Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Consumer Demand for Visual Appeal

In an era where first impressions matter, consumer demand for visually appealing products has become a powerful catalyst for the unprecedented growth of the global self-adhesive labels market. The marriage of aesthetics and functionality is reshaping the labeling landscape across industries, and self-adhesive labels are emerging as the frontrunners in meeting the evolving expectations of today's consumers.Consumers are increasingly drawn to products that catch the eye and stimulate the senses. Self-adhesive labels offer a versatile canvas for creative expression, allowing brands to infuse their products with a unique visual identity. From bold colors and intricate designs to sleek branding elements, these labels contribute to the overall aesthetic appeal of products on the shelf, enticing consumers to explore and engage with the packaging.

The demand for personalized experiences is at all-time high, and self-adhesive labels empower brands to cater to this consumer preference. Advanced printing technologies enable the customization of labels with intricate details, variable data, and even individualized graphics. Whether it's a limited-edition product or a personalized message, self-adhesive labels provide a platform for brands to connect with consumers on a personal level, fostering brand loyalty and repeat business.

The retail environment is fiercely competitive, with products vying for attention on crowded shelves. Self-adhesive labels play a pivotal role in enhancing shelf visibility and creating a strong brand presence. Eye-catching labels not only attract consumers but also influence their purchasing decisions. Brands investing in visually appealing labels are better positioned to stand out from the competition, prompting consumers to choose their products over others.

Consumers are increasingly aligning themselves with brands that share their values. Self-adhesive labels serve as a tangible representation of a brand's identity, allowing it to communicate its values and messaging effectively. Labels can convey messages of sustainability, quality, and innovation, resonating with consumers who prioritize these attributes in their purchasing decisions.

Versatility and Ease of Application

In the dynamic world of product packaging, the global self-adhesive labels market is experiencing a significant upswing, propelled by two key attributes that have become paramount in the eyes of manufacturers and consumers alike: versatility and ease of application. These qualities not only enhance the practical aspects of labeling but also contribute to the overall efficiency and appeal of the packaging industry.One of the primary factors driving the growth of the self-adhesive labels market is the unparalleled adaptability of these labels across diverse surfaces. Whether it's glass, plastic, metal, or paper, self-adhesive labels adhere with ease, providing a universal solution for a wide range of products. This adaptability eliminates the need for different labeling methods for different materials, streamlining the packaging process and reducing costs for manufacturers.

Ease of application is a cornerstone of the self-adhesive labels market's success. Traditional labeling methods often require specialized equipment, skilled labor, or time-consuming processes. In contrast, self-adhesive labels are designed for simplicity. The labels can be applied quickly and efficiently, minimizing production time and maximizing output. This ease of application not only enhances operational efficiency but also reduces the likelihood of errors in the labeling process.

The versatility and ease of application of self-adhesive labels translate to cost-effectiveness for manufacturers. The simplified application process reduces labor costs, and the ability to use the same label across various surfaces eliminates the need for multiple labeling setups. As a result, businesses can achieve economies of scale and allocate resources more efficiently, contributing to overall profitability and market competitiveness.

In fast-paced industries where time-to-market is critical, self-adhesive labels offer a distinct advantage. The ease of application facilitates rapid prototyping and label design changes, allowing manufacturers to respond quickly to market trends and consumer preferences. This agility is particularly valuable in industries with frequent product launches or those that require seasonal or promotional variations in labeling.

Sustainability and Environmental Concerns

In an era where environmental consciousness is at the forefront of consumer and industry concerns, the global self-adhesive labels market is experiencing a significant boost driven by a commitment to sustainability. As businesses align themselves with eco-friendly practices, self-adhesive labels are emerging as a beacon of change, offering not only functional benefits but also addressing the growing global imperative of environmental responsibility.The adoption of sustainable label materials is a key driver in the growth of the self-adhesive labels market. Manufacturers are increasingly opting for materials that are recyclable, biodegradable, and sourced from renewable resources. These choices not only reduce the environmental impact of label production but also align with the growing demand for eco-friendly packaging solutions from environmentally conscious consumers.

The production and transportation of traditional labels often contribute to a significant carbon footprint. Self-adhesive labels, particularly those manufactured with sustainability in mind, offer a solution to reduce this environmental impact. Lighter label materials, energy-efficient production processes, and reduced transportation costs contribute to an overall decrease in the carbon footprint associated with label manufacturing.

Sustainability in the self-adhesive labels market goes beyond just material choices. The shift towards a circular economy is gaining momentum, and self-adhesive labels are positioned to play a crucial role. Labels designed for easy removal and recycling facilitate the separation of packaging materials, supporting the circularity of resources and minimizing waste in the overall packaging lifecycle.

As consumers become more environmentally conscious, their purchasing decisions increasingly reflect a preference for sustainable products. Brands leveraging self-adhesive labels with eco-friendly attributes not only meet regulatory requirements but also resonate with consumers who actively seek products aligned with their values. This consumer-driven demand for sustainability creates a market pull that propels the growth of eco-friendly labeling solutions.

Growth Across End-User Industries

In the ever-evolving landscape of packaging solutions, the global self-adhesive labels market is experiencing a surge in growth, propelled by an expanding footprint across diverse end-user industries. From food and beverage to pharmaceuticals, retail, and logistics, the versatility and adaptability of self-adhesive labels are transforming the way products are presented and identified.One of the primary contributors to the growth of the self-adhesive labels market is the thriving food and beverage industry. The need for attractive and informative packaging is paramount in this sector, and self-adhesive labels provide a solution that meets these requirements. Whether it's for product branding, nutritional information, or promotional labels, the flexibility of self-adhesive labels caters to the diverse needs of food and beverage manufacturers, enhancing both aesthetics and functionality.

In the pharmaceutical and healthcare industries, where precision and compliance are critical, self-adhesive labels play a pivotal role. These labels offer a reliable solution for conveying essential information, dosage instructions, and regulatory compliance. As the demand for pharmaceutical products grows globally, the self-adhesive labels market expands in tandem, providing a crucial tool for ensuring the safety and integrity of medical packaging.

The retail sector is a dynamic arena where products vie for consumer attention. Self-adhesive labels enhance shelf appeal, making products stand out in a crowded market. Whether it's for new product launches, promotions, or branding updates, the versatility of self-adhesive labels enables quick and efficient changes, allowing brands to adapt to evolving consumer preferences and market trends.

Efficient and accurate labeling is indispensable in the logistics and packaging industries. Self-adhesive labels streamline the labeling process, facilitating smooth logistics operations and minimizing errors. As e-commerce and global trade continue to grow, the demand for reliable labeling solutions in logistics becomes increasingly pronounced, further contributing to the expansion of the self-adhesive labels market.

Key Market Challenges

Raw Material Price Volatility

One of the primary challenges facing the self-adhesive labels market is the volatility in raw material prices. The industry heavily relies on materials such as paper, film, adhesives, and inks. Fluctuations in the prices of these materials can significantly impact production costs, leading to challenges in maintaining profit margins. Companies in the market must adopt effective strategies to mitigate the impact of raw material price fluctuations, such as establishing long-term contracts with suppliers or exploring alternative, cost-effective materials.Competition and Market Saturation

The self-adhesive labels market is highly competitive, with numerous players vying for market share. As a result, companies face challenges in differentiating their products and maintaining profitability. Market saturation in certain regions and industries intensifies competition, prompting companies to explore niche markets or develop innovative label solutions to stand out. Strategic partnerships and mergers and acquisitions are becoming common strategies to enhance competitiveness and expand market presence.Key Market Trends

Smart Labels and RFID Technology

As the world becomes more digitally connected, smart labels and Radio-Frequency Identification (RFID) technology are poised to play a pivotal role in the self-adhesive labels market. Smart labels can provide real-time information about a product, including its location, temperature history, and authenticity. This trend is gaining traction in industries such as pharmaceuticals, food and beverage, and logistics, where accurate and timely data is crucial for supply chain management and consumer safety.Eco-Friendly Labeling Solutions

With increasing environmental awareness, there is a growing demand for eco-friendly and sustainable labeling solutions. The self-adhesive labels market is witnessing a shift towards the use of recycled materials, bio-based adhesives, and environmentally friendly inks. Companies are also exploring innovative ways to reduce waste, such as linerless labels and designs that facilitate easier recycling. Sustainability is not just a buzzword but a critical factor influencing consumer choices, driving the industry to adopt more responsible practices.Segmental Insights

Adhesive Type Insights

Hot-melt adhesives are poised to dominate the Global Self-Adhesive Labels Market for several compelling reasons. Firstly, hot-melt adhesives offer fast-setting properties, ensuring efficient and rapid bonding in the label application process. This speed not only enhances productivity but also contributes to cost-effectiveness, a crucial factor for manufacturers seeking streamlined operations. Additionally, hot-melt adhesives provide excellent adhesion to a wide range of substrates, including plastics, paper, and metals, making them versatile for various labeling applications across industries. Their superior bonding strength and durability further contribute to the longevity and reliability of self-adhesive labels. Moreover, hot-melt adhesives are known for their environmental friendliness, as they are solvent-free and produce minimal volatile organic compounds (VOCs), aligning with the growing demand for sustainable and eco-friendly solutions in the adhesive industry. These factors collectively position hot-melt adhesives as the adhesive type of choice, driving their dominance in the evolving landscape of the Global Self-Adhesive Labels Market.Application Insights

The Food & Beverage sector is poised to dominate the Global Self-Adhesive Labels Market for a multitude of compelling reasons. Firstly, the industry's strict regulations and requirements for clear and accurate labeling make self-adhesive labels an ideal choice due to their precision and customization capabilities. Self-adhesive labels enable the incorporation of detailed product information, nutritional facts, and branding elements in a visually appealing manner, meeting the stringent standards of the Food & Beverage sector. Additionally, the versatility of self-adhesive labels allows for application on a wide range of packaging materials, including glass, plastic, and flexible packaging, accommodating the diverse packaging formats prevalent in the industry. With consumer preferences increasingly leaning towards convenience and aesthetic appeal, self-adhesive labels offer a seamless and visually attractive solution, enhancing the overall packaging of food and beverage products. Furthermore, the global trend towards product differentiation and branding in the competitive market landscape further propels the adoption of self-adhesive labels in the Food & Beverage sector, solidifying its dominance in the Global Self-Adhesive Labels Market.Regional Insights

The Asia-Pacific region has asserted its dominance in the market and is poised for significant growth throughout the forecast period, driven by the burgeoning packaging, electronics, and personal care industries in key countries such as China, India, Japan, and South Korea. The consumption of self-adhesive labels is on the rise, reflecting the region's economic vitality. In 2022, China's personal care and cosmetics exports reached USD 5.63 billion, marking a notable increase from the USD 4.85 billion recorded in 2021, signifying a substantial 16.08% year-on-year growth, with expectations for further escalation. China, as the leading hub for electronics production, especially in smartphones, TVs, and personal devices, has experienced remarkable growth, catering to both domestic and international markets. The Asian electro market, according to ZEVI, soared to EUR 3.11 trillion (USD 3.674 trillion) in 2021, recording a 10% increase, followed by a 13% surge in 2022, with a projected growth rate of 7% in 2023. China's electronic industry, growing by 14% in 2022, anticipates an 8% expansion in 2023, solidifying its position as the world's largest market, surpassing the combined markets of all industrialized nations. The utilization of self-adhesive labels in pharmaceutical packaging, driven by the booming Indian pharma industry with an expected market size of USD 130 billion by 2030, further underscores the growing significance of the Asia-Pacific region. Additionally, India's flourishing packaging industry, stimulated by economic growth, demographic advantages, and the rise of e-commerce giants like Flipkart and Amazon, exemplifies the region's dynamic business landscape.Report Scope

In this report, the Global Self-Adhesive Labels Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Self-Adhesive Labels Market, By Adhesive Type:

- Hot-melt

- Emulsion Acrylic

- Solvent

Self-Adhesive Labels Market, By Application:

- Food & Beverage

- Pharmaceutical

- Logistics & Transport

- Personal Care

- Consumer Durables

- Others

Self-Adhesive Labels Market, By Face Material:

- Paper

- Plastic

Self-Adhesive Labels Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Self-Adhesive Labels Market.Available Customizations:

The analyst offers customization according to specific needs, along with the already-given market data of the Global Self-Adhesive Labels market report.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- 3M Co

- Asteria Group

- Avery Dennison Corp

- CPC Haferkamp GmbH & Co KG

- Fuji Seal International Inc

- HB Fuller Co

- Herma GmbH

- Lecta SA

- LINTEC Corporation

- Mondi PLC

Table Information

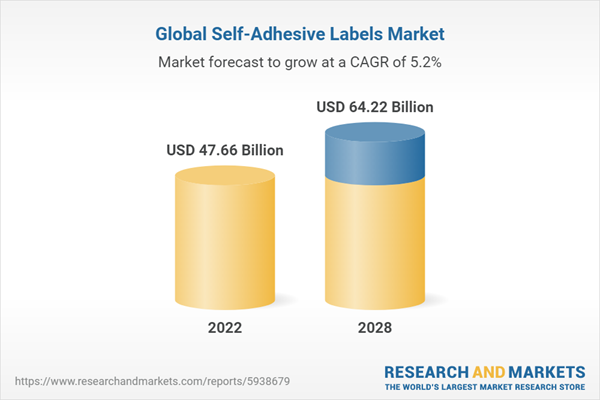

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | January 2024 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 47.66 Billion |

| Forecasted Market Value ( USD | $ 64.22 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |