Dyslipidemia: Introduction

Dyslipidemia is a condition characterized by abnormal levels of lipids in the bloodstream. The most common forms of dyslipidemia involve high levels of bad cholesterol (LDL), triglycerides or low levels of good cholesterol (HDL). Untreated or severe dyslipidemia may lead to coronary artery disease (CAD) or peripheral artery disease (PAD). Based on cause, it can be categorized into two broad categories, primary dyslipidemia, which is inherited, and secondary dyslipidemia, which is caused by lifestyle factors. Treatment for dyslipidemia constitutes medications and lifestyle changes to control cholesterol levels naturally.Dyslipidemia Market Analysis

The increasing development of drugs and new therapeutics to treat the condition are increasingly contributing to the dyslipidemia market share. Ezetimibe is frequently used in combination with statins and has shown significant reductions in LDL cholesterol levels. Alirocumab (Praluent) is a human immunoglobulin G1 monoclonal antibody while Evolocumab is another monoclonal G2 antibody belonging to PCSK9 category. Bempedoic acid is another key agent that decreases LDL-C levels and showcases evidence of good tolerability and safety.With advanced research and ongoing clinical trials, scientists are also working on using the potential of ASOs to impact mRNA and provide new avenues for the treatment of persistent disorders. Therefore, there is hope for treating primary dyslipidemia as well, especially with the rising advances in gene therapies. Such efforts in research and development, along with increased support from governments and healthcare organizations are likely to aid the dyslipidemia market demand in the coming years.

Dyslipidemia Market Segmentation

Dyslipidemia Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Disease Type

- General dyslipidemia

- Hyperlipidemia

- Combined Hyperlipidemia

- Hypoalphalipoproteinemia

Market Breakup by Drug Type

- Statin Drugs

- Non-Statin Lipid-Lowering Drugs

Market Breakup by Drug Type

- Generic

- Branded

Market Breakup by Distributor Channel

- Hospital Pharmacy

- Online pharmacy

- Retail Pharmacy

- Others

Market Breakup by End User

- Hospitals

- Homecare

- Specialty Clinics

- Others

Market Breakup by Region

- United States

- EU-4 and the United Kingdom

- Germany

- France

- Italy

- Spain

- United Kingdom

- Japan

Dyslipidemia Market Overview

With the rising prevalence of obesity, sedentary lifestyle habits, unhealthy dietary changes and tobacco consumption, the United States is at a higher risk of developing cardiovascular diseases. As a result, the region is expected to lead the dyslipidemia market share in the forecast period. The existence of regulatory authorities such as the FDA plays a pivotal part in maintaining the quality and efficacy of drugs being launched in the market. This can be a major factor in the growing market value in the region.Owing to a high percentage of the geriatric population, Europe is another major market for dyslipidemia. With a robust healthcare ecosystem as well as proactive government, there are several awareness and educational campaigns launched in the region, explaining the maintenance of a healthy heart. The market growth is further enhanced by the presence of key healthcare and academic institutions that continuously conduct clinical trials to determine the efficacy of treatments.

In Asia Pacific, the dyslipidemia market growth is certain with the increasing investment in healthcare research and development infrastructure. The region is witnessing numerous mergers and acquisitions between native and foreign companies that aim to leverage the academic expertise pertaining to the region while offering the latest technologies to develop quality solutions. In addition, the government is also aiding market growth by facilitating easy accessibility of relevant to the people in need at affordable prices.

Dyslipidemia Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Pfizer, Inc.

- Novartis AG

- AstraZeneca plc

- Amgen, Inc.

- Abbott Laboratories.

- Bayer AG

- Merck & Co., Inc.

- Bristol-Myers Squibb Company

- Mylan N.V.

- Shionogi & Co., Ltd.

- Catabasis Pharmaceuticals

- DAIICHI SANKYO COMPANY, LIMITED

- Eli Lilly and Company

- GlaxoSmithKline plc

- ESPERION Therapeutics, Inc.

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Pfizer, Inc.

- Novartis AG

- AstraZeneca plc

- Amgen, Inc.

- Abbott Laboratories

- Bayer AG

- Merck & Co., Inc.

- Bristol-Myers Squibb Company

- Mylan N.V.

- Shionogi & Co., Ltd.

- Catabasis Pharmaceuticals

- DAIICHI SANKYO COMPANY, LIMITED

- Eli Lilly and Company

- GlaxoSmithKline plc

- ESPERION Therapeutics, Inc.

Table Information

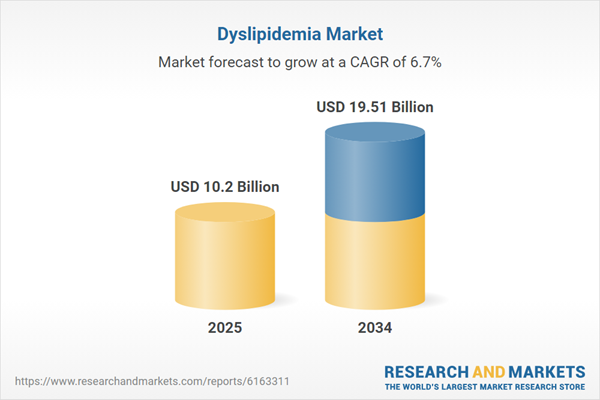

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 10.2 Billion |

| Forecasted Market Value ( USD | $ 19.51 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |