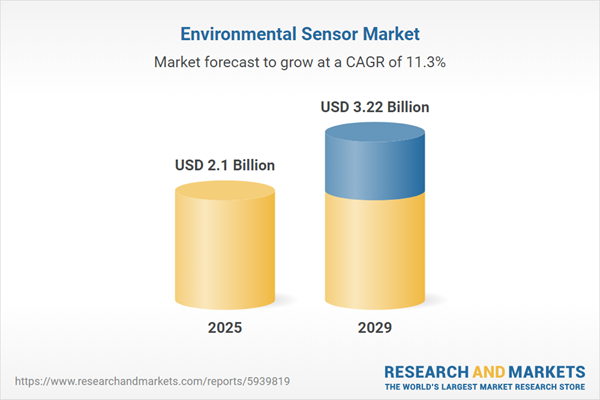

The environmental sensor market size is expected to see rapid growth in the next few years. It will grow to $3.22 billion in 2029 at a compound annual growth rate (CAGR) of 11.3%. The growth in the forecast period can be attributed to adoption of wireless sensor networks, expansion of smart city initiatives, emphasis on sustainable development, rising demand for real-time environmental monitoring, investments in environmental sensor research and development. Major trends in the forecast period include integration of ai and machine learning in sensor data analysis, growth of wearable environmental sensors, increasing use of drone-based environmental monitoring, development of low-cost sensor solutions, focus on sensor data interoperability.

The rapid integration of smart cities is poised to accelerate the growth of the environmental sensor market in the coming years. Smart cities, characterized by technologically advanced urban areas, utilize information and communication technology (ICT) to enhance operational efficiency, communicate information to the public, and improve public services and citizen well-being. Various environmental sensors are deployed in smart cities to gather electronic data on infrastructure and people, such as smart transportation systems offering traffic information and automatically processing toll payments, and smart energy systems minimizing downtime and damage to the electric grid. For example, as per the IMD Smart City Index (SCI) Report 2023 published by the International Institute for Management Development (IMD), the number of smart cities increased from 118 to 141 in 2021, marking a 20% growth since 2019. Consequently, the swift adoption of smart cities propels the environmental sensor market's growth.

The rising demand in the automotive industry is anticipated to drive the growth of the environmental sensor market in the future. The automotive industry encompasses activities related to the design, development, manufacturing, marketing, and sale of motor vehicles. Environmental sensors play a crucial role in the automotive sector, contributing to safety, efficiency, and comfort by providing essential data for various vehicle systems and features. For instance, data from the Board of Governors of the Federal Reserve System reveals that total vehicle production in the United States increased to 11.77 million units in July 2023, up from 10.91 million units in June 2023. Consequently, the increasing demand in the automotive industry acts as a driving force for the growth of the environmental sensor market.

Product innovation stands out as a prominent trend gaining traction in the environmental sensor market. Leading companies in the environmental sensor sector are actively engaged in the development of new and enhanced products, incorporating additional features to bolster their market position. A case in point is Zebra Technologies Corporation, a US-based mobile computing company specializing in real-time sensing, analysis, and action. In April 2023, the company introduced a new line of environmental sensors, including the ZS300 sensor, ZB200 bridge, and the Android Sensor Discovery app. This innovative range aims to enhance visibility in sectors such as food, pharmaceuticals, and healthcare, with the ZB200 bridge facilitating seamless data transfer from multiple Zebra electronic sensors to the cloud for immediate access.

Major companies in the environmental sensor market are focusing on technological advancements, such as advanced sensing devices, to enhance real-time monitoring and data accuracy for better environmental management and decision-making. These sophisticated instruments are designed to detect and measure various environmental parameters, including temperature, humidity, and air quality. By utilizing technologies like microelectromechanical systems (MEMS) and artificial intelligence, these devices provide accurate, real-time data for improved monitoring and analysis. For example, in April 2024, Advantech Co., Ltd., a China-based computer manufacturing company, launched the EVA-2000 Series Wireless LoRaWAN Technology Sensors. These sensors offer significant advantages for precision environmental monitoring, using low-power, long-range LoRaWAN technology to enable efficient data transmission over extensive distances. Their double 3.6V Li-ion batteries ensure exceptional battery life. This series not only simplifies integration with existing systems but also supports scalable deployments, making it a cost-effective solution for various industrial applications.

In December 2022, Interlink Electronics Inc., a US-based computer hardware and technology company, completed the acquisition of the businesses of SPEC Sensors and KWJ Engineering for $2 million. This strategic move positions Interlink to expand its product offerings and resources in the US market. The acquisition also brings in valuable engineering expertise and patented technology in gas and environmental air quality sensors. SPEC Sensors LLC, a US-based high-performance gas sensor manufacturer, offers accurate measurements of pollutant gases, while KWJ Engineering Inc., also based in the US, specializes in gas, air, and environmental sensors for detecting and monitoring various gases and environmental pollutants.

Major companies operating in the environmental sensor market include Siemens AG, Schneider Electric SE, Honeywell International Inc., ABB Ltd., Texas Instruments Incorporated, Emerson Electric Co., TE Connectivity, Microelectronics N.V., Infineon Technologies AG, Amphenol Corporation, Renesas Electronics Corporation, Omron Corporation, Ams OSRAM AG, Horiba Group, Sick AG, Sensirion AG, RioT Technology Corp., Figaro Engineering Inc., Omega Engineering Inc., Bosch Sensortec GmbH, Eurotech SpA., Raritan, Eko Instruments BV, Avtech Software Inc., Breeze Technologies, Elichens, NuWave Sensor, Nesa Srl., Apogee Instruments Inc., Aeroqual Ltd.

North America was the largest region in the environmental sensor market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the environmental sensor market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the environmental sensor market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Environmental sensors are devices designed to monitor the surrounding environment and furnish real-time data encompassing factors such as temperature, humidity, wind speed and direction, and rainfall. These sensors play a pivotal role in capturing, storing, analyzing, and precisely measuring crucial environmental data through the utilization of Data Center Infrastructure Management (DCIM) software.

The primary categories of environmental sensors include temperature, humidity, air quality, water quality, integrated, gas, chemicals, smoke, ultraviolet (UV), and soil moisture sensors. For instance, temperature sensors such as thermocouples are incorporated in the environmental sensor market to gauge temperature by assessing variations in electrical current resistance. These sensors find applications across diverse sectors such as smart home automation, factory automation, smart cities, automotive powertrain systems, energy harvesting, and more, catering to industrial, residential, commercial, automotive, government and public utilities, and various other end-users.

The environmental sensors research report is one of a series of new reports that provides environmental sensors market statistics, including the environmental sensors industry's global market size, regional shares, competitors with environmental sensors market share, detailed environmental sensors market segments, market trends and opportunities, and any further data you may need to thrive in the environmental sensors industry. This environmental sensor market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The environmental sensors market consists of sales of rainfall sensors, light sensors, wind speed sensors, direction sensors, gypsum blocks, tension meters, capacitance, volumetric, and neutron probes. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Environmental Sensor Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on environmental sensor market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for environmental sensor? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The environmental sensor market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Temperature; Humidity; Air Quality; Water Quality; Integrated; Gas; Chemicals; Smoke; Ultraviolet (UV); Soil Moisture2) By Application: Smart Home Automation; Factory Automation; Smart Cities; Automotive Powertrain System; Energy Harvesting; Other Applications

3) By End User: Industrial; Residential; Commercial; Automotive; Government and Public Utilities; Other End-Users

Subsegments:

1) By Temperature: Thermocouples; Thermistors; Infrared Sensors2) By Humidity: Capacitive Humidity Sensors; Resistive Humidity Sensors

3) By Air Quality: Particulate Matter Sensors; VOC Sensors; CO2 Sensors

4) By Water Quality: PH Sensors; Turbidity Sensors; Conductivity Sensors

5) By Integrated: Multi-parameter Sensors

6) By Gas: Carbon Monoxide Sensors; Methane Sensors; Hydrogen Sensors

7) By Chemicals: Ion-selective Electrodes; Optical Sensors

8) By Smoke: Ionization Smoke Detectors; Photoelectric Smoke Detectors

9) By Ultraviolet (UV): UV Index Sensors; UV Light Intensity Sensors

10) By Soil Moisture: Capacitive Soil Moisture Sensors; Resistive Soil Moisture Sensors

Key Companies Mentioned: Siemens AG; Schneider Electric SE; Honeywell International Inc.; ABB Ltd.; Texas Instruments Incorporated

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Siemens AG

- Schneider Electric SE

- Honeywell International Inc.

- ABB Ltd.

- Texas Instruments Incorporated

- Emerson Electric Co.

- TE Connectivity

- Microelectronics N.V.

- Infineon Technologies AG

- Amphenol Corporation

- Renesas Electronics Corporation

- Omron Corporation

- Ams OSRAM AG

- Horiba Group

- Sick AG

- Sensirion AG

- RioT Technology Corp.

- Figaro Engineering Inc.

- Omega Engineering Inc.

- Bosch Sensortec GmbH

- Eurotech SpA.

- Raritan

- Eko Instruments BV

- Avtech Software Inc.

- Breeze Technologies

- Elichens

- NuWave Sensor

- Nesa Srl.

- Apogee Instruments Inc.

- Aeroqual Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.1 Billion |

| Forecasted Market Value ( USD | $ 3.22 Billion |

| Compound Annual Growth Rate | 11.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |