment fragmentation, offering a significantly lower risk of scarring compared to traditional continuous-wave lasers. This transition is especially prominent in ophthalmology, where the demand for minimally invasive vision correction techniques like SMILE is stimulating considerable equipment sales. As evidence of this segment's financial impact, Carl Zeiss Meditec AG reported in its 'Annual Report 2024/25' in December 2025 that the Ophthalmology Strategic Business Unit achieved revenue of €1.72 billion, representing an 8.5% growth driven by a rebound in equipment sales and refractive procedure volumes.Another pivotal trend is the advancement of Hybrid Laser Systems that combine multiple wavelengths, addressing the clinical necessity for versatility across various skin phototypes. By consolidating distinct wavelengths, such as Alexandrite (755 nm) and Nd:YAG (1064 nm), into a single platform, practitioners can simultaneously target different chromophores, thereby improving safety and efficacy for hair removal and vascular treatments on darker skin tones. This integration of capabilities enhances the operational efficiency of clinics by eliminating the need for multiple standalone devices. Highlighting the commercial success of this approach, El.En. S.p.A.'s 'Interim Financial Report as of September 30, 2025', published in November 2025, indicated that the company's medical sector generated a turnover of €307.5 million during the first nine months of the year, reflecting sustained adoption of its laser technologies.

Key Players Profiled in the Medical Laser Systems Market

- Luminex Corp

- PhotoMedex Technology Inc.

- Koninklijke Philips N.V.

- Biolase Inc.

- IRIDEX Corporation

- BioForm Medical, Inc.

- Biolitec AG

- Cutera Inc.

- Candela Corp

- Cynosure LLC

Report Scope

In this report, the Global Medical Laser Systems Market has been segmented into the following categories:Medical Laser Systems Market, by Product:

- Diode Lasers

- Solid State Lasers

- Gas Lasers

- Dye Lasers

Medical Laser Systems Market, by Application:

- Dermatology

- Ophthalmology

- Gynecology

- Urology

- Dentistry

- Cardiovascular

- Others

Medical Laser Systems Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Medical Laser Systems Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Medical Laser Systems market report include:- Luminex Corp

- PhotoMedex Technology Inc

- Koninklijke Philips N.V.

- Biolase Inc

- IRIDEX Corporation

- BioForm Medical, Inc.

- Biolitec AG

- Cutera Inc

- Candela Corp

- Cynosure LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

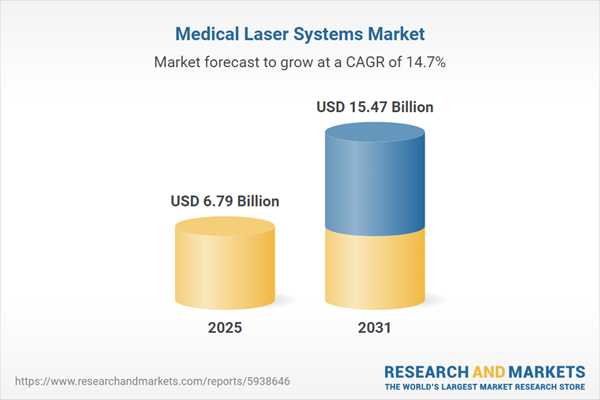

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 6.79 Billion |

| Forecasted Market Value ( USD | $ 15.47 Billion |

| Compound Annual Growth Rate | 14.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |