1 Introduction

1.1 Study Objectives

1.2 Market Definition

1.2.1 Inclusions and Exclusions at Company Level

1.2.2 Inclusions and Exclusions at Product Type Level

1.2.3 Inclusions and Exclusions at Display Technology Level

1.2.4 Inclusions and Exclusions at Display Size Level

1.2.5 Inclusions and Exclusions at Regional Level

1.3 Study Scope

Figure 1 Education Smart Display Market Segmentation

1.3.1 Regional Scope

1.3.2 Years Considered

1.4 Currency Considered

1.5 Units Considered

1.6 Limitations

1.7 Stakeholders

1.8 Impact of Recession

2 Research Methodology

2.1 Research Approach

Figure 2 Research Design

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews with Experts

2.1.2.2 List of Key Primary Interview Participants

2.1.2.3 Breakdown of Primaries

2.1.2.4 Key Data from Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach to Capture Market Using Bottom-Up Analysis

Figure 3 Bottom-Up Approach

2.2.2 Top-Down Approach

2.2.2.1 Approach to Capturing Market Using Top-Down Analysis

Figure 4 Top-Down Approach

2.3 Factor Analysis

2.3.1 Demand-Side Analysis

Figure 5 Market Size Estimation: Demand-Side Analysis

2.3.2 Supply-Side Analysis

Figure 6 Market Size Estimation: Supply-Side Analysis

2.3.3 Growth Forecast Assumptions

Table 1 Market Growth Assumptions

2.4 Impact of Recession

2.5 Market Breakdown and Data Triangulation

Figure 7 Data Triangulation

2.6 Research Assumptions

2.7 Risk Assessment

Table 2 Risk Assessment

3 Executive Summary

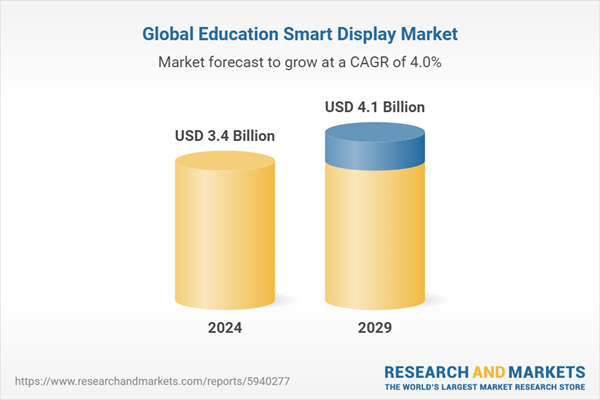

Figure 8 Education Smart Display Market Global Snapshot

Figure 9 Whiteboards Segment to Dominate Market During Forecast Period

Figure 10 Lcds Segment to Lead Education Smart Display Market During Forecast Period

Figure 11 Above 55” Display Segment to Dominate Market During Forecast Period

Figure 12 Asia-Pacific to Register Highest CAGR During Forecast Period

4 Premium Insights

4.1 Attractive Opportunities for Education Smart Display Market Players

Figure 13 Shift Toward Collaborative Learning in North America to Drive Market Growth

4.2 Education Smart Display Market, by Product Type

Figure 14 Whiteboards Segment to Account for Larger Share of Education Smart Display Market During Forecast Period

4.3 Education Smart Display Market, by Display Technology

Figure 15 Lcds Segment to Account for Largest Share of Education Smart Display Market During Forecast Period

4.4 Education Smart Display Market, by Display Size

Figure 16 Above 55” Segment to Dominate Education Smart Display Market During Forecast Period

4.5 North America: Education Smart Display Market, by Product Type and Country, 2023

Figure 17 Whiteboards Segment and US Led Education Smart Display Market in North America in 2023

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 18 Market Dynamics

5.2.1 Drivers

5.2.1.1 Digital Transformation in Learning

5.2.1.2 Rising Demand for Collaborative Learning

5.2.1.3 Technological Advancements

Figure 19 Impact Analysis of Drivers on Education Smart Display Market

5.2.2 Restraints

5.2.2.1 Budget Constraints

5.2.2.2 Integration Challenges

Figure 20 Impact Analysis of Restraints on Education Smart Display Market

5.2.3 Opportunities

5.2.3.1 Rising e-Learning Trend

5.2.3.2 Growing Adoption and Awareness About Numerous Benefits of Smart Displays

Figure 21 Impact Analysis of Opportunities in Education Smart Display Market

5.2.4 Challenges

5.2.4.1 Security Concerns

5.2.4.2 Teacher Training and Adaptation

5.2.4.3 Maintenance and Technical Support

Figure 22 Impact Analysis of Challenges on Education Smart Display Market

5.3 Value Chain Analysis

Figure 23 Value Chain Analysis

Table 3 Value Chain Analysis

5.4 Education Smart Display Market Ecosystem

Figure 24 Education Smart Display Market Ecosystem

5.5 Key Technology Trends

5.5.1 Related Technologies

5.5.1.1 Advanced Touchscreen Technologies

5.5.1.2 Interactive Projection Mapping

5.5.2 Upcoming Technologies

5.5.2.1 Micro-Led

5.5.3 Transparent Displays

5.5.4 Adjacent Technologies

5.5.4.1 5G Connectivity

5.5.4.2 Edge Computing for Real-Time Interactivity

5.6 Pricing Analysis

5.6.1 Average Selling Price Trend

Figure 25 Average Selling Price, by Product Type and Display Size (In USD)

Table 4 Average Selling Price, by Display Size (USD)

Table 5 Average Selling Price for Whiteboards (Above 55"), by Region (USD)

5.7 Patent Analysis

Table 6 Number of Patents Granted for Interactive Displays, 2013-2022

Figure 26 Number of Patents Granted for Interactive Displays

Figure 27 Top 10 Companies with Highest Number of Patent Applications During Review Period

Table 7 Top 20 Patent Owners During Review Period

Table 8 Key Patents Related to Interactive Displays

5.8 Porter's Five Forces Analysis

Figure 28 Porter's Five Forces Analysis-2022

Figure 29 Impact of Porter's Five Forces on Education Smart Display Market, 2023

Table 9 Porter's Five Forces Analysis -2023

5.8.1 Threat of New Entrants

5.8.2 Threat of Substitutes

5.8.3 Bargaining Power of Suppliers

5.8.4 Bargaining Power of Buyers

5.8.5 Intensity of Competitive Rivalry

5.9 Key Stakeholders and Buying Criteria

5.9.1 Key Stakeholders in Buying Process

Figure 30 Influence of Stakeholders on Buying Process for Education Smart Displays

Table 10 Influence of Stakeholders on Buying Process for Education Smart Displays (%)

5.9.2 Buying Criteria

Figure 31 Key Buying Criteria for Education Smart Displays

Table 11 Key Buying Criteria for Education Smart Displays

5.10 Trade Analysis

Table 12 Import Data for Monitors and Projectors, HS Code: 8528, by Country, 2018-2022 (USD Million)

Figure 32 HS Code: 8528, Import Values for Major Countries, 2018-2022

Table 13 Export Data for Monitors and Projectors, HS Code: 8528, by Country, 2018-2022 (USD Million)

Figure 33 HS Code: 8528, Export Values for Major Countries, 2018-2022

5.11 Case Studies

5.11.1 Enhanced Learning Experience for Students with Lcd Video Wall Display

Table 14 Samsung: Lcd Video Wall Enhanced Learning Experience for Students

5.11.2 Panasonic to Provide Display Technologies for Ad Hoc Teamwork Centers and Active-Learning Classrooms

Table 15 Panasonic: Video Wall Display Promoted Active-Learning in Classrooms

5.11.3 Enhanced Clarity and Readability in Classrooms

Table 16 Optoma: Interactive Flat Panel Displays Enhanced Clarity and Readability in Classrooms

5.12 Tariff and Regulations

5.12.1 Tariffs

Table 17 Mfn Tariffs for Products Included Under HS Code: 8528 Exported by US

5.12.2 Standards

5.12.2.1 Global

5.12.2.2 Europe

5.12.2.3 Asia-Pacific

5.12.2.4 North America

5.12.3 Regulations

5.12.3.1 North America

5.12.3.2 Europe

5.12.3.3 Asia-Pacific

5.13 Trends/Disruptions Impacting Customers Business

Figure 34 Revenue Shift for Displays Market

5.14 Key Conferences & Events in 2022-2023

Table 18 Detailed List of Conferences and Events, 2022-2023

6 Education Smart Display Market, by Resolution

6.1 Introduction

6.2 Fhd

6.3 4K and Above

6.4 Hd and Lower Than Hd

7 Education Smart Display Market, by Product Type

7.1 Introduction

Figure 35 Whiteboards Segment to Account for Larger Share of Education Smart Display Market During Forecast Period

Table 19 Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 20 Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

Table 21 Education Smart Display Market, by Product Type, 2020-2023 (Thousand Units)

Table 22 Education Smart Display Market, by Product Type, 2024-2029 (Thousand Units)

7.2 Whiteboards

7.2.1 Significant Improvement in Student Engagement and Fostering Collaborative Learning to Drive Market

Table 23 Whiteboards: Education Smart Display Market, by Display Size, 2020-2023 (USD Million)

Table 24 Whiteboards: Education Smart Display Market, by Display Size, 2024-2029 (USD Million)

Table 25 Whiteboards: Education Smart Display Market, by Display Size, 2020-2023 (Thousand Units)

Table 26 Whiteboards: Education Smart Display Market, by Display Size, 2024-2029 (Thousand Units)

Table 27 Whiteboards: Education Smart Display Market, by Display Technology, 2020-2023 (USD Million)

Table 28 Whiteboards: Education Smart Display Market, by Display Technology, 2024-2029 (USD Million)

Figure 36 Asia-Pacific to Register Highest CAGR in Education Smart Display Market for Whiteboards During Forecast Period

Table 29 Whiteboards: Education Smart Display Market, by Region, 2020-2023 (USD Million)

Table 30 Whiteboards: Education Smart Display Market, by Region, 2024-2029 (USD Million)

Table 31 Whiteboards: Education Smart Display Market in North America, by Country, 2020-2023 (USD Million)

Table 32 Whiteboards: Education Smart Display Market in North America, by Country, 2024-2029 (USD Million)

Table 33 Whiteboards: Education Smart Display Market in Europe, by Country, 2020-2023 (USD Million)

Table 34 Whiteboards: Education Smart Display Market in Europe, by Country, 2024-2029 (USD Million)

Table 35 Whiteboards: Education Smart Display Market in Asia-Pacific, by Country, 2020-2023 (USD Million)

Table 36 Whiteboards: Education Smart Display Market in Asia-Pacific, by Country, 2024-2029 (USD Million)

Table 37 Whiteboards: Education Smart Display Market in RoW, by Region, 2020-2023 (USD Million)

Table 38 Whiteboards: Education Smart Display Market in RoW, by Region, 2024-2029 (USD Million)

Table 39 Whiteboards: Education Smart Display Market in Middle East & Africa, by Region, 2020-2023 (USD Million)

Table 40 Whiteboards: Education Smart Display Market in Middle East & Africa, by Region, 2024-2029 (USD Million)

7.3 Video Walls

7.3.1 Growing Demand for Large Format Displays for Auditoriums to Drive Market

Table 41 Video Walls: Education Smart Display Market, by Display Size, 2020-2023 (USD Million)

Table 42 Video Walls: Education Smart Display Market, by Display Size, 2024-2029 (USD Million)

Table 43 Video Walls: Education Smart Display Market, by Display Size, 2020-2023 (Thousand Units)

Table 44 Video Walls: Education Smart Display Market, by Display Size, 2024-2029 (Thousand Units)

Table 45 Video Walls: Education Smart Display Market, by Display Technology, 2020-2023 (USD Thousand)

Table 46 Video Walls: Education Smart Display Market, by Display Technology, 2024-2029 (USD Thousand)

Figure 37 North America to Lead Education Smart Display Market for Video Walls During Forecast Period

Table 47 Video Walls: Education Smart Display Market, by Region, 2020-2023 (USD Million)

Table 48 Video Walls: Education Smart Display Market, by Region, 2024-2029 (USD Million)

Table 49 Video Walls: Education Smart Display Market in North America, by Country, 2020-2023 (USD Thousand)

Table 50 Video Walls: Education Smart Display Market in North America, by Country, 2024-2029 (USD Thousand)

Table 51 Video Walls: Education Smart Display Market in Europe, by Country, 2020-2023 (USD Thousand)

Table 52 Video Walls: Education Smart Display Market in Europe, by Country, 2024-2029 (USD Thousand)

Table 53 Video Walls: Education Smart Display Market in Asia-Pacific, by Country, 2020-2023 (USD Thousand)

Table 54 Video Walls: Education Smart Display Market in Asia-Pacific, by Country, 2024-2029 (USD Thousand)

Table 55 Video Walls: Education Smart Display Market in RoW, by Region, 2020-2023 (USD Thousand)

Table 56 Video Walls: Education Smart Display Market in RoW, by Region, 2024-2029 (USD Thousand)

Table 57 Video Walls: Education Smart Display Market in Middle East & Africa, by Region, 2020-2023 (USD Thousand)

Table 58 Video Walls: Education Smart Display Market in Middle East & Africa, by Region, 2024-2029 (USD Thousand)

8 Education Smart Display Market, by Display Size

8.1 Introduction

Table 59 Education Smart Display Market, by Display Size, 2020-2023 (USD Million)

Figure 38 Above 55” Segment to Account for Larger Share of Education Smart Display Market by 2029

Table 60 Education Smart Display Market, by Display Size, 2024-2029 (USD Million)

Table 61 Education Smart Display Market, by Display Size, 2020-2023 (Thousand Units)

Table 62 Education Smart Display Market, by Display Size, 2024-2029 (Thousand Units)

8.2 Up to 55”

8.2.1 Suitability for Smaller Classrooms, Meeting Rooms, or Interactive Displays in Limited Spaces to Drive Market

Table 63 Up to 55": Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Figure 39 Whiteboards Segment to Account for Larger Share for Up to 55” Display Size of Education Smart Display Market by 2029

Table 64 Up to 55": Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

Table 65 Up to 55": Education Smart Display Market, by Product Type, 2020-2023 (Thousand Units)

Table 66 Up to 55": Education Smart Display Market, by Product Type, 2024-2029 (Thousand Units)

8.3 Above 55”

8.3.1 Higher Resolution, Interactive Functionalities, and Advanced Collaborative Tools Catering to Diverse Needs to Drive Market

Table 67 Above 55": Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Figure 40 Whiteboards Segment to Account for Larger Share for Above 55” of Education Smart Display Market by 2029

Table 68 Above 55": Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

Table 69 Above 55": Education Smart Display Market, by Product Type, 2020-2023 (Thousand Units)

Table 70 Above 55": Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

9 Education Smart Display Market, by Display Technology

9.1 Introduction

Table 71 Global Education Smart Display Market, by Display Technology, 2020-2023 (USD Million)

Figure 41 Lcd Technology to Account for Largest Share of Education Smart Display Market by 2029

Table 72 Global Education Smart Display Market, by Display Technology, 2024-2029 (USD Million)

9.2 Lcds

9.2.1 Lower Production Cost and Versatility to Drive Market

Table 73 Lcds: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Figure 42 Whiteboards Segment to Dominate Lcd Technology in Education Smart Display Market

Table 74 Lcds: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

9.3 Direct-View Leds

9.3.1 Increasing Demand for Large Video-Walls and Digital Signage in Educational Institutions to Drive Market

Table 75 Direct-View Leds: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 76 Direct-View Leds: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

9.4 Oleds

9.4.1 Growing Demand for Premium Interactive Displays Delivering Enhanced Visual Experiences to Propel Market

Table 77 Oleds: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Figure 43 Whiteboards Segment to Dominate Oled Technology in Education Smart Display Market

Table 78 Oleds: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

9.5 Other Display Technologies

Table 79 Other Display Technologies: Education Smart Display Market, by Product, Type 2020-2023 (USD Million)

Table 80 Other Display Technologies: Education Smart Display Market, by Product, Type 2024-2029 (USD Million)

10 Education Smart Display Market, by Region

10.1 Introduction

Figure 44 Education Smart Display Market, by Region

Table 81 Education Smart Display Market, by Region, 2020-2023 (USD Million)

Table 82 Education Smart Display Market, by Region, 2024-2029 (USD Million)

10.2 North America

Figure 45 North America: Education Smart Display Market Snapshot

Table 83 North America: Education Smart Display Market, by Country, 2020-2023 (USD Million)

Table 84 North America: Education Smart Display Market, by Country, 2024-2029 (USD Million)

Table 85 North America: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 86 North America: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

10.2.1 Impact of Recession on North America

10.2.2 US

10.2.2.1 Strong Education Sector, Government Backing, Major Company Presence, and Fostering Dynamic and Interactive Learning Experiences to Drive Market

Table 87 US: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 88 US: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

10.2.3 Canada

10.2.3.1 Pioneer in Embracing Technology in Education and Tech-Savvy Population to Contribute to Market Growth

Table 89 Canada: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 90 Canada: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

10.2.4 Mexico

10.2.4.1 Efforts to Modernize Classrooms and Enhance Overall Learning Environment to Drive Market

Table 91 Mexico: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 92 Mexico: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

10.3 Europe

Figure 46 Europe: Education Smart Display Market Snapshot

Table 93 Europe: Education Smart Display Market, by Country, 2020-2023 (USD Million)

Table 94 Europe: Education Smart Display Market, by Country, 2024-2029 (USD Million)

Table 95 Europe: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 96 Europe: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

10.3.1 Impact of Recession on Europe

10.3.2 UK

10.3.2.1 Edtech Strategy Launched by Department for Education to Drive Market

Table 97 UK: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 98 UK: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

10.3.3 Germany

10.3.3.1 Government Initiatives and Commitment to Technological Advancement in Education to Drive Market

Table 99 Germany: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 100 Germany: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

10.3.4 France

10.3.4.1 Implementing Cutting-Edge Educational Tools Enabling Technology-Enhanced Education to Drive Market

Table 101 France: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 102 France: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

10.3.5 Rest of Europe (RoE)

Table 103 Rest of Europe: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 104 Rest of Europe: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

10.4 Asia-Pacific

Figure 47 Asia-Pacific: Education Smart Display Market Snapshot

Table 105 Asia-Pacific: Education Smart Display Market, by Country, 2020-2023 (USD Million)

Table 106 Asia-Pacific: Education Smart Display Market, by Country, 2024-2029 (USD Million)

Table 107 Asia-Pacific: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 108 Asia-Pacific: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

10.4.1 Impact of Recession on Asia-Pacific

10.4.2 China

10.4.2.1 Implementation of Comprehensive National Plans Focused on Integrating Technology into Education to Drive Market

Table 109 China: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 110 China: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

10.4.3 Japan

10.4.3.1 Integration of Interactive Displays Providing Students with Dynamic and Technologically Enriched Learning Environments to Drive Market

Table 111 Japan: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 112 Japan: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

10.4.4 South Korea

10.4.4.1 Educational Innovation in Government Policies Encouraging Integration of Modern Teaching Tools in Classrooms to Drive Market

Table 113 South Korea: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 114 South Korea: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

10.4.5 India

10.4.5.1 Rising Awareness Among Educators and Institutions About Multifaceted Benefits of Interactive Displays to Drive Market

Table 115 India: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 116 India: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

10.4.6 Rest of Asia-Pacific

Table 117 Rest of Asia-Pacific: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 118 Rest of Asia-Pacific: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

10.5 Rest of the World (RoW)

Table 119 Rest of the World: Education Smart Display Market, by Region, 2020-2023 (USD Million)

Table 120 Rest of the World: Education Smart Display Market, by Region, 2024-2029 (USD Million)

Table 121 Rest of the World: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 122 Rest of the World: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

10.5.1 Impact of Recession on RoW

10.5.2 South America

10.5.2.1 Recognition of Transformative Impact of Technology on Education and Emphasis on Preparing Students for Digital Future to Drive Market

Table 123 South America: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 124 South America: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

10.5.3 Middle East & Africa

10.5.3.1 Economic Prosperity, High Education Standards, and Proactive Government Policies to Drive Market

Table 125 Middle East & Africa: Education Smart Display Market, by Region, 2020-2023 (USD Million)

Table 126 Middle East & Africa: Education Smart Display Market, by Region, 2024-2029 (USD Million)

Table 127 Middle East & Africa: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 128 Middle East & Africa: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

10.5.3.2 GCC Countries

10.5.3.2.1 Focus on Technology-Driven Solutions for Continued Growth in Education Sector to Drive Market

Table 129 GCC Countries: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 130 GCC Countries: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

10.5.3.3 Rest of Middle East & Africa

Table 131 Rest of Middle East & Africa: Education Smart Display Market, by Product Type, 2020-2023 (USD Million)

Table 132 Rest of Middle East & Africa: Education Smart Display Market, by Product Type, 2024-2029 (USD Million)

11 Competitive Landscape

11.1 Introduction

11.2 Market Evaluation Framework

Table 133 Overview of Strategies Adopted by Key Players

Figure 48 Companies Adopted Partnerships as Key Growth Strategy from 2020 to 2023

11.2.1 Organic/Inorganic Growth Strategies

11.2.2 Product Portfolio

11.2.3 Geographic Presence

11.2.4 Manufacturing and Distribution Footprint

11.3 Market Share Analysis, 2023

Table 134 Market Share Analysis of Top 5 Players in Education Smart Display Market, 2023

11.4 Company Evaluation Matrix

11.4.1 Stars

11.4.2 Emerging Leaders

11.4.3 Pervasive Players

11.4.4 Participants

Figure 49 Company Evaluation Matrix, 2023

11.5 Startup/SME Evaluation Matrix

11.5.1 Competitive Benchmarking

Table 135 Detailed List of Key Startup/SMEs

Table 136 Competitive Benchmarking for Startups/SMEs: Display Technology (13 Companies)

Table 137 Competitive Benchmarking for Startups/SMEs: Product Type (13 Companies)

Table 138 Competitive Benchmarking of Startups/SMEs: Region (13 Companies)

11.5.2 Progressive Companies

11.5.3 Responsive Companies

11.5.4 Dynamic Companies

11.5.5 Starting Blocks

Figure 50 Startup/SME Evaluation Quadrant, 2023

11.6 Company Footprint

Table 139 Company Footprint (25 Companies)

Table 140 Company Display Technology Footprint (25 Companies)

Table 141 Company Product Type Footprint (25 Companies)

Table 142 Company Region Footprint (25 Companies)

11.7 Competitive Scenario

11.7.1 Product Launches

Table 143 Product Launches, 2020-2023

11.7.2 Deals

Table 144 Deals, 2020-2023

12 Company Profiles

12.1 Introduction

12.2 Key Players

(Business Overview, Products /Solutions/Services Offered, Recent Developments, Analyst's View, Right to Win, Strategic Choices, and Weaknesses and Competitive Threats)*

12.2.1 Samsung

Table 145 Samsung: Company Overview

Figure 51 Samsung: Company Snapshot

Table 146 Samsung: Product Launches

Table 147 Samsung: Deals

12.2.2 Lg Electronics

Table 148 Lg Electronics: Company Overview

Figure 52 Lg Electronics: Company Snapshot

Table 149 Lg Electronics: Product Launches

12.2.3 Newline Interactive

Table 150 Newline Interactive: Company Overview

Table 151 Newline Interactive: Products/Solutions/Services Offered

Table 152 Newline Interactive: Product Launches

Table 153 Newline Interactive: Deals

12.2.4 Ppds (Philips)

Table 154 Ppds (Philips): Company Overview

Table 155 Ppds (Philips): Products/Solutions/Services Offered

Table 156 Ppds (Philips): Deals

12.2.5 Sharp Nec Display Solutions

Table 157 Sharp Nec Display Solutions: Company Overview

Table 158 Sharp Nec Display Solutions: Products/Solutions/Services Offered

Table 159 Sharp Nec Display Solutions: Product Launches

12.2.6 Leyard

Table 160 Leyard: Company Overview

Figure 53 Leyard: Company Snapshot

Table 161 Leyard: Products/Solutions/Services Offered

Table 162 Leyard: Product Launches & Developments

Table 163 Leyard: Deals

12.2.7 Smart Technologies Ulc

Table 164 Smart Technologies Ulc: Company Overview

Table 165 Smart Technologies Ulc: Products/Solutions/Services Offered

Table 166 Smart Technologies Ulc: Products Launches & Developments

Table 167 Smart Technologies Ulc: Deals

12.2.8 Sony Group Corporation

Table 168 Sony Group Corporation: Company Overview

Figure 54 Sony Group Corporation: Company Snapshot

Table 169 Sony Group Corporation: Product Launches

12.2.9 Barco

Table 170 Barco: Company Overview

Figure 55 Barco: Company Snapshot

Table 171 Barco: Products/Solutions/Services Offered

Table 172 Barco: Product Launches & Developments

12.2.10 Panasonic Holdings Corporation

Table 173 Panasonic Holdings Corporation: Company Overview

Figure 56 Panasonic Holdings Corporation: Company Snapshot

Table 174 Panasonic Holdings Corporation: Products/Solutions/Services Offered

12.2.11 Benq

Table 175 Benq: Company Overview

Table 176 Benq: Products/Solutions/Services Offered

Table 177 Benq: Deals

12.2.12 Viewsonic Corporation

Table 178 Viewsonic Corporation: Company Overview

Table 179 Viewsonic Corporation: Products/Solutions/Services Offered

Table 180 Viewsonic Corporation: Products Launches & Developments

12.2.13 Promethean World Limited

Table 181 Promethean World Limited: Company Overview

Table 182 Promethean World Limited: Products/Solutions/Services Offered

Table 183 Promethean World Limited: Product Launches & Developments

12.2.14 Cleartouch

Table 184 Cleartouch: Company Overview

Table 185 Cleartouch: Products/Solutions/Services Offered

Table 186 Cleartouch: Product Launches & Developments

12.2.15 Optoma Corporation

Table 187 Optoma Corporation: Company Overview

Table 188 Optoma Corporation: Products/Solutions/Services Offered

12.3 Other Players

12.3.1 Clevertouch (By Boxlight)

12.3.2 Hdi Ltd.

12.3.3 Peerless-Av

12.3.4 Absen Inc.

12.3.5 Christie Digital Systems Usa, Inc.

12.3.6 Ricoh

12.3.7 Hitevision Tech Asia-Pacific Co. Ltd.

12.3.8 Boxlight

12.3.9 Primeview Global

12.3.10 Promark Techsolutions Pvt. Ltd.

*Details on Business Overview, Products /Solutions/Services Offered, Recent Developments, Analyst's View, Right to Win, Strategic Choices, and Weaknesses and Competitive Threats Might Not be Captured in Case of Unlisted Companies

13 Appendix

13.1 Insights from Industry Experts

13.2 Discussion Guide

13.3 Knowledgestore: The Subscription Portal

13.4 Customization Options