On-Body is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The increasing global prevalence of chronic diseases represents a primary driver for the wearable injectors market, necessitating continuous and often complex drug administration. Conditions like diabetes, cardiovascular disease, and autoimmune disorders demand regular, precise dosing over extended periods, making convenient delivery crucial. Wearable injectors offer an effective solution, enabling patients to manage therapies outside clinical settings, thereby supporting adherence and improving quality of life. Addressing this expanding patient population, according to Novo Nordisk, February 2025, Novo Nordisk Annual Report 2024, the company served over 45.2 million people living with serious chronic diseases in 2024, highlighting the critical demand for accessible drug delivery systems.Key Market Challenges

The high initial cost associated with developing advanced wearable injectors presents a significant challenge to the Global Wearable Injectors Market. This substantial financial outlay directly hampers market expansion by elevating the final product price, which can limit widespread adoption. Such cost implications are particularly pronounced in regions with constrained healthcare budgets or limited reimbursement coverage, making these innovative devices less accessible to a broader patient population requiring continuous self-treatment.Key Market Trends

Seamless digital integration and remote monitoring are transforming wearable injectors by embedding connectivity for real-time data exchange and patient oversight. This capability allows for continuous tracking of adherence, device performance, and patient physiological responses, leading to more informed treatment adjustments. According to France Biotech, in 2023, remote monitoring solutions demonstrated the highest growth in the digital health sector, increasing by four points compared to 2022 to represent 14% of digital health products. This integration supports decentralized care by extending clinical supervision into the home setting, improving patient safety and engagement.Key Market Players Profiled:

- Becton & Dickinson Co.

- Johnson & Johnson Service Inc.

- F. Hoffmann-La Roche Ltd.

- Frederick Furness Publishing Ltd

- Steady Med Therapeutics, Inc (United Therapeutics Corporation)

- Amgen Inc.

- Insulet Corporation

- Enable Injections

- West Pharmaceutical Services, Inc.

- CeQur SA

Report Scope:

In this report, the Global Wearable Injectors Market has been segmented into the following categories:By Type:

- On-body

- Off-body

By Technology:

- Spring-based

- Motor-driven

- Rotary Pump

- Expanding Battery

- Other

By Application:

- Oncology

- Infectious Disease

- Cardiovascular Disease

- Autoimmune Disease

- Immunodeficiency

- others

By Region:

- North America

- South America

- Aisa Pacific

- Europe

- MEA

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Wearable Injectors Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Becton & Dickinson Co.

- Johnson & Johnson Service Inc.

- F. Hoffmann-La Roche Ltd.

- Frederick Furness Publishing Ltd

- Steady Med Therapeutics, Inc (United Therapeutics Corporation)

- Amgen Inc.

- Insulet Corporation

- Enable Injections

- West Pharmaceutical Services, Inc.

- CeQur SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | November 2025 |

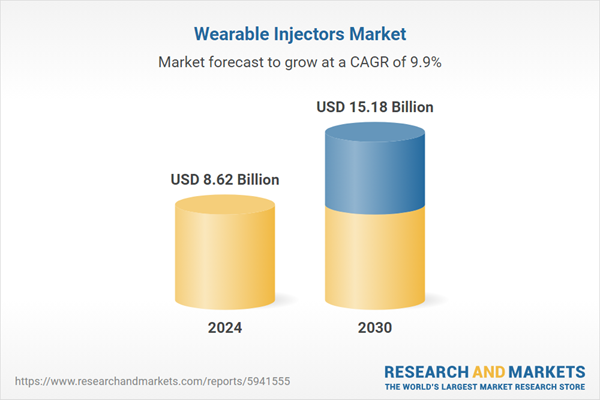

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.62 Billion |

| Forecasted Market Value ( USD | $ 15.18 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |